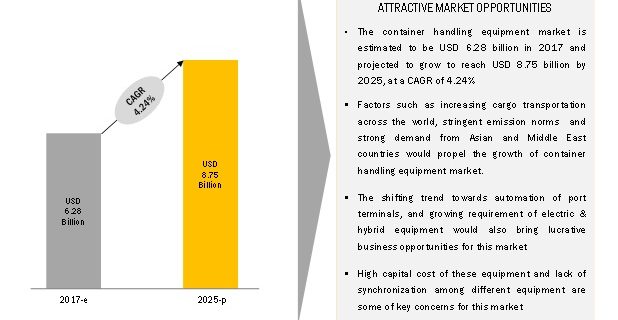

The Container Handling Equipment Market is projected to grow at a CAGR of 4.24%, during the forecast period, to reach a market size of USD 8.75 billion by 2025. Increased cargo transportation, growing use of automation technologies at port terminals, stringent emission levels resulting in the increased demand for electric and hybrid equipment, and the rising demand in Asia Pacific and the Middle East are the key factors driving the growth of the container handling equipment market.

The container handling equipment market is dominated by a few global players and comprises several regional players. Some of the key manufacturers and suppliers in the container handling equipment market are Kalmar (Finland), Konecranes (Finland), Liebherr (Switzerland), Hyster (US), Sany (China), ZPMC (China), Lonking (China), Anhui Heli (China), CVS Ferrari (Italy), and Hoist Liftruck (US). Contracts & agreements and new product developments were the prominent strategies adopted by these players to gain traction in the container handling equipment market. For instance, in January 2018, CVS Ferrari completed the delivery of an F500.RS3 reach stacker to Indorama Ventures (Thailand) at its production plant in Corlu, Turkey. The plant produces pet bottles for the European market and the F500.RS3 reach stacker would handle containers of raw chemicals. Alternatively, companies also adopted the new product developments strategy to maintain their positions in the market. In September 2017, Hyster planned to develop a new 48-ton electric container handling product. The testing phase is expected to start shortly, and the equipment will utilize lithium-ion battery technology for electrification, helping the company achieve its zero-emission targets.

Download PDF Brochure @https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239108007

Kalmar is the leading player in the container handling equipment market due to its wide range of equipment such as RTG, RMG, reach stackers, and terminal tractors. Kalmar has adopted a mix of the contracts & agreements and mergers & acquisitions strategies to retain its position in the container handling equipment market. In January 2018, the company received a contract for 10 TL2 terminal tractors from Trac-Wheels (Malaysia). Kalmar also entered into a 3-year contract with PSA Corporation Limited (Singapore) for the maintenance and repair of mobile equipment, where the company will provide maintenance and service support to 700 prime movers and trailer sets installed at the Pasir Panjang Terminal. Furthermore, as part of its acquisition strategy, the company took over the port services business of Inver Engineering (Australia), a part of Inver Engineering, which provides repair, maintenance, and refurbishment services for cargo handling equipment at port terminals in Australia, New Zealand, and the Pacific region.

Konecranes is another prominent player in the container handling equipment market. Konecranes adopted the mergers & acquisitions and contracts & agreements strategies to strengthen its market position. In January 2017, it acquired the material handling and port solutions (MHPS) business segment of Terex Corporation (US). The acquisition, worth USD 1.22 billion, added Terex Demag and Port solutions to Konecranes’ product portfolio, including container handling equipment and reach stackers. The company has also been awarded multiple contracts. In December 2017, Konecranes received a contract from Kramer Group (Netherlands) for 11 SMV 6/7 ECC 100 DS empty container handlers and 11 SMV 4531 TC5 reach stackers. These machines would be deployed at Kramer’s city depot in Waalhaven/Eemhaven and the Delta depot at Maasvlakte. This contract would enable Konecranes to showcase its extensive product portfolio at the Rotterdam port area.

Key Players

Some of the key container handling equipment manufacturers and suppliers include Kalmar (Finland), Konecranes (Finland), Liebherr (Switzerland), Hyster (US), Sany (China), ZPMC (China), Lonking (China), Anhui Heli (China), CVS Ferrari (Italy), and Hoist Liftruck (US). Kalmar adopted a mix of the contracts & agreements and mergers & acquisitions strategies to retain its market position, while Konecranes also followed these strategies to remain a prominent player in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst