Integration of monitoring technologies in smartphones and wireless devices is a key trend in patient care, resulting in the introduction of remote monitoring systems, mobile cardiac telemetry devices, mobile personal digital assistant (PDA) systems, ambulatory wireless EEG recorders, and ambulatory event monitors are the key factors supporting the growth of the market.

The patient monitoring devices market is projected to reach USD 55.1 billion by 2025 from USD 36.4 billion in 2020, at a CAGR of 8.6% during the forecast period. Patient Monitoring Devices Market by Product (EEG, MEG, TCD, Pulse Oximeter, Spirometer, Fetal Monitor, Temperature Monitoring, MCOT, ECG, ICP, ILRs, Blood Glucose Monitoring, Blood Pressure Monitor), End-User (Hospitals, ASCs).

COVID-19 Impact on the global Patient Monitoring Devices market

As a result of the pandemic, during March 2020 and throughout the second quarter of 2020, access to customers to sell and implement the patient monitoring devices (such as neuromonitoring devices, weight monitoring devices) diminished as hospitals became primarily focused on the COVID-19 pandemic. The pandemic has led to a significant increase in the demand for remote monitoring and patient engagement solutions.

COVID-19 has led to a significant surge in demand for patient monitoring systems, and manufacturers are increasingly focusing on expanding production to meet the increasing need for respiratory monitoring devices, multi-parameter monitoring devices, blood glucose monitoring devices, cardiac monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, and fetal/neonatal monitoring devices. Furthermore, the market for neuromonitoring devices is expecting to recover the losses by the fourth quarter of 2020.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=678

Opportunity: Growing Demand For Patient Monitoring Devices In Non-hospital Settings

In recent years, the rising healthcare expenditure, especially in hospital settings, has shifted the focus towards alternative methods of treatment, such as home healthcare. This, in turn, has ensured a growing demand for effective home-use devices such as thermometers, pulse oximeters, weight scales, ECG monitors, event monitors, EEG recorders, and fetal monitors.

The sustainability of the current healthcare system is a key area of concern for governments across the globe. According to the CDC, in the US, long-term care services were provided by 4,600 adult day service centers, 12,200 home health agencies, 4,300 hospice care facilities, 15,600 nursing homes, and 28,900 assisted living and similar residential care communities in 2016. Moreover, the number of hospital readmissions has decreased considerably due to the rising use of remote and home monitoring devices.

Challenge: Increasing Pricing Pressure On Market Players

Various initiatives are being taken to curtail healthcare costs through price regulations, competitive pricing, bidding and tender mechanics, coverage and payment policies, comparative effectiveness of therapies, technology assessments, and managed-care arrangements globally. In response to the increasing pressure to reduce healthcare costs, healthcare providers have aligned themselves with group purchasing organizations and integrated health networks, negotiating for the bulk purchase of medical devices.

In 2018, the Indian government increased import duties on medical devices from 5% to 7.5% of the overall product costs and imposed additional excise duty of 4% on previously exempted medical devices. Such taxes are expected to increase operational costs and negatively affect the cash flow of medical device companies across major healthcare markets worldwide.

Region Covered in Patient Monitoring Devices Industry

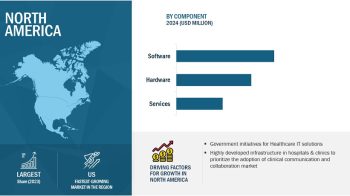

The report covers the patient monitoring devices market across five major geographies, namely, Europe, North America, Asia Pacific, Latin America, and MEA. North America commanded the largest share of the patient monitoring devices market in 2019. The increasing R&D to develop novel sensor based patient monitoring systems, rising prevalence of infectious diseases, safety concerns, and technological advancements in patient monitoring devices products are the key factors supporting market growth in North America.

Moreover, most of the prominent companies in the global market are headquartered in the region or have a strong presence in this market, such as Masimo Corporation, GE Healthcare, Edward Lifesciences and Natus Medical. Others have focused on expansion to increase their reach and capabilities. This is another key factor attributed to the prominent growth of the market.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=678

Leading Companies

The major players in the patient monitoring devices market are Abbott Laboratories (US), HILL-ROM HOLDINGS, INC. (US), Drägerwerk AG & Co. KGaA (Germany), Edwards Lifesciences Corporation (US), OMRON Corporation (Japan), Masimo Corporation (US), Compumedics Limited (Australia), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Nihon Kohden Corporation (Japan), Natus Medical (US), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), Getinge AB (Sweden), Boston Scientific Corporation (US), Dexcom, Inc. (US), Nonin (US), BIOTRONIK (Germany), SCHILLER (Switzerland), and BioTelemetry, Inc. (US), among others.