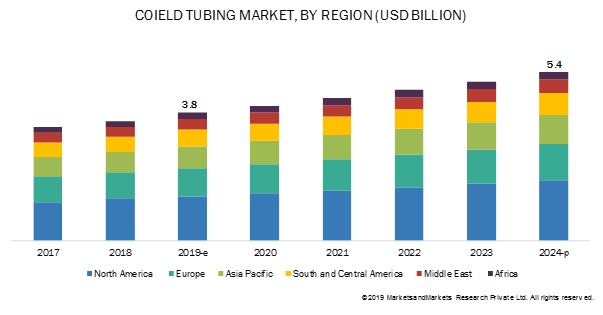

The global coiled tubing market size is projected to reach USD 5.4 billion by 2024 from an estimated USD 3.8 billion in 2019, at a CAGR of 7.1% during the forecast period. The rising number of mature fields in Europe and the Middle East, along with rising primary energy demand from Asia Pacific are the driving factors for the coiled tubing industry, globally. Coiled tubing units are required while intervention and drilling operations during either of the phases, well drilling, completion, and production.

Download PDF Brochure –

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=804

The well intervention segment is expected to dominate the coiled tubing market, by service, during the forecast period.

At the initial stage, every crude oil or natural gas reservoir has sufficient reservoir pressure, but it declines with time. Post that, the oil well operators need to pump fluids and perform certain intervention operations, such as well stimulation, sand control, unloading well with nitrogen, gravel packing, pumping slurry, and scale removal. These are generally categorized as well cleaning & pumping operations. Similarly, for depleting reservoirs, the well requires some completions or mechanical operations such as the setting of plug or packer, fishing, perforation of producing wells, removing of scales, cutting tubular service, running a completion unit, and performing of straddle for zonal isolation. Demand for these services drives the well intervention segment for the coiled tubing market.

Speak to Analyst –

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=804

This research report categorizes the coiled tubing market based on service, application, fleet, and region.

Based on Service:

- Well intervention

- Well Cleaning & Pumping Operations

- Well Completions & Mechanical Operations

- Drilling Service

- Others (Fishing, fracturing, wireline logging, and inspection)

Based on the Application:

- Onshore

- Offshore

Based on the Fleet:

- Region

- Operator

Based on the Region:

- North America

- Asia Pacific

- South & Central America

- Europe

- Middle East

- Africa

North America: The largest coiled tubing market.

In this report, the coiled tubing industry has been analyzed for six regions, namely, North America, South & Central America, Europe, Asia Pacific, Middle East, and Africa. According to the IEA, the US is determined to become the net exporter of energy by 2020, and to fulfill this objective, oil production is being increased across the nation. Moreover, the US is the top explorer and producer of shale oil and gas. The old oil & gas fields in the Permian Basin and Bakken Ford require intervention operations to enhance the productivity of the wells. Thus, North America dominated the coiled tubing industry in 2018.

Request for Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=804

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top players in the coiled tubing market.

Some of the key players are Schlumberger (US), Halliburton (US), C&J Energy Service (US), Weatherford (US), and BHGE (US). The leading players are adopting various strategies to increase their share in the coiled tubing industry. Contracts & agreements and new product launches have been a widely adopted strategy by the major players in the coiled tubing market.