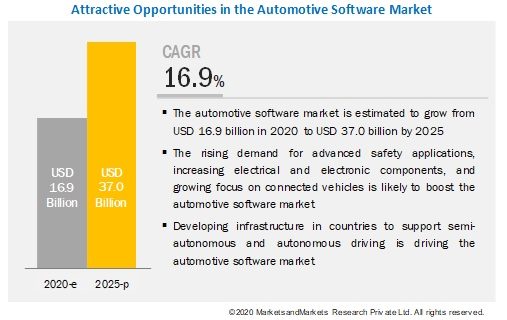

The global Automotive Software Market size is projected to reach USD 37.0 billion by 2025 from USD 16.9 billion in 2020, at a CAGR of 16.9%. The growth of the market is driven by upcoming safety regulations, increase in demand for vehicle management and fuel-efficient vehicles.

Increasing focus on active safety systems and car assessment programs would drive the demand for ECUs in modern vehicles. Increasing number of ECUs will drive the market for automotive software. The increasing number of accidents due to distraction and alcohol-impaired driving fatalities has become a major concern for lawmakers. In 2018, out of total 36,560 fatalities in the US, 10,511 were alcohol-impaired. Distraction affected fatalities reached 2,841 in the US in 2018, accounting for 7.8% of the total casualties for the year. Such instances have sparked the demand for advanced safety features such as driver monitoring systems, automatic emergency braking, lane departure warning, and many others. In addition, upcoming mandates and safety awareness have led to the adoption of software to support these advanced applications.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=200707066

Governments in European countries and the US have mandated the use of AEB in vehicles. For instance, Regulation No. 661/2009 of the European Parliament and Council mandates the introduction of advanced emergency braking systems. The systems were mandated in all new commercial vehicles above 3.5 tons and buses in November 2013 and in all vehicles sold in the European Union in November 2015. In addition, 40 European countries agreed to standardize and lay down technical specifications for advanced AEB systems at the United Nations Economic Commission for Europe (UNECE) in 2019. These specifications will lay down the foundation of vehicle-to-vehicle, and vehicle-to-pedestrian AEBS (Advanced Emergency Braking Systems) fitted on cars. Such developments would surge the demand of automotive software for advanced application during the forecast period.

Battery management software will be a key focus area of automotive software player for electric vehicle. It will cover the largest market share of the automotive software market for EV applications. The advent of electric vehicles has driven the growth of battery management software. Despite the slowdown in the automotive sector, electric vehicle sales have increased steadily in Europe. According to CleanTechnica, in June 2019, Tesla Model 3 and Renault Zoe sold 11,604 units and 4,881 units, respectively, in Europe. Major OEMs plan to introduce electric vehicles with a high voltage powertrain. For instance, in March 2020, General Motors unveiled its modular electric vehicle platform with an improved battery pack called Ultium. Ultium-powered vehicles will have a 400-volt battery pack and up to 200kW fast charging capability. In addition, truck platforms will have 800-volt battery packs with 350 kW fast charging capability. GM’s major brands, such as Chevy, Cadillac, GMC, and Buick, will launch new electric vehicles. In addition, the OEM announced a joint venture in December 2019 with LG Chem with an investment of USD 2.3 billion to mass-produce batteries for electric vehicles in Lordstown, Ohio. Such developments will escalate the demand for battery management software for charging management applications.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=200707066

Key Market Players

The automotive software market is dominated by a few global players and comprises several regional players. Some of the key players in the automotive software industry are Robert Bosch (Germany), NXP (Netherlands), Renesas Electronics (Japan), BlackBerry (Canada), NVIDIA (US), Airbiquity (US), Elektrobit (US), Green Hills Software (US), and Wind River Systems (US).

Critical Questions:

- What would be the impact of COVID-19 on the automotive software market?

- Where will the introduction of safety and emission standards take the automotive software industry in the long term?

- How important is software for advanced electronics and safety systems in vehicles?

- How 5G and wireless technology would enable the automotive software market?

- What is the impact of developments in autonomous driving on the automotive software market?

- What are the upcoming trends in the automotive software market? What impact would they make post-2022?

- What are the key strategies adopted by top automotive software market players to increase their revenue?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst