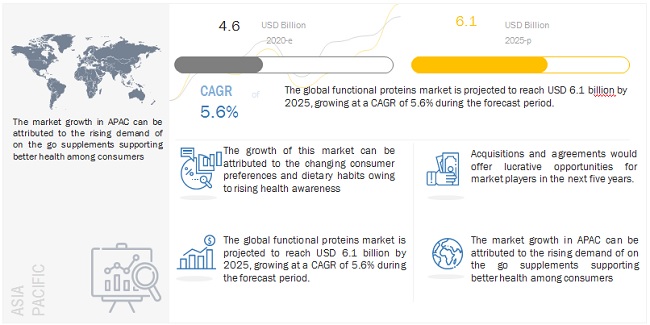

The report “Functional Proteins Market by Type (Whey Protein Concentrates, Isolates, Hydrolysates, Casein, Soy Protein), Source (Animal, Plant), Form (Dry, Liquid), Application and Region – Trends and Forecast to 2025” According to MarketsandMarkets, the global functional proteins market size is estimated to be valued at USD 4.6 billion in 2020 and projected to reach USD 6.1 billion by 2025, recording a CAGR of 5.6% during the forecast period.

The demand for functional proteins is increasing significantly owing to the shift in consumers’ food-related preferences and the rising prevalence of chronic diseases. Rising health awareness and increase in disposable income across the globe are key factors that are driving the growth of the functional proteins market. The millennial population is capturing a large share of the market as the ongoing health and wellness trend ergo the surging internet penetration is altering consumer preferences and moving towards adapting protein-infused functional foods into their diets in order to maintain quality of life.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=140299581

Restraints: High cost of functional proteins

Science and technology are helping people identify foods that will help people manage their weight and overall health. Functional food and dietary supplements involve significantly high costs, which could act as a restraint for the growth of the functional proteins market. These products being less economic might restrict the growth of the market, particularly in price-sensitive countries such as South Africa and Mexico.

Also, animal-based proteins are facing restraints as the vegan population is on the rise and the health benefits of vegetarianism are trending among consumers. The rising demand for plant-based proteins is having an adverse effect on the sale and consumption of animal-based proteins, which is hindering market growth.

Opportunities: Shift toward plant-based products

The market for plant proteins is growing at a high rate as consumers are drifting away from animal proteins to plant-based protein. Increasing shifts to veganism, environment sustainability and animal compassion are the key factors cumulatively leading to demand of plant-based proteins as an alternative functional ingredient. Thus, the plant-based protein market is expected to witness high demand and surging growth rate, presenting number of opportunities for expansion and investment in the functional proteins market.

The North American region dominates the functional proteins market with the largest share in 2020.

North America is projected to hold the largest share in the functional proteins market. This dominance is driven by the prevalence of chronic diseases due to the hectic lifestyles and increasing awareness among consumers regarding the health benefits of consuming functional proteins. Also, obesity is on the rise among the North American population, especially the US. According to the CDC, in the US, the obesity prevalence was 39.8% and affected about 93.3 million adults between 2015 and 2016. Such factors are projected to drive the growth of the functional proteins market.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=140299581

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, ADM (US), DuPont (US), Cargill (US), Ingredion (US), Arla Foods (UK), Roquette (France), BASF (Germany), Glanbia (Ireland), Fonterra (New Zealand), DSM (Netherlands), FrieslandCampina (Netherlands), Essentia Protein Solutions (UK), Amai Proteins (Israel), Mycorena (Sweden), Merit Functional Foods (Canada), Plantible Foods (US), BENEO (Germany), ProtiFarm (Gelderland), and Omega Protein (US).

Recent Developments:

- December 2020, Cargill expanded its European ingredient portfolio with the addition of pea protein. This product launch enabled Cargill to get access to the pea protein market.

- November 2020, Ingredion acquired Verdient Foods (Vanscoy, SK) with 100% ownership. The acquisition enabled net sales growth and expanded the manufacturing capability of Ingredion, with the addition of two manufacturing facilities in Canada.

- September 2020, ADM expanded their protein portfolio with textured wheat and pea proteins. These high-functionality proteins improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant protein market.