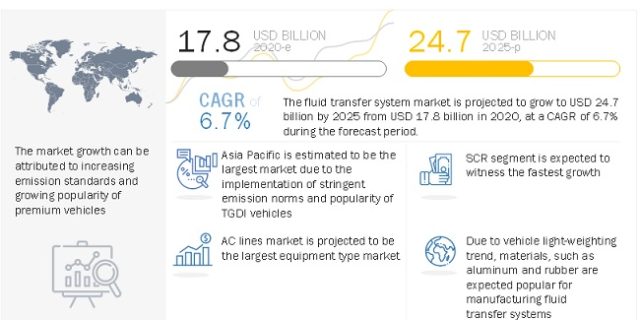

The Fluid Transfer System Market is projected to grow to USD 24.7 billion by 2025 from USD 17.8 billion in 2020, at a CAGR of 6.7% during the forecast period. The demand for fluid transfer system is primarly driven by stringent emission norms, coupled with increasing adoption of SCR, turbochargers and growing demand for premium vehicles.

The fluid transfer system industry is expected to be positively impacted by growing popularity of electric vehicles. The decreased emission limits and increased fuel efficiency requirements have increased the focus on electric & hybrid vehicles, which, in turn, is expected to have a significant impact on the global fluid transfer system market. For instance, PHEVs are premium vehicles equipped with the most high-end features available and are high on cost. PHEVs employ lines such as battery cooling lines, engine cooling lines, brake lines, air suspension lines etc. Thus, with growth of such electric vehicles, the fluid transfer system market may witness a landscape change in the coming years.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=163311077

Fluid Transfer System Market Dynamics

Driver: Stringent emission norms to mandate aftertreatment devices

Due to the implementation of stringent emission norms, adoption of aftertreatment devices, such as SCR and DPF, has increased significantly. DPF lines have witnessed the highest growth in recent years; however, SCR lines are expected to grow at a faster rate in the coming years. SCR technology offers benefits, including more enhanced NOx reduction than LNT by nearly 90%, and hence, it is mostly preferred in diesel vehicles across the globe. SCR has maximum installation rate in European and North American countries due to the ongoing emission norms, such as Euro 6 and Tier 3, respectively. The EU follows one of the most stringent emission norms globally. Thus, it has a higher installation rate of SCRs than other regions such as Asia Oceania and North America in these vehicle types. Further, the newer trucks and buses of developed countries must withstand the NOx permissible limits and should be fitted with SCRs. Moreover, due to the ongoing and upcoming stringent emission norms in developing countries, such as China, India, and Thailand, the demand for SCRs is expected to increase significantly across all diesel vehicle types.

Opportunities: Increasing demand for lightweight vehicle parts

Light weighting is a popular trend in the automotive industry. The increased usage of lightweight materials to reduce the overall vehicle weight helps enhance fuel efficiency and lowers the cost of driving a vehicle. Vehicle and component manufacturers are seeking innovative ways to reduce vehicle weight by using lighter materials such as aluminum. Moreover, deployment of a new production process is likely to provide desired results. For instance, hot stamping or hydroforming methods can be used to manufacture steel parts and assemblies instead of conventional stamping. This method helps make lightweight products with equal or improved strength. Additionally, the use of lightweight materials, such as plastics, aluminum, and advanced high strength steel (HSS), for the manufacturing of fluid transfer systems is expected to create lucrative growth opportunities for manufacturers in the near future.

Key Market Players:

The fluid transfer system market is dominated by global players and comprises several regional players as well. The key players in the fluid transfer system market are Cooper Standard (US), Kongsberg (Switzerland), TI fluid systems (UK), Contitech (Germany), Akwel (France), Hutchinson (France), Lander automotive (UK), Tristone (Germany), Castello Italia (Italy), and Gates (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=163311077