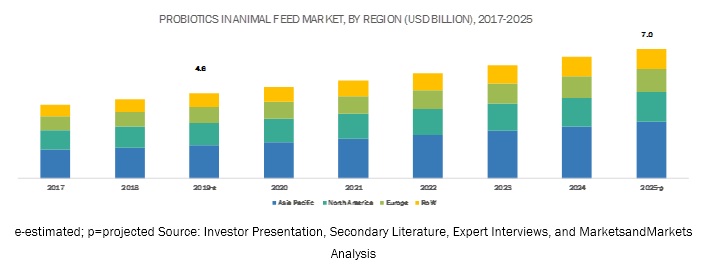

The report “Probiotics in Animal Feed Market by Livestock (Poultry, Ruminants, Swine, Aquaculture, Pets), Source (Bacteria [Lactobacilli, Streptococcus Thermophilus, Bifidobacteria] and Yeast & Fungi), Form (Dry and Liquid), and Region – Global Forecast to 2025″ The global probiotics in animal feed market is estimated to be valued at USD 4.6 billion in 2019 and is projected to reach about USD 7.0 billion by 2025, at a CAGR of 7.4%. The growth of this market is attributed to the rise in demand for functional animal feed products in emerging economies such as Asia Pacific and RoW.

Report Objectives:

- To define, segment, and project the global market size of the probiotics in animal feed market

- To understand the probiotics in animal feed market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85832335

Opportunity: Ban on the use of AGPs (Antibiotic feed promoters) in animal feed

In 2006, the European Union (EU) implemented a ban on the use of antibiotics in animal feed. Antibiotic growth promoters (AGP) are chemicals/drugs that are added to animal feed to improve growth and the quantity of animal produce. According to the EU, the use of these drugs led to the development of antibiotic-resistant microbes to treat infections in humans and animals.

Following this ban by the EU, the use of antibiotics declined in many countries around the globe, especially in countries such as China, India, and the US due to their overexploitation or misuse. In January 2017, the US Food and Drug Administration (USFDA) banned the usage of antibiotics as feed supplements to help livestock and poultry grow faster. The new regulations also state that the over-the-counter sales of antibiotics used in feed is prohibited.

Challenge: High R&D costs for developing new probiotic strains

Substantial investments in R&D activities and investments in laboratories, research equipment, and the high cost of hiring trained professionals create barriers for the development of the market for probiotics in animal feed. The scientific validation regarding the usage of probiotics in their applications becomes a success to this market. Probiotic applications are linked with health benefits, which make it challenging for manufacturers to get an adequate return on high initial investments. Key companies such as Chr. Hansen (Denmark) and DowDuPont (US) have focused their strategies on building a strong R&D base to gain a competitive advantage, which has created a barrier for other players in the market for probiotics in animal feed.

The Asia Pacific region is projected to dominate the market through the forecast period

In 2018, the Asia Pacific region led the global probiotics in animal feed market. Factors such as a large livestock base, high meat consumption, and increasing consumer awareness about the positive impact of probiotics on animal health are driving the Asia Pacific market. Some of the countries contributing to the growth of this region include China, India, Japan, Australia, and New Zealand.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=85832335

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the probiotics in animal feed market. It includes the profiles of leading companies such as Chr. Hansen (Denmark), Koninklijke DSM N.V. (Netherlands), DowDuPont (US), Evonik Industries (Germany), Land OLakes (US). Other players include Lallemand (Canada), Bluestar Adisseo Co. (China), Lesaffre (France), Alltech (US), Novozymes (Denmark), Calpis Co., Ltd. (Japan), Schouw & Co. (Denmark), Unique Biotech (India), Pure Cultures (US), Kerry (Ireland), and Mitsui & Co., Ltd. (Japan).

Recent Developments:

- In December 2018, Evonik and Vland (China) formed an agreement by signing MoU for strategic cooperation. The two companies would work on innovations related to probiotics in animal nutrition.

- In May 2018, BioMar launched broodstock feed type—EFICO Genio, for the African catfish farmers. It contains Bactocell, the only approved probiotic by the European Commission for inclusion in fish feed.

- In October 2017, Koninklijke DSM N.V. acquired Twilmij B.V. (Netherlands). The company expanded its presence in the Northwest-European region in the animal feed market.

- In October 2017, Danisco Animal Nutrition, a business unit of DuPont Industrial Bioscience, launched Enviva PRO, a three-strain Bacillus probiotic, for the European market.

- In September 2016, Chr. Hansen signed a partnership with LinkAsia Partners (Singapore). The partnership was expected to help Chr. Hansen’s R&D expertise as it was beneficial to its probiotic solutions, such as GalliPro and BioPlus in the Asia Pacific region.