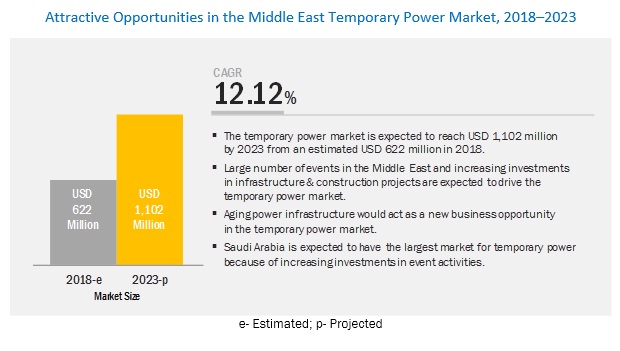

The Middle Eastern temporary power market is projected to reach USD 1,102 million by 2023 at a CAGR of 12.12% from an estimated USD 622 million in 2018, whereas the Middle Eastern temporary cooling market is projected to reach a size of USD 305 million by 2023 at a CAGR of 5.78% from an estimated USD 230 million in 2018. An increasing number of events, expansion of IT and data center projects, rise in GDP contribution from the non-oil sectors, and growing construction and infrastructure investments are likely to drive the Middle Eastern temporary power and cooling market.

The above 1,250 KVA segment is expected to hold the largest share of the Middle Eastern temporary power and cooling market, by power rating, during the forecast period.

The above 1,250 KVA segment led the Middle Eastern temporary power market in 2018 and is projected to have the largest market share during the forecast period. Temporary power generators with a capacity of above 1,250 kVA are used in heavy construction, oil & gas, utilities, and manufacturing. The energy sector requires temporary power on a large scale to support various upstream and midstream activities. Heavy construction, manufacturing, and utilities are expected to drive the temporary power market during the forecast period. For instance, the construction sector in the UAE has more than 3,200 active projects with an estimated value of over USD 245 billion. This includes 187 projects for the transport sector worth USD 32.4 billion, 203 projects for the utility industry worth USD 24.3 billion, 377 industrial projects worth USD 5.8 billion, and 12 projects in the oil & gas sector worth USD 4.6 billion.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=173635918

The chiller segment of the Middle Eastern temporary power and cooling market, by equipment, is expected to be the largest market during the forecast period

The chiller segment led the Middle Eastern temporary cooling market in 2018 and is estimated to be the largest market during the forecast period. Increasing government measures over efficient energy use in industries are expected to drive the demand for chillers during the forecast period. It also provides high energy efficiency, improved performance, easy maintenance, and space optimization during installation. Moreover, chillers are used in various industries such as plastic, food & beverage processing, paper & cement processing, power supplies & power generation stations, compressed air & gas cooling, chemical processing, hospitals, and pharmaceutical. Some of the major construction activities such as Phase 1 of the Red Sea Touristic Development in Saudi Arabia, Haramain high-speed train in Saudi Arabia, and Miral’s Warner Bros Abu Dhabi theme park in the UAE, would require chillers as they are highly energy efficient, easy to maintain, and have a low environmental impact.

This research report categorizes the Middle East temporary power and cooling market based on power rating, equipment, application, and region

On the basis of power rating, the Middle East temporary power and cooling market has been segmented as follows:

- Up to 500 kVA

- 501–1,000 kVA

- 1,001–1,250 kVA

- Above 1,250 kVA

On the basis of equipment, the Middle East temporary power and cooling market has been segmented as follows:

- Cooling Tower

- Air Handling Unit (AHU)

- Air Conditioner

- Chiller

On the basis of application, the Middle East temporary power and cooling market has been segmented as follows:

- Construction

- Oil & gas

- Utilities

- Real estate & Data Center

- Events

- Marine

- Military

- Manufacturing

On the basis of country, the Middle East temporary power and cooling market has been segmented as follows:

- Saudi Arabia

- UAE

- Oman

- Bahrain

- Kuwait

- Qatar

- Rest of the Middle East

Ask for Sample pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=173635918

Saudi Arabia: The leading market in the Middle East for temporary power and cooling

In this report, the Middle Eastern temporary power and cooling market has been analyzed with respect to 6 countries-Saudi Arabia, UAE, Oman, Bahrain, Kuwait, and Qatar. Saudi Arabia led the Middle Eastern temporary power and cooling market in 2018. An increasing number of events and infrastructure activities across the region are expected to drive the temporary power and cooling market. Moreover, according to Timetric’s Construction Intelligence Center (CIC), the construction industry in Saudi Arabia is estimated to rise from USD 105.6 billion in 2015 to USD 148.5 billion by 2020 owing to the increased government contributions and investments in sectors such as healthcare, education, and construction. Such factors would drive the temporary power and cooling market in Saudi Arabia during the forecast period.

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top players in the Middle Eastern temporary power and cooling market. The key players of temporary power include Aggreko (UK), RSS (UAE), Altaaqa (UAE), Cummins (Saudi Arabia), and Byrne (UAE); and for temporary cooling include Aggreko (UK), Johnson Controls (Ireland), Geo Rental (UAE), RSS (UAE), and Argonaut (UAE). The leading players are adopting various strategies to increase their share in the Middle Eastern temporary power and cooling market.