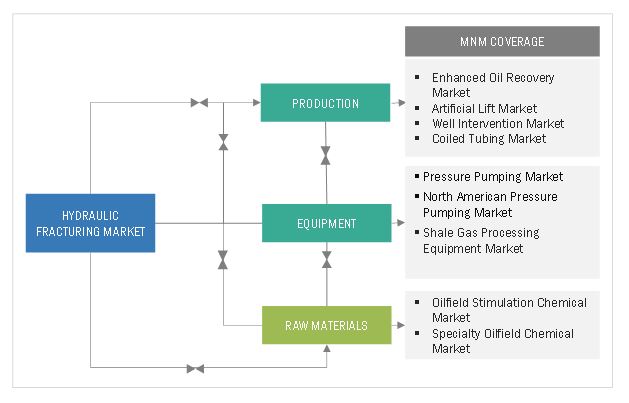

New Revenue Pockets:

The global hydraulic fracturing market is projected to reach USD 50.2 billion by 2026 from an estimated USD 34.8 billion in 2021, at a CAGR of 7.6% during the forecast period. The global hydraulic fracturing market is driven by the maturing conventional oil and gas reserves, the need for substitute resources, which could efficiently meet the rising energy demand, is growing. The discovery of shale oil and gas has proved helpful in meeting the requirements for clean and efficient energy sources.

The hydraulic fracturing market has promising growth potential due to the continuous shale developments. It is difficult to extract oil & gas from shale reservoirs due to which shale reservoirs require more intervention processes to optimize oil production. According to the IEA, the shale production from the US alone is expected to cross 100 million barrels per day. Shale development in other countries such as China and Argentina are also likely to boost the well production activities in these countries, which is likely to drive the hydraulic fracturing market in North America, Latin America, and Asia Pacific.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=745

The hydraulic fracturing market, by technology, is segmented into plug & perf and sliding sleeve. Plug & Perf are observed to be new revenue pockets for the oilfield service providers owing to the increase in drilling activities in unconventional reservoirs such as shale reservoirs and tight formations. The plug & perf technology can be used in both vertical and horizontal wells. It is the most preferred and common fracturing technology used for unconventional wells.

The report segments the hydraulic fracturing market, by well type, into horizontal wells and vertical wells. The horizontal segment of the hydraulic fracturing market is expected to grow at the highest CAGR during the forecast period, as horizontal drilling is observed as a more efficient method of drilling. The horizontal wells account for about 70.0% of the total drilled wells. Furthermore, the offshore and shale developments have boosted the horizontal well type to be the largest and fastest-growing segment of the global hydraulic fracturing market.

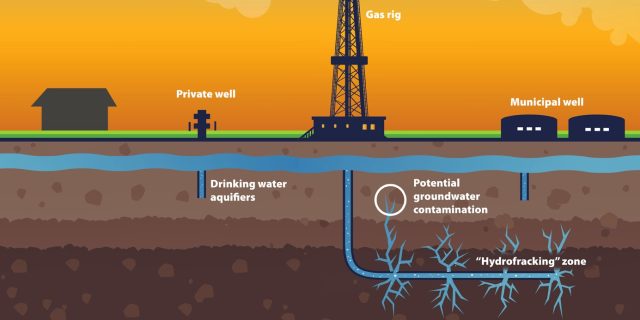

The hydraulic fracturing market, by application, is categorized into shale gas, tight oil and tight gas. Furthermore, Hydraulic fracturing is the process used to extract shale gas. The increasing demand for natural gas is expected to drive the growth of the hydraulic fracturing market for shale gas applications. Furthermore, there are a large number of shale reserves across the globe. According to the EIA, in total, there are 48 shale gas basins in 32 countries, containing almost 70 shale gas formations. For instance, China has 21.8 tcm technically recoverable shale gas reserve and 764.3 bcm proved shale gas reserve, mainly in marine facies in the Sichuan basin. Presence of large shale gas reserves provides a lucrative opportunity for the hydraulic fracturing manufacturers during the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=745

North America is estimated to be the largest and fastest-growing market for hydraulic fracturing during the forecast period. The region has been segmented, by country, into US and Canada. The growth in unconventional reserves such as tight oil and shale gas are primarily driving the demand for hydraulic fracturing services in the US and Canada. The combination of hydraulic fracturing and horizontal drilling led to the “Shale Revolution,” which enabled the US to significantly increase its production of oil and natural gas from unconventional reserves such as tight oil formations and shale formations. Furthermore, proved reserves of natural gas from shale increased from 68% of the US total in 2018 to 71% in 2019. Thus, the production of natural gas from shale increased 15.9%—from 22.1 tcf in 2018 to 25.6 tcf in 2019.

Browse Related Reports:

Coiled Tubing Market by Fleet (Operator, Region), Service (Well Intervention Service (Well Completions & Mechanical Operations, Well Cleaning & Pumping Operations) Drilling Service, Others), Application (Onshore, Offshore), Region – Global Forecast to 2025

Well Intervention Market by Service (Logging and Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation), Intervention (Light, Medium, Heavy), Application (Onshore, Offshore) Well (Horizontal, Vertical) Region – Global Forecast to 2026