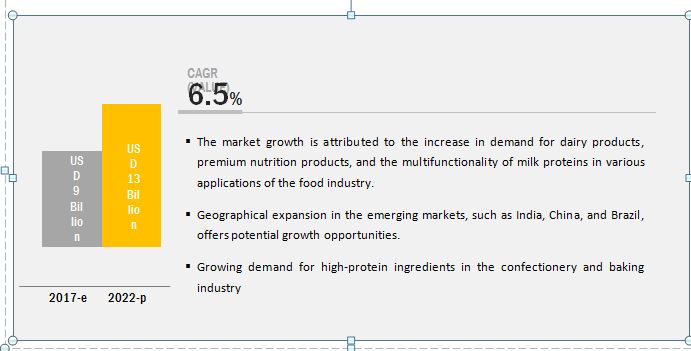

The milk protein market is projected to grow at a CAGR of 6.5%, in terms of value, from 2017 to reach a projected value of USD 13.38 Billion by 2022. The multifunctional nature of milk protein, ease of incorporation in a wide range of applications, increase in demand for high protein food, and increase in consumption of premium products are the factors driving the global market. Increase in awareness with regard to the importance of high nutritional food and its rising applications among the global population, fuels the demand for milk protein.

Increase in the requirement for high-protein solutions in sports nutrition and clinical nutrition due to the rise in consumer awareness toward health to drive the milk protein market growth

Milk protein can also be termed as dairy proteins, and include products, such as milk protein concentrates (MPC), milk protein isolates (MPI), milk protein hydrolysates (MPH), whey protein concentrates (WPC), whey protein isolates (WPI), and casein & caseinates, which are extracted from milk using various biological, physio-chemical, or physical processes. The proportion of protein compared to that of the other components distinguishes milk protein products from one another. These products are used in the food and non-food sectors, such as dairy products, dietary supplements, infant milk formula, and sports & clinical nutrition.

The milk protein market in the food & beverage industry witnesses strong growth prospects, demand for high protein foods, and ease of incorporation of milk protein in a wide range of applications due to its multifunctional properties and high protein content. The increase in consumer awareness pertaining to the importance of high nutritional food and the rise in fitness trends among the younger population demographic is also projected to drive the demand for milk protein.

Attractive Opportunities in the Milk Protein market

The global market for milk protein is projected to reach USD 13.3 billion by 2022, recording a CAGR of 6.5%

The key characteristics of milk protein include high protein content and anti-catabolic properties, which makes it ideal for use in infant nutrition and sports nutrition. Milk protein is commonly used in the dry form in the food & beverage processing industry. There have been an increasing demand for milk protein in the infant nutrition and food processing industries due to the changing consumer lifestyles and the increasing preference for the adoption of a healthy lifestyle among customers.

Milk protein helps in improving muscle performance and prevents muscle breakdown, which leads to a surge in demand for high protein dairy ingredient products among the youth population. To meet the demand and address the needs of customers, manufacturers are developing new products with enhanced physical and chemical properties. In the current market, new application areas have emerged, such as dairy-based functional foods and medical nutrition, which are gaining traction in the food industry. These factors are projected to have a considerable impact on the market growth over the next decade.

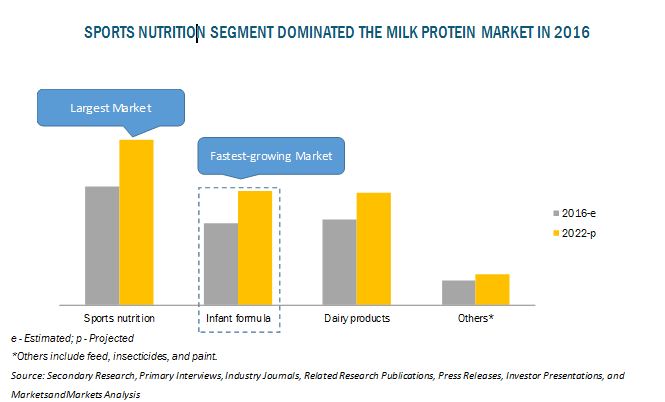

Sports nutrition to encourage the demand for milk protein as the focus toward high-protein solutions from athletes drive the market growth

Due to the functional properties and nutritional qualities of high protein products, such as WPC & MPC, milk proteins are widely used in pediatric and geriatric nutrition, medical nutrition (enteral foods), powdered dietary supplements, and sports nutrition products. Milk proteins have been gaining importance in the infant formula market with the increasing importance of infant nutrition and the rise in concerns regarding lactose intolerance among infants, which is projected to drive the demand for low-lactose and high protein infant nutrition. The demand among sports nutrition applications is projected to offer strong growth prospects for milk protein manufacturers due to the presence of essential amino acid content in whey protein, which helps in increasing the ability of the body to metabolize whey protein faster and make them suitable for muscle grooming and maintenance. The anti-catabolic property of milk protein helps to prevent muscle damages and also restores damaged muscles. These properties of whey proteins make it an integral part of an athlete’s diet.

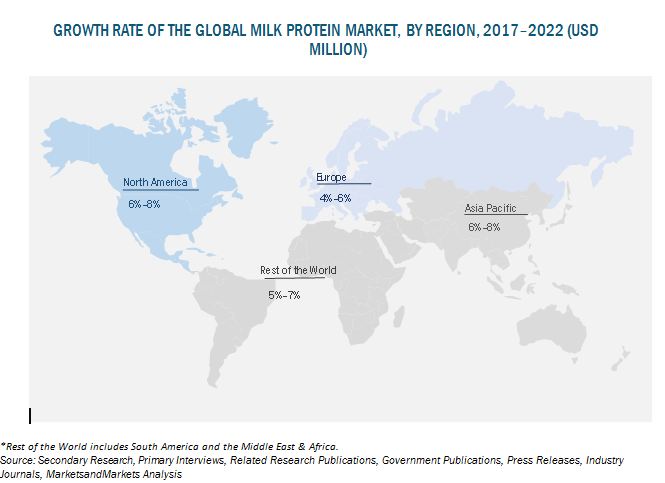

Geographical Prominence:

North America is the largest market for milk protein and is driven by the high demand for milk in the region. The region is projected to play a key role in the milk protein market, as it has a large manufacturing and consumer base. The market holds a strong position for manufacturers with access to raw material, which is projected to improve the industry access for regional manufacturing, as well as export prospects. In recent years, ingredient processors in the US have invested in specialized production of milk protein. The US milk protein concentrate (MPC) production has more than doubled over the past eight years, and micellar casein concentrate (MCC) ingredients are now available commercially as a relatively new ingredient. Providing value-added ingredients that deliver functionality and advantages, which result in successful product formulations, are a priority for the US dairy sector.

Conclusion:

Companies that are involved in the production of milk and milk protein products are focusing on expanding their businesses into new markets in order to expand their global presence and strengthen their manufacturing capabilities. Milk protein is projected to witness significant industrial growth over the next few years due to the increase in demand for protein-based products, mainly due to the growing health consciousness. An increasing number of protein-based products are exported by the US, New Zealand, and countries in Europe, such as Germany, Italy, France, and the UK. The Asian market is a key importer of whey protein, with China witnessing an increasingly high demand for whey protein products in the past decade. Key players in the market, such as Lactalis Ingredients (France), Fonterra Co-operative Group (New Zealand), FrieslandCampina (Netherlands), Arla Foods (Denmark), and Saputo Ingredients (Canada), have adopted growth strategies, such as expansions & investments, agreements & joint ventures, and acquisitions, to enhance their geographical reach and increase their global market.