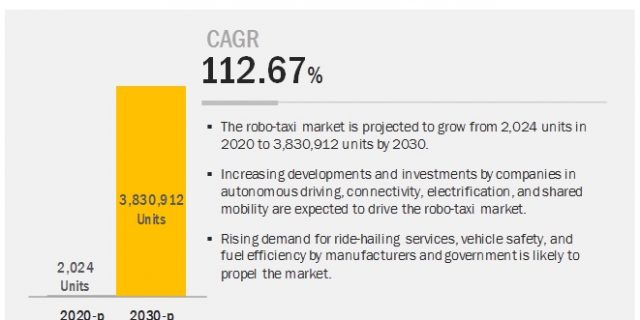

The Robo-Taxi Market is projected to grow from 2,024 units in 2020 to reach 3,830,912 units by 2030, at a CAGR of 112.67%. Automotive companies are investing huge amounts in research and testing of self-driving technology. The emerging trend of robo-taxis, shuttles, and vans are fueling the overall growth of the market. Other major factors responsible for growth are increasing demand for ride-hailing services, optimizing fleet management, and reducing the overall cost of operations. With the rising demand for public transport, there has been a substantial increase in the use of technologically advanced vehicles such as fully-electric vehicles, semi-austonomous, and autonomous vehicles which have raised the demand for self-driving vehicles. Companies such as Waymo LLC, Aptiv, GM Cruise, Ridecell, Inc, Uber Technologies Inc., NAVYA, EasyMile, and others are focusing on the development of robo-taxis.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/robo-taxi-market-132098403.html

Asia Pacific is estimated to be the fastest growing market during the forecast period, due to the development related to autonomous vehicles in countries such as China, Japan, South Korea, and Singapore. The key driver in China is the growing concern on pollution and the growing number of vehicles on the road leading to traffic congestions. Also, China is home to manufacturers such as DiDi, and Baidu which are highly focusing on robo-taxis in the country. Baidu has developed an autonomous driving platform called Apollo. They have partnered with the Swedish car maker, Volvo, to produce self-driving cars for their fleet. Baidu has decided to start pilot testing in Changsha. The fleet is expected to reach 100 by the end of 2019. Other countries in the region such as Japan, South Korea, and Singapore are also investing heavily in the development of autonomous vehicles. Nissan and an internet venture DeNA have a joint venture called Easy Ride for autonomous cabs. Easy Ride is using 100% electric Nissan Leaf in the pilot testing. Easy Ride is expected to roll out for masses by 2020 during the Olympic Games in Tokyo.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=132098403

The European region is one of the main markets, as it focuses highly on autonomous public transport such as shuttles and vans. Manufacturers such as NAVYA, EasyMile, Moia, and other players are majorly contributing to the growth in this region. The technological advancements and supportive infrastructure in the region have helped the operators test and deploy easily in this region. European countries are ahead in the race to curb rising emission by focusing on manufacturing EVs. Countries such as Norway and the Netherlands have registered remarkable growth in EV sales in the past few years. Additionally, other countries such as Germany, France, Sweden, Norway, and the Netherlands are also focusing on autonomous vehicles. For instance, The French government has started the development of a national strategy for autonomous mobility including new regulation and laws for pilot testing. Also, they have a dedicated team to tackle cybersecurity and privacy related issues in robo-taxi services. NAVYA offers AUTONOM SHUTTLE and AUTONOM CAB. These vehicles are deployed all over the world. Another French company Easy Mile also developed EZ10 and EZ10c. These vehicles are being tested all over the world. The French auto maker Renault has shown the concept of their upcoming autonomous vehicle EZ-GO at the 2018 Geneva Motors Show.

In Germany, Volkswagen and Mobileye, a division of Intel has partnered to launch robo-taxi. The German automaker Volkswagen also has a ride sharing division called Moia. The company is looking to deploy a new fully electric vehicle with Moia ride sharing service for robo-taxis. All the above developments make Europe likely for the adoption of self-driving vehicles.

Critical Questions:

- Where will robo-taxis take the industry in the long term?

- How will the robo-taxi market cope with the challenge of the high cost of implementation?

- What is the impact of ride sharing services on the robo-taxi market?

- What are the upcoming trends in the ride-sharing services? What impact would they make post 2022?

- What are the key strategies adopted by the top players to increase their revenue?

Request Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=132098403