MarketsandMarkets projects the global market for PET packaging to grow from USD 57.64 billion in 2016 to USD 74.32 billion by 2021, at a CAGR of 5.21%. The growth in the PET packaging market is supported by the growing parent industries such food, beverage, pharmaceutical, and personal & household products in both developed and developing countries as well as increasing need for the sustainable and efficient ways of packaging which are responsible for both safety of the packed products.

The key players in the PET packaging market are CCL Industries, Inc. (Canada), E. I. du Pont de Nemours and Company (DuPont) (U.S.), Amcor Limited (Australia), Resilux NV (Belgium), Rexam PLC (U.K.), Smurfit Kappa Group PLC (Ireland), Gerresheimer AG (Germany), and Klöckner Pentaplast GmbH & Co. KG (Germany).

The other notable players in the market are Graham Packaging (U.S.), GTX Hanex Plastic Sp. z o.o. (Poland), Berry Plastic Group Inc. (U.S.), Dunmore (U.S.), and Huhtamaki Group (Finland). These players have adopted various strategies to expand their global presence and increase their market share. Agreements & partnerships, acquisitions, investments & expansions, and new product launches are some of the major strategies adopted by the market players to achieve growth in the PET packaging market.

Request Report Sample At https://www.marketsandmarkets.com/requestsampleNew.asp?id=192975723

The growth of the PET packaging market was largely influenced by mergers and acquisitions in the past years. The year 2015 experienced a large number of strategies being used by top players in the market. Agreements & partnership, new product launches, and investments & expansions formed the essential part of their strategies, which led to the flow of considerable income within the company. To maintain the competitive advantages on the competitors, top players emphasized on new product launches.

Mergers and acquisitions were adopted by most of the players in PET packaging market. Companies adopted this strategy to increase the reach of their offerings, improve their production capacity, and focus on core operations. Companies aim to serve the market efficiently by investing in manufacturing facilities and acquiring distribution centers in the fast-growing regions. As a result of the same, Amcor Limited (Australia) and CCL Industries, Inc. (Canada) emphasized on launching new products to increase their product portfolios.

CCL Industries, Inc. is a leader in the manufacturing of pressure-sensitive and extruded film materials. Its customer base comprises global consumer product, healthcare, chemical, and durable goods companies. CCL operates through three business segments, namely, Label, Avery, and Container. Avery is the supplier of labels, specialty converted media, and software solutions to enable effective digital printing.

This segment’s product line includes pressure-sensitive, shrink sleeve, and expanded labels. CCL Label is a supplier of decorative, informational, and promotional labels & packaging material. It specializes in the engineering and manufacturing of PET bottles for a variety of business domains such as food & beverage, healthcare & pharmaceutical, and home & personal care, and is also used to ensure brand protection. The company emphasized on mergers and acquisitions to expand its customer base and product portfolio. The company acquired companies in Singapore, the U.S., and the U.K.

Amcor Limited is one of the key players in the global packaging industry. The company operates through two main segments, namely, rigid and flexible packaging. Amcor has expertise in the manufacturing of raw materials such as polymers, aluminum foil, and fiber for packaging products for the food, beverage, medical, tobacco, and household product industries.

Amcor has its presence in over 43 countries across Europe, America, Asia, the Middle East, and Africa. It also has more than 190 facilities. From 2012 to 2016, the company emphasized on the merger & acquisitions strategy to expand the business horizon around the globe. The key competitors of this company are American Packaging Corporation (U.S.), CCL Industries, Inc. (Canada), DuPont (U.S.), and Mondi Group (South Africa).

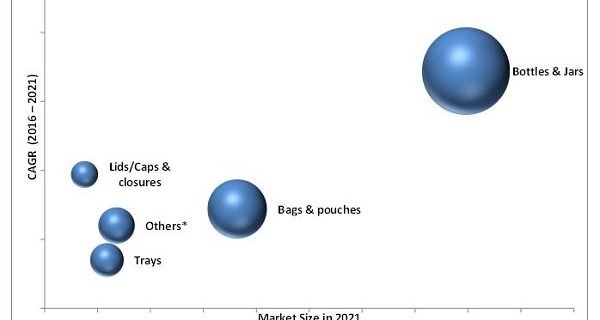

The market for PET packaging is segmented, on the basis of pack type, into bottles & jars, bags & pouches, trays, lids/caps & closure, and others, which includes cups and clamshells. The bottles & jars segment is estimated to account for the largest share in the market for PET packaging and this trend is projected to follow during the forecast period. The PET bottles & jars are highly preferred in food, beverage, pharmaceutical, and personal care industries.

Increasing demand of sustainable packaging in industries such as food, beverage, pharmaceutical, and personal care and emerging economies around the world are the key drivers for the growth of the PET packaging market.

Among regions, the Asia-Pacific market is projected to grow at the highest rate between 2016 and 2021. High growth potential in the emerging Asia-Pacific markets is expected to provide new growth opportunities to players in the PET packaging market and China is the fastest-growing market in this region. In terms of value, the region accounted for a maximum share of the overall PET packaging market in 2015.

Rising demand in industries such as food, beverage, healthcare & pharmaceutical, and personal care, in line with a focus on adapting latest technologies and processes to foster the way of business operations in a variety of industries in countries such as Japan and India are making Asia-Pacific the fastest-growing market for PET packaging.

The PET packaging market is segmented, on the basis of end-use industry, into food, beverages, personal care & cosmetics, household products, pharmaceuticals, and others. The food segment held the largest share, in terms of value, in 2015 and the beverage segment is projected to grow at the highest CAGR during the forecast period.

On the basis of pack type, the bottles & jars segment held the largest share, in terms of value, in 2015 and is projected to grow at the highest CAGR, as bottles and jars are highly preferred to store food, beverages, and other consumables without contaminating the same. They also perform exceptional in conditions such as temperature, humidity, oxygen & carbon dioxide levels, and water level in perishable goods. Along with the same, PET packaging is highly used in logistics & transportation because of its light weight.