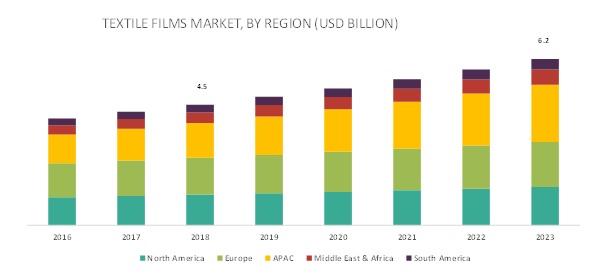

The textile films market size is estimated to be USD 4.5 billion in 2018 and is projected to reach USD 6.2 billion by 2023, at a CAGR of 6.6%. The growing demand for quality hygiene products and rising awareness about maintaining proper feminine and child hygiene are expected to drive the market between 2018 and 2023. In addition, growing athleisure trend and rapid urbanization are likely to propel the textile films market in the next five years.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=249957469

Medical application is projected to register the highest CAGR during the forecast period.

Based on application, the medical segment is projected to register the highest CAGR between 2018 and 2023. The use of textile films is increasing as they provide a liquid barrier, but at the same time allow breathability in the apparel. The demand for textile films in medical application is expected to grow in the near future owing to increased demand from hospitals, growing urbanization, new technological innovations, and awareness regarding prevention of infection in healthcare institutions.

APAC is projected to register the highest CAGR in the textile films market between 2018 and 2023.

The textile films market in APAC has immense growth potential. The increasing demand for hygiene products owing to widespread awareness around proper hygiene and the growing urbanization and industrialization in the region are expected to fuel the demand for textile films during the forecast period. China, India, Japan, Australia, and South Korea are some of the key textile films markets in the region.

Some of the key players in the textile films market are RKW Group (Germany), Covestro (Germany), Berry Global (US), Mitsui Hygiene (Thailand), Arkema (France), SWM International (US), and Toray Industries (Japan). Investment & expansion and merger & acquisition were the major growth strategies adopted by the market players between 2015 and 2018 to enhance their regional footprint and meet the growing demand for textile films in the emerging economies.

Recent Developments

- In November 2017, Toray Industries established a new company, Toray Polytech (Foshan) Co., Ltd. in November 2017, and plans to build a production facility for PP spunbond with an annual capacity of 20,000 tons. The facility is expected to start operations in 2019. With this expansion, the company expects to serve the rising demand for breathable films in China.

- In February 2017, Mitsui Hygiene Materials (Thailand) expanded its already existing plant capacity. With this expansion, the company’s production capacity increased from 6,700 tons to 10,900 tons per annum. The company thus, expects to meet customers’ demand for breathable textile films in East and Southeast Asia.

- In February 2018, Berry Global acquired Clopay Plastic Products Company (US), Inc., which was a subsidiary of Griffon Corporation. This acquisition of Clopay has opened up many application areas for Berry Global such as hygiene and healthcare.

- In November 2018, Covestro (Germany) raised stakes in its partnership with DIC Corporation (Japan) from 50-80%, acquiring the business. This helped the company in becoming a market leader in the textile films market.

Get 10% FREE Customization on this Study @ https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=249957469