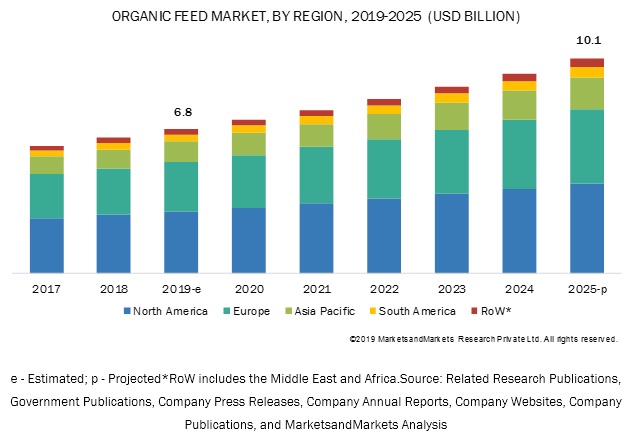

The report “Organic Feed Market by Type (Cereals & Grains, Oilseeds), Form (Pellets, Crumbles, Mashes), Livestock (Poultry, Ruminants, Swine, Aquatic Animals), Additives (Amino Acids, Enzymes, Vitamins, Minerals, Phytogenics), and Region – Global Forecast to 2025″ The global organic feed market size is estimated at USD 6.8 billion in 2019 and is projected to reach USD 10.1 billion by 2025, recording a CAGR of 6.8% during the forecast period. The market growth is driven by the increasing demand for organic food, rising organic livestock farming, expansion of organic farmlands, and the contribution to the environment. Developing countries in South America are projected to create lucrative opportunities for organic feed manufacturers in the coming years.

Report Objectives:

- To define, segment, and project the global market size for the organic feed market

- To understand the structure of the organic feed market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total feed market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158519224

By type, the cereal & grains segment is projected to dominate the organic feed market during the forecast period.

The cereals & grains segment is estimated to account for the largest share, on the basis of type, in the organic feed market in 2019. Cereals and grains include wheat, corn, and barley. The high growth in the Asia Pacific region is attributed to the increasing awareness about the benefits of feeding organic cereals and grains to livestock, to maintain their nutrient requirements and enhance their growth, and fulfill the rising demand for organic food. High availability of cereals and grain crops in Europe and Asia Pacific due to the increasing organic farmland practices in most of the countries in the region is also one of the key factors driving the growth of the segment.

By livestock, the poultry segment is projected to dominate the organic feed market during the forecast period.

The poultry segment, on the basis of livestock, is estimated to account for the largest share in the organic feed market in 2019. The poultry industry is the largest and also the fastest-growing sector that witnesses high organic production. Poultry meat is consumed across regions, and unlike beef and swine, it does not have any religious constraints. The increasing concerns about animal health and the rising awareness pertaining to the benefits of organic feed feedstuffs have contributed to the growth of this market. Due to the increase in organic poultry production and the rise in demand for organic meat, the meat producers are focusing on investing in organic rearing of livestock to produce meat, dairy, and other by-products from animals.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158519224

North America is projected to be the largest market during the forecast period.

North America is projected to be a key revenue generator for organic feed manufacturers due to the increased demand in the US. North America witnesses various key players operating in the organic feed market. These include Cargill (US), SunOpta (Canada), and Purina Animal Nutrition LLC (US). The demand for organic feed products remains high in the poultry segment in the region. The US is among the largest producers and consumers of corn, wheat, and soybean at a global level. These ingredients are majorly used in the feed industry, as they increase their nutrient quotient. Due to the rising consumer preferences for natural ingredients, the demand for these ingredients is projected to increase in the coming years.

In Canada, some of the small scale players are focusing on offering organic feed for poultry, swine, and ruminants. In Mexico, the demand for organic poultry products, such as eggs and poultry meat, is projected to create lucrative opportunities for organic feed manufacturers. Milk is also projected to increase the demand for organic feed products among ruminant livestock, as consumers opt for organic dairy products in the region. Thus, North America is projected to offer high growth prospects for organic feed manufacturers in the coming years.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies, in the organic feed market. It consists of the profiles of leading companies, such as Cargill (US), BernAqua (Belgium), Country Heritage Feeds (Australia), ForFarmers (Netherlands), SunOpta (Canada), Ranch-Way Feeds (US), Aller Aqua (Denmark), Purina Animal Nutrition LLC (US), Scratch and Peck Feeds (US), Cargill (US), K-Much Feed Industry Co., Ltd (Thailand), The Organic Feed Company (UK), B&W Feeds (UK), Feeddex Compaies (US), Country Junction feed (US), Green Mountian Feeds (US), Unique Organic (US), Kreamer Feed (US), Yorktown Organics, LLC (US), and Hi Peak Feeds (UK).