Target Audience:

# Animal Parasiticides Manufacturers

# Animal Parasiticides Distributors

# Animal Health Research & Development (R&D) Companies

# Government Associations

# Research and consulting firms

# Venture Capitalists and Investors

In 2014, ectoparasiticides accounted for the largest share of the global animal parasiticides market and this segment is expected to witness the highest growth over the next five years. The high growth in this segment can be attributed to the advantages offered by ectoparasiticides over other parasiticide formulations.

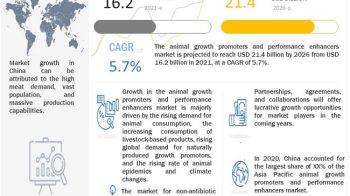

The animal parasiticides market witnessed healthy growth during the last decade and is expected to grow at a CAGR of 5.7% between 2015 and 2020 to reach 9.75 Billion by 2020.

Download PDF Brochure@

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=258895412

The growth in this market is majorly attributed to factors such as rising animal healthcare expenditure, rising pet adoption, growing demand for animal-derived food products, increasing number of veterinary practitioners and their growing income levels in developed regions, increasing number of animal research activities along with growing research grants, and rising awareness about zoonotic diseases.

Critical questions the report answers:

# What are the geographic growth opportunities in the animal parasiticides market?

# How growing consolidation in the animal health industry will impact the animal parasiticides market in future?

Europe is the largest regional segment for animal parasiticides owing to the well-established animal healthcare market and growing R&D activities in this region. However, the market in the Asia-Pacific region is expected to grow at the highest CAGR, owing to rising pet adoption and increasing demand for animal-derived food products in India and China.

Some major mergers and acquisitions by Global Leaders are summarized below:

# In March 2015, Perrigo Company PLC (US) acquired Omega Pharma Invest N.V. (Belgium) for USD 4.61 million. This acquisition helped the company to enhance its presence across the globe.

# Zoetis, Inc. (US) acquired animal health assets of Abbott Laboratories (US) for USD 255 million, in February 2015. This acquisition expanded Zoetis’ companion animal product portfolio

# In January 2015, Eli Lilly and Company (US) acquired Novartis Animal Health (Switzerland). This acquisition helped the company strengthen its product portfolio and expanded its global commercial presence.

# In April 2014, Vetoquinol S.A. (France) acquired the animal health business of Bioniche Life Sciences Inc. (Canada). This acquisition helped Vetoquinol to leverage its existing animal healthcare product portfolio as well as its geographic presence.

Request Sample Pages@

https://www.marketsandmarkets.com/requestsampleNew.asp?id=258895412

Major Leaders:

The market players, namely, Sanofi (France), Bayer AG (Germany), and Zoetis, Inc. (U.S.) together accounted for the largest share of the animal parasiticides market and will continue to dominate the market between 2015 and 2020.