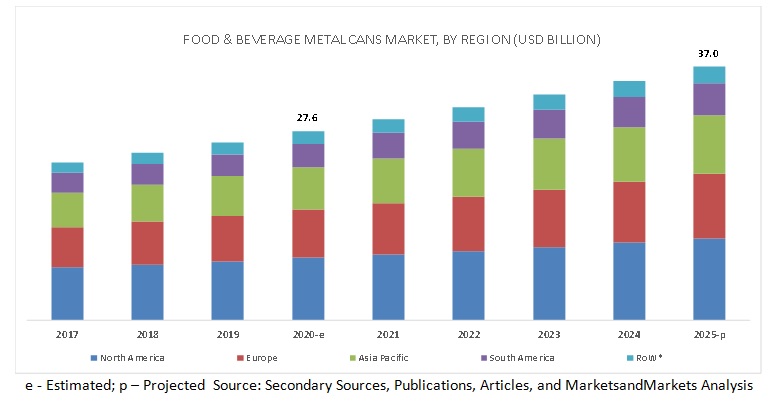

The report “Food & Beverage Metal Cans Market by Material (Aluminum and Steel), Type (2-Piece and 3-Piece), Degree of Internal Pressure (Pressurized Cans and Vacuum Cans), Application (Food and Beverages), and Region – Global Forecast to 2025″, According to MarketsandMarkets, the food & beverage metal cans market is estimated to be valued at USD 27.6 billion in 2020 and is projected to reach USD 37.0 billion by 2025, recording a CAGR of 6.1%. The rapid growth in awareness toward environmental sustainability and recyclable properties of metal cans are the driving factors for the food & beverage metal cans market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=251

By material, the aluminum segment is projected to account for the larger share in the food & beverage metal cans market

The aluminum segment is projected to dominate the market, on the basis of material, during the forecast period. This is attributed to the cost-effectiveness and recycling rates of aluminum. Increasing use of metal packaging for food & beverages packaging provides a sustainable and environment-friendly solution for packaging in multiple applications. Aluminum cans are convenient to keep in refrigerators and ovens. Changes in consumer preferences are observed for food & beverage packaging. According to the Environmental Protection Agency of the United States (EPA), 1.9 million tons of aluminum packaging was generated for beers and soft drink cans, and 49.2% of aluminum beverage cans were recycled. The metal packaging for the food industry is considered to be safe, which is one of the major factors to support its growth in the market.

By application, the beverages segment accounted for the larger size in the food & beverage metal cans market during the forecast period

Based on application, the food & beverage metal cans market is segmented into food and beverages. The beverage cans are estimated to account for the larger share, because of the high consumption of carbonated, non-carbonated, and sports & energy drinks. The rise in consumption of alcoholic beverages leads to the growth of beverage cans market. Moreover, changes in consumer trends toward healthy drinks are driving the market for metal cans during the forecast period.

The Asia Pacific region is projected to witness the fastest growth during the forecast period

The Asia Pacific food & beverage metal cans market is projected to have higher growth potential in the coming years. A large consumer market and increasing disposable income in India and China are driving the growth of the demand for high-quality metal packaging. Also, China is the hub for the manufacture of metal cans and has sufficient manufacturing plants to meet the demand for food & beverage metal packaging. Moreover, rapid urbanization in countries such as India and China are expected to result in high growth of the food & beverage metal cans market in Southeast Asia during the forecast period.

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies. It consists of the profiles of leading companies such as Crown Holdings, Inc (US), Ball Corporation (US), Silgan Holdings Inc. (US), Ardagh Group (Luxembourg), CAN-PACK S.A. (Poland), Kian Joo Group (Malaysia), CPMC Holdings Limited (China), Huber Packaging Group GmbH (Germany), CCL Industries (US), Toyo Seikan Group Holdings Ltd (Japan), Universal Can Corporation (Japan), Independent Can Company (US), Mauser Packaging Solution LLC (Germany), Visy (Australia), Lageen Food Packaging (Israel), Massilly Holding S.A.S (France), P. Wilkinson Containers Ltd. (UK), Unimpack (Netherlands), Müller und Bauer GmbH (Germany), and Allied Cans (Canada).

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=251

Recent Developments:

- In April 2019, Crown Holdings, Inc. announced the launch of round and square shorter cans in the luxury packaging market. This will help the company to broaden its product portfolio.

- In August 2019, Ball Corporation signed an agreement to sell its tinplate steel aerosol packaging facilities to Envases del Plata (Argentina), an Argentinian metal packaging company. This agreement will help the company to expand its reach in the South American region.

- In October 2019, Ball Corporation announced the construction of its new aluminum cups manufacturing plant in Rome, Georgia to cater to the growing demand for beverage packaging in the US. This new plant will help the company expand its presence in the US region.

- In July 2019, Ardagh Group launched a slimline 187 ml can, particularly designed for protecting wine and wine-based drinks. This launch would help the company to expand its product portfolio.