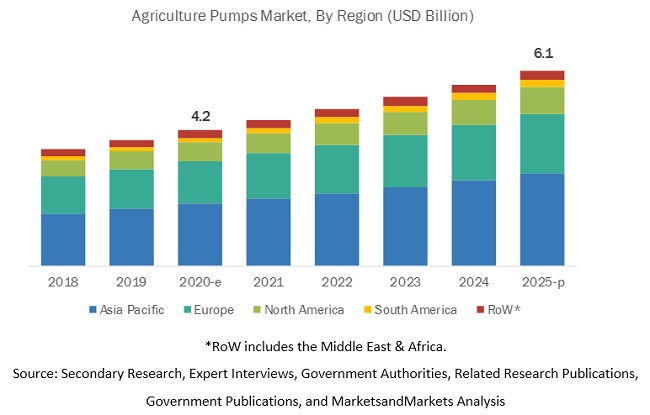

The report “Agricultural Pump Market by Type (Rotodynamic Pumps, Positive Displacement Pumps), Power Source (Electricity-grid Connection, Diesel/Petrol, Solar), HP, End-Use (Irrigation, Livestock Watering), and Region – Global Forecast to 2025″ size is estimated to be valued at USD 4.2 billion in 2020. It is projected to reach a value of USD 6.1 billion by 2025, growing at a CAGR of 7.6% during the forecast period. Factors such as increasing land being brought under irrigation, rising adoption of modern agricultural practices in developing countries, government support in the adoption of new agricultural equipment and technology, increased rate of mechanization, and the advent of big data in agricultural farms are some of the factors that are driving the growth of the market. However, the operation of pumps in fragmented landholdings and high maintenance costs are some of the factors hindering the growth of this market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=223029062

The positive displacement pumps segment, by type, is projected to grow at the fastest rate during the forecast period

The agricultural pumps market, by type, has been segmented into rotodynamic pumps and positive displacement pumps. Rotodynamic pumps have been further classified as centrifugal, axial flow, and mixed flow. Positive displacement pumps have been further classified as rotary and reciprocating pumps. Although rotodynamic pumps account for the largest market share during the forecast period, the market for positive displacement pumps is projected to grow at the fastest rate due to an increase in the investments being made for the adoption of these pumps in the agricultural sector. It is being used in open fields for applications such as drip and sprinkler irrigation, fertigation, and spraying.

The irrigation segment, by end-use, is estimated to hold the largest revenue share in the agricultural pumps market in 2020

The agricultural pumps market, by end-use, has been segmented into irrigation and livestock watering. With the increasing population and subsequent rise in demand for food, there has been an increase in the land area being brought under irrigation due to which a complementary demand pattern can be witnessed for agricultural pumps. The major portion of the water withdrawals made across the globe caters to the agricultural sector, and within the agricultural sector, it is used for irrigation purposes.

Asia Pacific accounted for the largest share of the global agricultural pumps market

Asia Pacific accounted for the largest share in the global agricultural pump industry due to the increasing land being brought under irrigation. The agricultural ministries of countries such as China and India are providing subsidies for solar and electric pumps, which is also one of the factors that are driving the growth of the market.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=223029062

Key Market Players:

Key participants in the global market include Grundfos (Denmark), Xylem Inc (US), KSB SE & Co. (Germany), Flowserve Corporation (US), Lindsay Corporation (US), Valmont Industries (US), and Jain Irrigation Systems (India). These companies are focused on strategies such as acquisitions and new product launches to cater to the growing demand for intelligent pump systems in the agricultural sector. The market for agricultural pumps for the study has been segmented by type, end-use, hp, and power source.

Recent Developments:

- In January 2020, Franklin Electric acquired Valley Farms Supply, Inc. (Lansing, Michigan) for USD 9.0 million. Valley Farms is a professional groundwater distributor operating three locations in the State of Michigan and one in the State of Indiana. Valley Farms has approximately USD 28.0 million of consolidated annual sales.

- In November 2019, WILO USA LLC, a subsidiary of WILO SE, through its newly-established subsidiary, American-Marsh Pumps LLC, acquired the assets of US manufacturer J-Line Pump Co. d/b/a American-Marsh Pumps. The acquisition of American-Marsh Pumps strengthens its footprint in the US and expands the product portfolio for its customers in the Water Management, Industry, and Building Services segments.

- In February 2018, Lindsay Corporation announced the launch of a new version of its FieldNET application, which is designed to fully automate farm functions, including pumps, motors, and emitters.