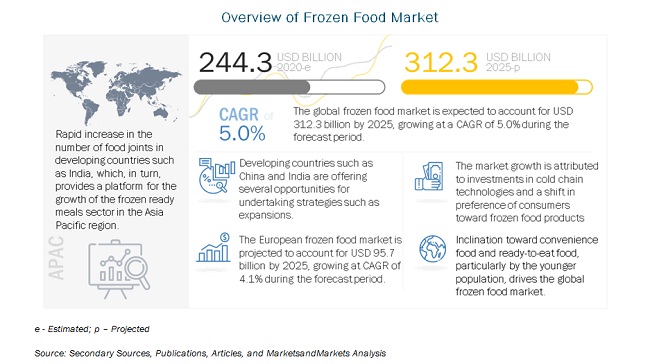

The frozen food market, in terms of value, is estimated to account for nearly USD 244.3 billion in 2020 and projected to grow at a CAGR of 5.0%, to reach nearly USD 312.3 billion by 2025. Developments in the retail landscape, rising demand for convenience food, and technological advancements in the cold chain market are the major driving factors for the market. Online grocery shopping and new apps (applications) in the retail sector are creating several opportunities for the overall processed food market and hence accelerating the frozen food market.

Key players that have a strong presence in the frozen food market include General Mills Inc (US), Conagra Brands, Inc. (US), Grupo Bimbo S.A.B. de C.V. (Mexico), Nestle SA (Switzerland), Unilever (Netherlands), Kellogg Company (US), McCain Foods Limited (Canada), Kraft Heinz Company (US), Associated British Foods plc (UK), Ajinomoto (Japan), Vandemoortele NV (Belgium), Lantmannen Unibake International (Denmark), Cargill (US), Europastry S.A. (Spain), JBS (Brazil), Kidfresh (US), Aryzta (US), Kuppies (India), OOB Organics (New Zealand), Omar International Pvt Ltd (India), Bubba Foods (US), Shishi He Deming (China), and Smart Price Sales & Marketing (US), Chevon Agrotech Pvt Ltd (India), and Omar International Pvt Ltd (India).

To know about the assumptions considered for the study download the pdf brochure

Major players in the market are mainly focusing on undertaking expansions for innovating and developing research centers to meet the growing requirements of consumers. The core strengths of the key players identified in this market are their growth strategies such as new product launches and acquisitions. Undertaking new product launches and expansions have enabled the market players to enhance their presence in the frozen food market. Key players such as Unilever (Netherlands) undertook these strategies to improve their distribution network, gain a stronger foothold, and enhance market share.

Unilever is focusing on offering a diverse variety of frozen food products. For example, in December 2018, Ben & Jerrys, a brand of Unilever (Netherlands), launched a new coconut-flavored vegan ice-cream in the UK. This product launch was part of the company’s expansion strategy in the UK market. In addition, the company is also focusing on acquisitions. Unilever (Netherlands) acquired Betty Ice (Romania) to strengthen its ice-cream segment. This acquisition would strengthen its position in Romania.Unilever is a consumer goods (FMCG) company operating worldwide, with more than 35 brands in categories such as soaps, detergents, shampoos, skin care, toothpaste, deodorants, cosmetics, tea, coffee, packaged foods, ice cream, and water purifiers. The company has six main R&D centers in the US, the UK, the Netherlands, India, and China; these centers work on technologies that are applicable to the product development process. Unilever invests about USD 1 billion in R&D each year. The company’s subsidiaries include Ben & Jerrys (US), Kwality Wall (India), Hindustan Unilever (India), Dollar Shave Club (US), Seventh Generation, Inc. (US), Gromart S.p.A. (Italy), and Tazo Tea Company (US).

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=130

Nestle SA (Switzerland) is one of the largest food & beverage companies, with more than 2000 brands. Apart from food & beverages, the company is also involved in the pharmaceutical business. It manufactures beverages, milk-based products, ice creams, prepared dishes, and pharmaceutical products. Nestle operates globally with its presence across Europe, America, Asia, Oceania, and Africa. The company mainly operates through its subsidiaries and has 29 R&D facilities, worldwide. It offers its products in 189 countries and has factories in 85 countries. The company focuses on market strategies such as joint ventures and new product launches. For example, in October 2016, Nestlé and R&R (UK) started Froneri, a new joint venture in ice cream, frozen food, and chilled dairy. Froneri was opened to combine Nestlé and R&R’s ice cream business in the Philippines, Europe, Australia, the Middle East (excluding Israel), South Africa, Argentina, and Brazil.

Recent Developments:

- In June 2018, Lantmännen Unibake opened up a new production plant in Nowa Sól, Poland to increase its production capabilities.

- In October 2018, Conagra acquired Pinnacle Foods Inc. (US); the acquisition helped Pinnacle foods to widen its frozen meals & snacks and sweet treats categories.

- In September 2018, Grupo Bimbo added four frozen bakery lines to its Argentina plant. This step was taken to increase the export business of the company in neighboring countries such as Chile.

- In November 2018, Nestle launched Wildspace, a range of healthy frozen meals in reusable and recyclable containers. Wildscape meals include six different varieties, such as the gochujang cauliflower with Brussel sprouts, quinoa, chickpeas, pickled onions, riced cauliflower, and cashews.