The food coating ingredients and equipment markets were valued at USD 2.60 billion and USD 1.87 billion, respectively, in 2017 and are projected to reach a value of USD 3.62 billion and USD 2.21 billion by 2023, at a CAGR of 5.8% and 3.7%, respectively, from 2018 to 2023. Some of the major factors driving market growth includes rising demand for meat, seafood, poultry, bakery products, snacks, and confectionery products, growing demand for processed and convenience food, and increased focus on production efficiency, processing time, and quality of food products.

Growing food processing in meat, bakery, snacks, and breakfast cereal

Meat, snacks, bakery products, and breakfast cereal are some of the major applications of food coating ingredients and equipment. The fast changing and busy lifestyles of consumers due to rapid urbanization have also led to a high demand for ready-to-eat and ready-to-cook meat, confectionery products, and bakery food products as they are processed food products that require less time and effort to cook, while also ensuring nutrition and durability. Furthermore, rising inclination of consumers toward protein-based food products, popularity of frozen food, and the growing frequency of snacking are driving the demand for these products in the market, leading to the growth in demand for ingredients such as spices, fats and oils, cocoa, flours, and sugar and syrups. As a result, the demand of equipment such as coaters, applicators, and enrobers is also expected to rise. Due to the growing demand for healthy food products in Europe, the demand for gluten-free bakery products has also increased in many European countries between 2010 and 2014. Increase in product launches has also resulted in higher demand for gluten-free flours and other ingredients used in the bakery industry, in turn, driving the market for food coating ingredients in the region.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

Rising costs of production due to fluctuating ingredient prices is a major restraint for the market.

Rising prices of ingredients and their subsequent fluctuations have emerged as key restraints in food coating. The high cost of ingredients has led to high production cost, which further hinders the chances of adoption of new coating technologies by the manufacturer due to the resultant lower margins and longer time taken to attain breakeven point for food manufacturers. The food coating equipment must thus offer cost effectiveness in terms of output and ingredient usage to make up for the rising ingredient prices and make it easier for food manufacturers to achieve economies of scale. For instance, the prices of cocoa beans and sugar, which are the major ingredients used in coating confectionery, chocolates, and snacks increased continuously between 2013 and 2016, leading to high cost of the end product, which, in turn, leads manufacturers to focus on cutting cost, rather than investments on new technologies or equipment in their manufacturing facilities.

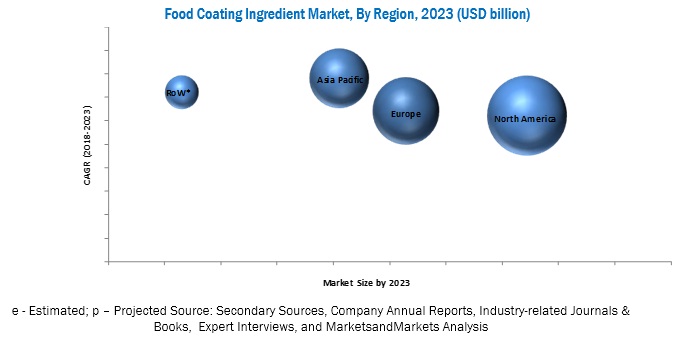

North America region is expected to dominant the food coating ingredient market during the forecast period.

The North American region is expected to dominate the food coating market during the forecast period. The region is backed by superior food coating technologies and utilizes automatic equipment for coating food ingredients. Consumers in the US and Canada majorly consume salty snacks such as potato chips, which need dry coating. Apart from this, these countries consume frozen food that requires a coating for extended shelf life. Consumers in this region opt for cereal as breakfast options which also require coating. The US is also a huge market for confectionery products.

Asia Pacific is also projected to be the fastest-growing market for food coating equipment. The growth of the coating equipment market is led by rapid industrialization, growing demand from various applications, and increasing government spending on supporting food manufacturers & processors in the modernization of their technologies and processes. Many global companies are focusing on these emerging markets and are increasing their footprint by setting up manufacturing facilities, distribution centers, and R&D centers. India is projected to be the fastest-growing market in the region as there are many investments being made by several multinational corporations due to the favorable support of the government and low labor cost.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes profiles of leading companies such Marel (Iceland), GEA Group (Germany), Bühler AG (Switzerland), JBT Corporation (US), TNA Australia Pty Limited (Australia), Clextral (France), Dumoulin (France), Spice Application Systems (UK), Cargill (US), Kerry Group (Iceland), Tate & Lyle Plc (UK), Newly Weds Foods (US), PGP International (US), Archer Daniels Midland Company (US), Ingredion Incorporated (US), and Bowman Ingredients (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst