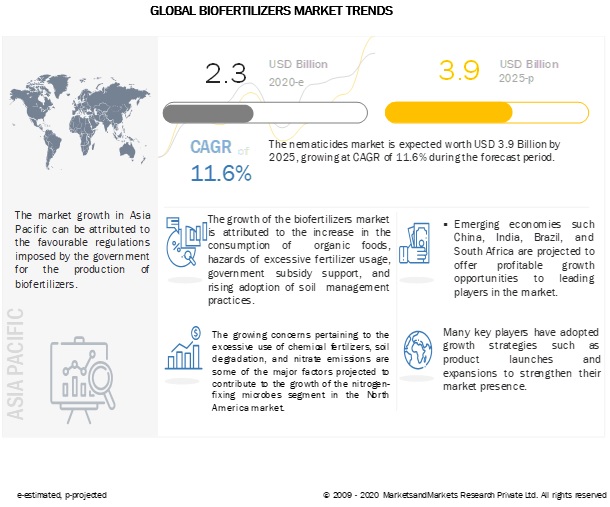

The report “Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Crop Type, Type (Nitrogen-Fixing, Phosphate Solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Region – Global Forecast to 2025″ The biofertilizers market is projected to reach USD 3.9 billion by 2025, from USD 2.3 billion in 2020, recording a CAGR of 11.6% during the forecast period. Rising awareness about the hazards of chemical fertilizers among consumers, soil degradation, nitrate emissions, along with government initiatives, is projected to witness significant growth during the forecast period.

The biofertilizers market includes domestic companies suppliers like Madras fertilizers Ltd, National Fertilizers company Ltd, Jaipur Biofertilizers and Varsha Biosciences Biotech Pvt Ltd. These suppliers have their manufacturing facilities mainly across single region. Though COVID-19 has impacted their businesses as well but there is no significant impact on the supply chain of their biofertilizers. Multiple manufacturing facilities of players are still in operation. Due to supply chain disruptions, labour shortage, closure of food outlets, the supply hasn’t been able to cross the regional and national borders. But due to the increasing demand for food, will increase the production area in the future, once the crisis comes to standstill. However, the demand for biofertilizers is yet to increase after government relaxations.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

Driver: Growth in the organic food industry

Consumers, nowadays, are becoming highly concerned about food safety issues, the rising residue levels in food, and environmental issues, due to the rising concerns about their health. This rise in awareness has induced them to prefer chemical-free food products. With the outbreak of COVID-19 pandemic, people have become more conscious about healthy organic food products, which has driven the market growth of biological inputs, such as biofertilizers. These factors have increased organic retail sales in many countries, such as the US, Germany, China, Switzerland, and Denmark.

Constraint: Environmental and technological constraints

Biofertilizer products have a limited shelf-life and run a high risk of contamination. The microorganisms used as biofertilizers become non-viable when exposed to high temperature. Therefore, it is very important to store them in a cool and dry place. The major problem in the agricultural inoculation technology is the survival of microorganisms during storage; other challenges revolve around several parameters such as culture medium, physiological state of the microorganisms when harvested, dehydration process, rate of drying, temperature maintenance during storage, and water activity of inoculants. These challenges influence the shelf-life of microbes.

With the increasing demand for organic food products, North America is estimated to dominate the biofertilizers market in 2020

Changing lifestyle and increasing buying power among consumers has increased the demand for biofertilizers. High adoption of advanced irrigation systems such as drip & sprinkler irrigation and widespread acceptance of biofertilizers among the farmers is further propelling the market growth. The farmers in this region are highly skilled in terms of knowledge and machinery. Due to the rampant use of chemical fertilizers, the fertility of the soil is declining. To maintain soil fertility as well as the yield of crops, farmers are sustainably opting for biofertilizers.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=856

This report includes a study of the development strategies of leading companies. The scope of this report consists of a detailed study of biofertilizer manufacturers such as Novozymes (Denmark), Kiwa-Biotech (China), Rizobacter Argentina S.A (Argentina), Lallemand Inc. (Canada) and Symborg (Spain).

Recent Developments:

- In June 2019, Novozymes (Denmark) announced plans to continue its research and distribution partnership with Bayer (Germany), where Novozymes could form multi-partnership with UPL (India) and Univar Solutions (US) to distribute its biological products.

- In July 2018, Rizobacter Argentina (Argentina) registered an inoculant for chickpea. This product would help to increase the potential pulses market of Europe and India.

- In May 2016, Lallemand Inc. (Canada) acquired Lage y Cia (Uruguay), a prominent seed inoculant company in South America. This acquisition would help Lallemand in the product development of yeast, fungi, and bacteria as a biostimulant, biocontrol, and biofertilizer agent in the agriculture industry.