The growth of the market can be attributed to the transition to ICD-10 coding standards from ICD-9 in North America, the growing demand for CAC solutions, the growing need within the global healthcare system to curtail increasing healthcare costs, improve coding accuracy, and streamline the revenue cycle management procedures. The computer-assisted coding market is expanding with the emergence of new products and applications. These computer assisted coding solutions being used in many applications such as automated computer-assisted encoding, management reporting & analytics, and clinical coding auditing.

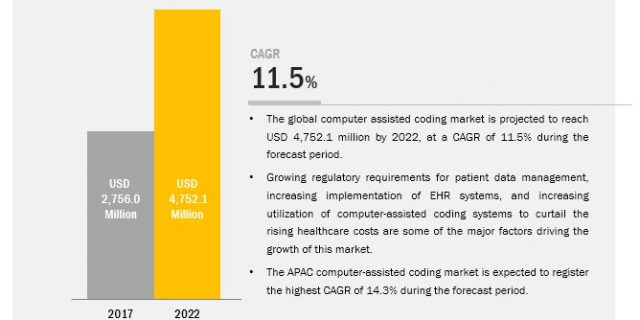

The global computer assisted coding market is valued at USD 2.76 billion in 2017 and is expected to register a CAGR of 11.5% to reach to USD 4.75 billion by 2022. Computer Assisted Coding Market by Software (Natural Language Processing, Structured Input, Integrated Systems), Service (Support, Education & Training), Application (Automated Encoding, Clinical Coding Audit, Management Reporting).

Implementation of ICD-10 Drive the Global Computer Assisted Coding Market

Many hospitals, especially in North America, are adopting CAC systems to manage the increasing load of coding resulting from the adoption of ICD-10 standards. Major health plans like Medicare have reported a smooth transition to ICD-10 due to rigorous testing for over six years. The ICD-10 coding system requires the use of 72,000 procedure codes and 68,000 CM codes, as opposed to the 4,000 and 14,000 codes, respectively, in the ICD-9 system. The requirement of managing a high volume of codes in the ICD-10 system is in turn driving the demand for automation.

The US is expected to dominate the global CAC market due to the mandated switchover to ICD-10 coding standards in October 2015. This transition may result in a decline in coders’ productivity, thereby resulting in lower profitability for hospitals. The implementation of CAC systems can resolve this issue as they enable healthcare organizations to work more efficiently while complying with procedural coding standards as per ICD-10 guidelines. This trend is expected to provide a strong stimulus to the growth of the CAC market in North America in the coming years.

The high implementation and maintenance costs and lack of on-site CAC support and in-house CAC domain knowledge are major factor restraining the growth of the market. The American Health Information Management Association (AHIMA) states that the cost of the hardware, initial licensing fees, ongoing maintenance fees, and the requisite IT support for CAC systems can cross USD 500,000 a year for a small health system (1,000 beds). Even though smaller hospitals generally pay less in licensing fees for the software, the per-chart coding cost is usually higher. Also, services and maintenance, which include software upgradation as per changing user requirements, represent a recurring expenditure for healthcare organizations. This has adversely affecting the affordability of various computer assisted coding solutions for organisations.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170644018

Applications such as automated computer-assisted encoding, management reporting & analytics, and clinical coding auditing drive the growth of computer assisted coding market.

Automated Computer-assisted Encoding

Automated computer-assisted encoding is one of those applications enables compliance with regulatory standards for clinical coding, thus ensuring that the information exchanged between different healthcare organizations is consistent, comparable, and meaningful.

Management Reporting & Analytics

The healthcare IT industry is facing challenges to make data accessible, sharable, and actionable. The management reporting and analytics modules of computer-assisted coding are designed to enable coding and revenue managers to monitor and track coding processes throughout the workflow. These tools help in tracking the various stages of coding procedures such as case assignment, recording the point and time of modifications to original coding, and the duration for which the chart was open. With analytics tools, coding data can be examined and used more efficiently in making critical decisions.

Clinical Coding Auditing

Clinical coding auditing reduces regulatory compliance risks by identifying potential patterns for fraud and enables healthcare organizations to maximize reimbursement by improving coding accuracy. Clinical coding audits include a statistical audit, subset audit, percentage audit, and a complete audit. They are aimed at providing a more comprehensive overview of the areas of concern using a more extensive data set. The complete clinical code audit uses all relevant data available to ensure a thorough audit. However, there are a number of solutions in the market that provide customizable auditing options, enabling users to define specific parameters for the information to be used. Such solutions help accelerate the auditing process.

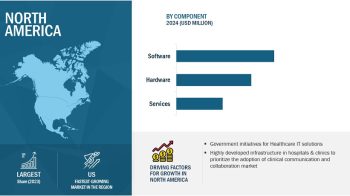

Region Covered in CAC Market

North America dominated the global computer-assisted coding market. Increasing government support for improving healthcare infrastructure, growing need for reducing healthcare costs, and advancements in healthcare facilities are driving the growth of the computer-assisted coding market in this region.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=170644018

Leading Companies

3M Health Information Systems (US), Optum (US), McKesson Corporation (US), Nuance Communications (US), Cerner Corporation (US), Dolbey Systems (US), Precyse Solutions (nThrive) (US), Craneware (UK), Artificial Medical Intelligence (US), and TruCode (US). Other players include Quest Diagnostics (US), Streamline Health Solutions (US), M-scribe Technologies (US), eZDI Inc. (US), Alpha II LLC. (US), ID GmbH & Co. KGaA (Germany), ZyDoc (US), Coding Strategies (US), Patient Code Software (US), and Flash Code (US) among others.