New Revenue Pockets:

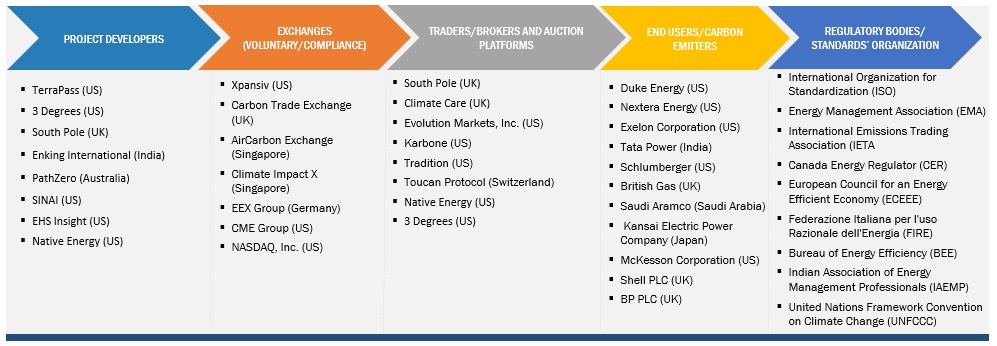

The global carbon credit trading platform market is expected to reach USD 317 million by 2027 from an estimated USD 106 million in 2022, at a CAGR of 24.4% from 2022 to 2027. Increasing carbon emissions are the primary driver for global warming across the globe. Anthropogenic greenhouse gas emissions have increased since the pre-industrial era, driven largely by economic and population growth, and are now higher than ever. There is an urgent need to minimize the impact of carbon emissions on the environment. Producers must reverse and diminish carbon emissions by investing in renewable energies, securing new uses of CO2, adopting carbon capture technologies, and using carbon offset/carbon credits. This will drive the market for carbon credit trading platforms as there will be an increase in the exchange and trading of these carbon credits.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=93146916

The voluntary carbon market, by type segment, is expected to be the fastest-growing segment of the carbon credit trading platform market. Voluntary carbon credits are significantly more fluid, unrestrained by boundaries set by nation-states or political unions. They also have the potential to be accessed by every sector of the economy instead of a limited number of industries.

The cap and trade segment, by system type, is projected to be the fastest growing segment of the carbon credit trading platform market. Cap and trade, and baseline and credit systems aim to reduce global carbon emissions and maintain a sustainable planet for future generations. The cap and trade system controls carbon emissions that sets an upper limit on total emissions, allowing entities to tread according to their usage. It also creates a powerful economic incentive for significant investment in cleaner, more efficient technologies that help drive the market. The “trade” part gives companies flexibility. The growth of this segment can also be attributed to the increasing investments in decarbonization goals, along with clean energy projects in China, India, South Korea, and Australia.

Utilities segment is expected to grow at the fastest CAGR in the carbon credit trading platform market. The carbon credit trading platform market has been segmented, based on end use, into industrial, utilities, energy, petrochemical, aviation, and others. Others include forestry, agriculture, and waste. Carbon credits represent certain amounts of carbon reduced or removed from the air through nature or technology. The utilities are focused on executing decarbonization initiatives to tackle climate change, driving the demand for carbon credit trading platforms. The need for carbon trading and demand for carbon credits play a crucial role. The biggest increase in CO2 emissions in 2021 was observed in the utility sector during electricity and heat production, where it reached more than 900 Mt.

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=93146916

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Since the economies in the region has the largest carbon footprints, there is a more likely chance to offset more credits which will increase the market for carbon credits trading in the region. Not only the compliance carbon market but also the voluntary carbon market seems to be prominent in the region. The economies in the region are working rigorously towards net zero goals. The countries such as China, South Korea, and Japan have a heavy manufacturing and industrial network. Hence the decarbonization target seems to be an opportunity for this region.