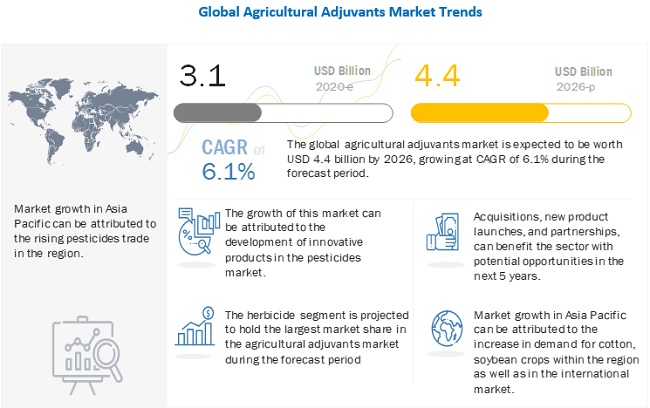

The global agricultural adjuvants market size is estimated to account for a value of USD 3.1 billion in 2020 and is projected to grow at a CAGR of 6.1% from 2020, to reach a value of USD 4.4 billion by 2026. The increasing need for green adjuvants, improving efficiency, and effectiveness of agrochemicals are some of the factors driving the growth of the agricultural adjuvants market.

COVID-19 Impact on the Global Agricultural Adjuvants Market

The FAO has acknowledged that the spread of COVID- 19 pandemic is subsiding in a few countries and regions of the world. Still, it is also resurging or spreading quickly in some other countries such as Korea, Brazil, and India. This outbreak has affected significant elements of both food supply and demand. Border closures, quarantines, market supply chains, and trade disruptions have restricted people’s access to sufficient and nutritious sources of food, especially in countries hit hard by the virus. However, as the governments on a global level shut down borders and economies for restricting the spread of the coronavirus, the businesses observed major impacts on their international trades. Many markets are focusing on fulfilling their requirements for fertilizers, pesticides, and adjuvants by domestic companies. This is, however, causing an imbalance between the demand and supply quantities. However, some regions are completely dependent on imports and are facing tough situations. Adjuvants are majorly dependent on raw materials such as vegetable oils and petroleum for their production. Gradually the rise in the prices of these commodities has resulted in higher adjuvant prices. All these factors hampered the potential growth of the market at the beginning of 2020.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

Driver: Increased demand for green adjuvant, with an increasing focus on health and consumption of organically produced food during the Coronavirus outbreak.

In recent years, companies have been developing eco-friendly bio-based adjuvants such as methylated seed oil (MSO), modified vegetable oils, and organo-modified siloxanes. These biologically derived adjuvants are considered environment-friendly due to their high level of safety and biodegradability. In the time of the COVID outbreak, the world population is showing a trend towards higher demand for organically produced foods. There is a lot of concern rising for hygienic, healthy, and nutritious food in the markets, with people concerned about health amid the virus outbreak. Thus the demand for green and organic adjuvants is seen to remain stable in the pandemic times to increase to organic farm produce.

Asia Pacific is projected to grow at the highest CAGR% during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2020 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as this market include Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), WinField United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), Innvictis Crop Care (US), Interagro (UK), Lamberti S.P.A (US), Drexel Chemical Company (US), GarrCo Products Inc. (US), and Loveland Products Inc. (US).

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=1240

Recent Developments:

- In April 2020, Corteva entered in a joint venture with the MercyOne Healthcare Organisation, to meet the urgent need for the processing of COVID-19 samples with an initial focus on Iowa area.

- In April 2020, Solvay entered into a partnership with Boeing, who is a face shield manufacturer, wherein the company would supply high-performance, medical-grade transparent film. The strategy was a response to the rising demands for personal protective equipment amongst healthcare professionals.

- In October 2019, Nufarm initiated a state of art crop protection segment facility in Greenville, Mississippi, which will help broaden the companies production in their facilities in Chicago to North American based platforms.