Feed additives are defined as products used in animal nutrition for the purpose of improving the quality of feed and the quality of food from animal origin, or to improve animals’ performance and health. MarketsandMarkets expects the global feed additives market to grow from USD 33.0 billion in 2018 to USD 44.3 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 6.1% during the forecast period. Increase in the demand and consumption of livestock-based products; growth in feed production; and implementation of innovative animal husbandry practices to improve meat quality and output of other livestock-based products are expected to drive the growth of the feed additives market.

Report Objectives:

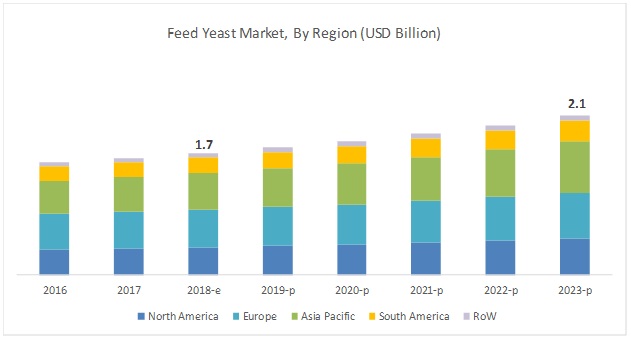

- Determining and projecting the size of the feed yeast market with respect to type, livestock, genus, and region over a five-year period from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Understanding the competitive landscape for a comparative analysis of market leaders and identifying the key market shareholders across the industry.

- Analyzing regulatory frameworks across regions and their impact on prominent market players

- Providing insights on key investments in technology innovations

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=108142106

The dry segment is estimated to dominate the market for feed additives, by form, in 2018. Dry feed additives have higher demand among livestock producers, as they are easy to mix with the feed, and are easy to store and handle. Additionally, unavailability of modern feed mills and equipment for using liquid feed additives makes the dry form more preferable among the livestock farmers. Amino acids, flavors & sweeteners, minerals, probiotics, phosphates, carotenoids, acidifiers, mycotoxin detoxifiers, antioxidants, and vitamins are a few types of feed additives that are mostly preferred in a dry form.

In terms of geographical coverage, the feed additives market has been segmented into 5 regions, namely, North America, Europe, Asia Pacific (APAC), South America, and RoW. Asia Pacific is projected to be the fastest-growing segment during the forecast period. This is due to large livestock population and higher consumption of levels of meat and dairy in the region. Developments and innovations in the production processes in countries such as China have further improved the output and capacity of the meat industry in the region. Increasing demand for processed meat, protein diet, and dairy products, due to growth in household income levels, also continue to drive the demand for feed additives in this region. Shift toward the usage of natural growth promoters and increase in demand for nutrition supplements for monogastric animals are expected to create an opportunity for the feed additives market in the coming years.

The major feed additives vendors include Cargill (US), DowDuPont (US), ADM (US), Evonik (Germany), BASF (Germany), DSM (Netherlands), Solvay (Belgium), Ajinomoto (Japan), Novozymes (Denmark), Chr. Hansen (Denmark), InVivo (France), Nutreco (Netherlands), Kemin (US), Adisseo (France), and Alltech (US). Expansions and investments have been the most dominating strategy adopted by major players, followed by acquisitions. This has helped them to increase their presence in different regions and enhance their product portfolio.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=108142106

Key questions addressed by the report:

- How would the feed yeast market be dependent on the distilleries and livestock industry, and which livestock would adopt maximum usage of feed yeast?

- Which region will account for the highest share in the feed yeast market?

- Which type of feed yeast holds high potential for growth in each key country?

- What are the trends and factors responsible for influencing the adoption rate of feed yeast in key emerging countries? What is the level of support offered by the government across countries towards the manufacturers to adopt these natural growth promoters in feed?

- Which are the key players in the market and how intense is the competition?