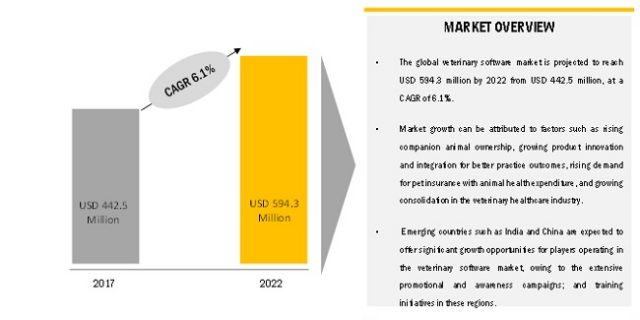

The major factors that are expected to be driving the veterinary software Industry are rising companion animal ownership and demand for pet insurance with growing animal health expenditure. However, lack of government incentives for the adoption of veterinary software, reluctance of veterinarians towards adopting new technologies, and lack of awareness about veterinary software in the developing countries are restricting the growth of this market.

What the Veterinary Software Industry Looks Like?

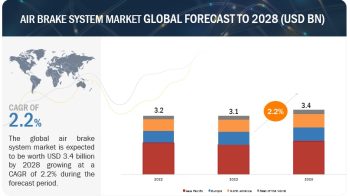

MarketsandMarkets forecasts the veterinary software market to grow from USD 442 million in 2017 to USD 594 million by 2022, at a CAGR of 6.1% during the forecast period.

Rising Companion Animal Ownership

Over the years, the number of pet owners has increased significantly across the globe, and this trend is expected to continue in the coming years. According to the American Pet Products Association’s 2017– 2018 National Pet Owners Survey, 68% of households (84.6 million) in the US owned a pet. The canine population in the US increased from 69.90 million in 2012 to 89.70 million in 2016, while the feline population increased from 74.05 million in 2012 to 94.20 million in 2016.

Similarly, according to the European Pet Food Industry Federation (FEDIAF), the canine population in Germany increased from 5.30 million in 2012 to 8.60 million in 2016, whereas the feline population in the country increased from 11.80 million in 2014 to 13.40 million in 2016. In the UK, as of 2017, 44% of households own pets (Source: Pet Food Manufacturers Association).

Download a PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=186264514

Restraint: Lack of Government Incentives

The veterinary software Industry has minimal support from governments across the globe. In the US, the adoption rate of veterinary software is very low as compared to healthcare IT (HCIT) tools such as human EHR.

This can be attributed to the lack of incentives or funding provided for implementing veterinary software. The slow adoption rate of veterinary software will make it difficult for small vendors to break even in the market.

Moreover, in developing regions such as the Asia Pacific and Latin America, government support for the implementation of veterinary software is very low. This makes it difficult for companies to operate in these regions. Thus, the lack of government incentives is restraining the growth of the veterinary software market.

Request a Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=186264514

Geographical growth scenario of Veterinary Software Industry

In 2017, North America was the largest regional market for veterinary software, followed by Europe. The high demand for veterinary software in North America can primarily be attributed to the growing demand for quality pet care in the region.

Also, the growing awareness about veterinary software and the easy availability of veterinary software & services are the major factors that are expected to drive market growth in North America during the forecast period.

Leading market players and strategies adopted

The Veterinary Software Industry is a fragmented market, with several large as well as emerging players operating in it. The prominent players in the this market include Henry Schein (US), IDEXX Laboratories (US), Patterson Companies (US), Vetter Software (US), Animal Intelligence Software (US), Timeless Veterinary Systems (Canada), Brittons Wise Computers (US), ezyVet Limited (New Zealand), FirmCloud Corporation (US), MedaNext (US), OR Technology (Oehm Und Rehbein GmbH, Germany), VIA Information Systems (US), Hippo Manager Software (US), Finnish Net Solutions (Finland), Carestream (Canada), and ClienTrax (US).

Recent Developments

- In 2017, Vetter Software partnered with Vetstoria to integrate Vetter’s practice management solution with Vetstoria’s online appointment booking solution

- In 2017, Vetter Software partnered with Pawprint, (the mobile pet health app) to integrate Vetter’s practice management solution with Pawprint’s client engagement tools

- In 2017, Finnish Net Solutions signed an agreement with Tolnagro Ltd to distribute the Provet Cloud veterinary practice management system in Hungary.

Inquiry before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=186264514