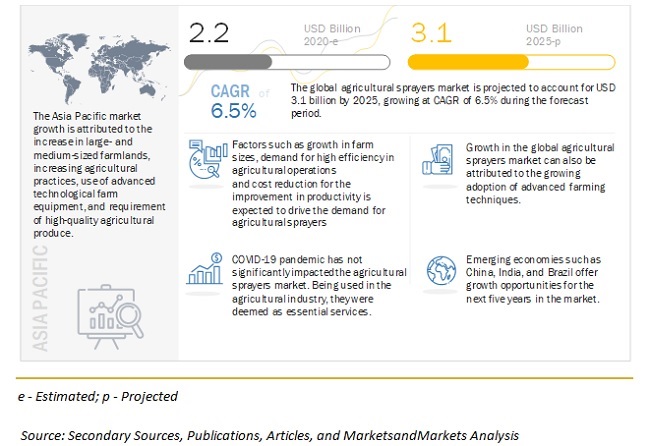

The report “Agricultural Sprayers Market by Type (Self-propelled, Tractor-mounted, Trailed, Handheld, Aerial), Capacity, Farm Size, Crop Type, Power Source (Fuel-based, Electric & Battery-driven, Manual, Solar), and Region – Global Forecast to 2025“, According to MarketsandMarkets, the global agricultural sprayers market size is estimated to be valued at USD 2.2 billion in 2020. It is projected to reach USD 3.1 billion by 2025, recording a CAGR of 6.5% during the forecast period. Agricultural sprayers have become essential for farmers or growers for spraying pesticides, herbicides, and fertilizers in the field pre- and post-harvest as per the requirement. Thus, the market for agricultural sprayers is growing due to extensive changes in farming and spraying technologies.

COVID-19 Impact on the Global Agricultural Sprayers Market

The agricultural sprayers market includes major Tier I and II manufacturers like John Deere, CNH Industrial N.V., Kubota Corporation, Mahindra & Mahindra Ltd., STIHL, AGCO Corporation, Yamaha Motor Corp., and Bucher Industries AG. These manufacturers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses as well. Though this pandemic situation has impacted their businesses, there is no significant impact on their agricultural sprayers’ global operations and supply chain. Multiple manufacturing facilities of players are still in operation.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

The COVID-19 pandemic has slightly impacted the supply-chain of agricultural sprayers. The movement restrictions and illnesses are resulting in labor shortages and reduced supply of new sprayers to the customers. As the companies’ manufacturing units were closed, the production of new sprayer units was impacted in the first and second quarter of the year. But the production is expected to be regular, post a decrease in the government’s barriers such as lockdowns and trade bans. Companies have started opening their manufacturing units after taking all the necessary preventive measures such as regular temperature checks, wearing PPE gear, and a limited number of staff.

Drivers: Increase in focus on farm efficiency and productivity

Agriculture has traditionally been a risky economic activity, and farmers worldwide have been impacted by economic downturns and environmental shifts. The newer technology versions of agricultural sprayers have provided various benefits to the farmers, such as low cost, increased spray efficiency, safety, and less damage to the crops and environment. This is subsequently growing the demand for sprayers in the global market. Agricultural sprayer manufacturers are increasingly inclined to focus on enhancing farmers’ capabilities and knowledge to make them more productive and help them compete in the market. Also, the increasing implementation of precision farming techniques has improved the potential of manufacturers of sprayers to make the agricultural steps more efficient and predictable.

By crop type, the cereals segment is projected to account for the largest share in the agricultural sprayers market during the forecast period

Cereals form an important segment for the agricultural sprayers market as wheat and maize are grown abundantly in different regions. The use of agricultural sprayers helps farmers cover larger farm sizes and protect crops, resulting in higher crop yield. According to the OECD-FAO Agricultural Outlook for 2014–2023, the global wheat utilization volume is projected to reach 774 million tons by 2023; 295 million tons is projected to be utilized in developed countries while the remaining 479 million tons are expected to be utilized in developing countries. Agricultural sprayers experience high demand from cereal producers to increase crop yield. Thus, increasing demand for cereals and grains in consumers’ diets drives the growth of the agricultural sprayers market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=46851524

The Asia Pacific region is projected to account for a major share in the market during the forecast period

This market is also projected to be the fastest-growing during the forecast period. Agriculture is the major occupation in the Asia Pacific region; it has a huge regional presence, including countries like China, India, Australia, Japan, and the Rest of Asia Pacific. Thus, the increasing agricultural practices, use of advanced technological farm equipment, and requirement of high-quality agricultural produce are expected to drive the agricultural sprayers market in this region.

This report includes a study on the marketing and development strategies and the product portfolios of leading companies. It consists of profiles of leading companies, such as John Deere (US), CNH Industrial N.V. (UK), Kubota Corporation (Japan), Mahindra & Mahindra Ltd. (India), STIHL (Germany), AGCO Corporation (US), Yamaha Motor Corp. (Japan), Bucher Industries AG (Switzerland), EXEL Industries (France), AMAZONEN-Werke (Germany), BGROUP S.p.A. (Italy), Agro Chem Inc. (US), Boston Crop Sprayers Ltd. (UK), H&H Farm Machine Co. (US), Buhler Industries Inc. (Canada), AG Spray Equipment, Inc. (US), and John Rhodes AS Ltd (UK).