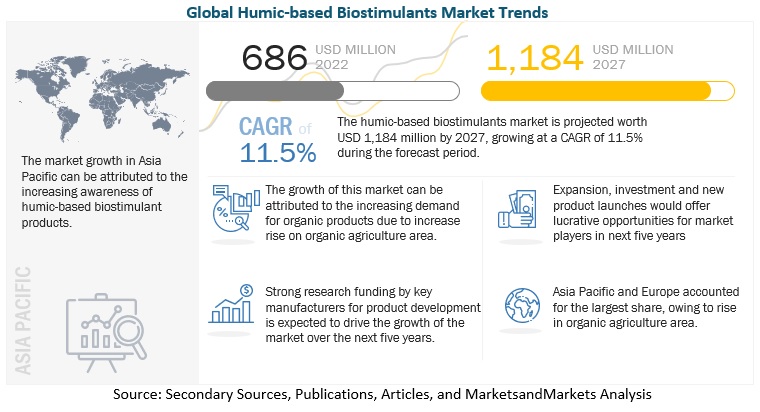

The report “Humic-based Biostimulants Market by Type (Humic Acid, Fulvic Acid, and Potassium Humate), Mode of Application (Foliar Treatment, Seed Treatment, and Soil Treatment), Formulation, Crop Application, and Region – Global Forecast to 2025″, size is estimated to account for a value of USD 515 million in 2020 and projected to grow at a CAGR of 10.5% from 2020, to reach USD 848 million by 2025. Factors such as the rise in demand for products which enhance the crop productivity and increase in the adoption of sustainable solutions like organic farming to meet the consumers demand with changing lifestyle is projected to drive the growth of the humic-based biostimulants market.

Report Objectives:

- To define, segment, and project the global market size of the humic-based biostimulants market.

- To understand the humic-based biostimulants market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=45726696

The humic acid segment is projected to be the largest segment in the humic-based biostimulants market during the forecast period.

Humic acid is usually applied to make nutrients and micronutrients readily available to the plants and increase the plant’s resistance to stress. Due to its immense and cheap availability in countries like China and India, the demand for humic acids for plant growth is boosting. It can be combined with fertilizers for better results, which is practices in most countries.

The liquid segment is estimated to account for the largest market share, in terms of value, in 2020.

The liquid formulation is easy in handling and application; hence most of the farmers use liquid formulation. The application of liquid humic-based biostimulants enhances efficiency by distributing evenly on the required area. Therefore, manufacturers are also offering most biostimulant products in the liquid formulation as per the requirement.

The seed treatment segment is projected to witness the fastest growth in the humic-based biostimulants market, 2020 to 2025.

Seed treatment is the method that is mostly used by every farmer where the seeds are applied with pesticides to develop resistance in plants. Similarly, humic-based biostimulants can also be applied to the seeds before sowing, which will improve the uptake of nutrients and water retention capacity. It is not a very popular method presently, but in the coming years, it will gain more popularity because of the benefits associated with it.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=45726696

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

The market for humic-based biostimulants in the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2025. Regions like China, India are major producers and exporters of high-value crops like fruits and vegetables. Therefore, the growth in such regions is mainly due to the increase in the cultivation of high-quality products/organic food products, compelling the farmers to shift to organic input consumption for crop production. The demand to meet the rising population is also one of the major factors driving the demand for humic-based biostimulants in the Asia Pacific region.

This report includes a study on the marketing and development strategies and a study on the product portfolios of the leading companies operating in the humic-based biostimulants market. It consists of the profiles of leading companies like Bayer AG (Germany), FMC Corporation (US), UPL Ltd(India), Borregaard (Norway), Koppert Biological Systems (Netherlands), Valagro SpA (Italy), Biolchim SpA (Italy), Haifa Group (Israel), Sikko International Ltd (India), Novihum Technologies GMBH ( Germany), Humintech GMBH (Germany), Qingdao Future Group (China), Promisol (Spain), Bioline (Canada), Humic Growth Solutions (Florida), Actagro (US), Rovensa (Portugal), Tagrow (China), CIFO (Italy) and Loveland (US).