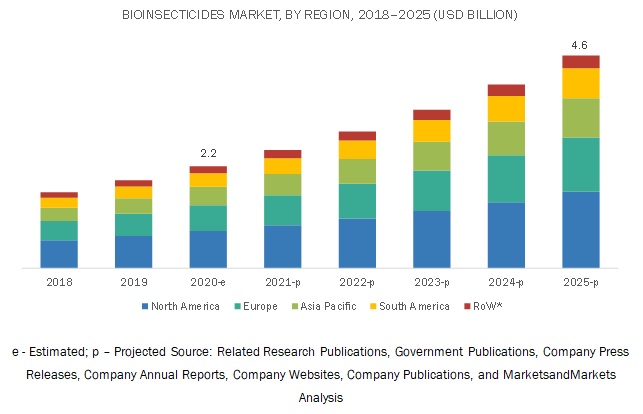

The global bioinsecticides market size is projected to grow at a CAGR of 15.8% from an estimated value of USD 2.2 billion in 2020 to reach USD 4.6 billion by 2025. Factors such as the increasing awareness of consumers about pesticide residues in crops, growing acceptance of organic food, increase in integrated pest management practices, and the ban of pesticides which are detrimental to the public health and environment has led to a huge demand for bioinsecticides, creating sustainable solutions.

The bioinsecticides market is consolidated, with a few players occupying a major share. The wide variety of products offered by these companies for various market trends covered, their strong brand value, their vast geographical presence in terms of manufacturing, R&D units, and distribution partners are the major reasons for this organized market.

Report Objectives:

- To describe, segment, and project the global market size for the bioinsecticides market

- To offer detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To evaluate the micro-markets, concerning individual growth trends, prospects, and their contribution to the total bioinsecticides market

- To propose the size of the submarkets, in terms of value, for various regions

- To profile the major players and comprehensively analyze their core competencies

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=53876759

By organism type, the baculovirus segment is projected to dominate the bioinsecticides market during the forecast period.

With the ban of key synthetic pesticides, there is a significant growth in the usage of bioinsecticides. Baculovirus is an effective biocontrol agent that does not harm the health of applicators, do not kill natural enemies of pests, do not contaminate the environment, or leave residues in the products; these are some of the driving factors for the growth of baculovirus as a bioinsecticide. The US has been one of the key markets for using virus-based bioinsecticides. Due to its effectiveness in killing invasive pests, it has boosted the growth of the baculovirus market.

By crop type, the fruits & vegetables segment is projected to be the fastest-growing segment in the bioinsecticides market during the forecast period.

Increasing demand for high-value crops grown under organic farming is driving market growth. With the change in dietary habits, farmers are compelled to cultivate crops organically using inputs that are devoid of harmful chemicals.

There is huge infestation witnessed in fruits and vegetables both in open fields and greenhouses. To meet the export demand for residue-free crops, farmers are implementing the use of bioinsecticide in combination with conventional chemicals. These are some of the key reasons that are driving the adoption of bioinsecticides in the fruits & vegetables segment.

The markets in South America and Asia Pacific to witness tremendous growth during the forecast period.

The increase in agriculture cultivation has led to the use of quality inputs to obtain better crop performance. The need to maintain minimum residual levels in food products and high growth prospects for organic food has been driving the bioinsecticides market in these regions. Stringent regulations in these countries to limit excessive chemical application is also driving the market. The demand for export-quality fruits and vegetables in Europe and North American region has compelled the farmers to take up sustainable solutions in farming. Even the government has aided through the banning of pesticides so that the adoption of biological solutions grows exponentially. Various key companies are investing in these regions to expand the bioinsecticides business strategically.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=53876759

This report includes a study of the marketing and development strategies, along with the product portfolio of leading companies in the global bioinsecticides market. These companies include BASF SE (Germany), Bayer AG (Germany), Biobest Group NV (Belgium), Certis USA LLC (US) Novozymes A/S (Denmark), Marrone Bio Innovations (US), Syngenta AG (Switzerland), Nufarm (Australia), Som Phytopharma India Ltd (India) Valent Biosciences LLC (US), BioWorks Inc. (US) Camson Biotechnologies Ltd (India), Andermatt Biocontrol AG (Switzerland), International Panaacea Ltd (India), Kan Biosys (India), Futureco Bioscience S.A. (Spain), KilPest India Ltd (India), BioSafe Systems, LLC. (US), Vestaron Corporation (US), and SDS Biotech K.K (Japan), among others.

Recent Developments:

- In March 2020, Marrone Bio Innovations signed an agreement with Anasac (Chile) to develop and distribute Grandevo and Venerate bioinsecticide in Chile.

- In March 2020, Andermatt Biocontrol AGs’ Madex Top product was approved to be used in Sweden and Israel, to control codling moth in pome fruit orchards.

- In October 2019, Nufarm opened a new manufacturing facility in Greenville, Mississippi, US, which will allow the company to support its expanding portfolio and provide customers with high-quality crop protection products.