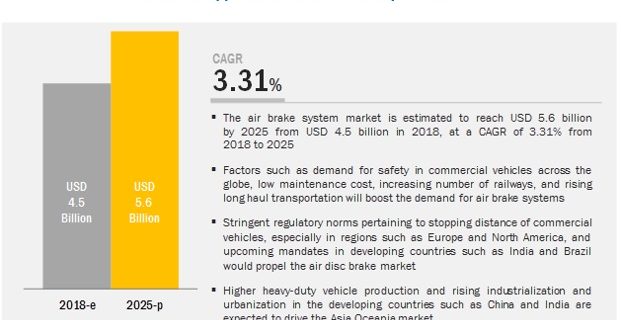

The Air Brake System Market is estimated to be USD 4.5 billion in 2018 and is projected to reach USD 5.6 billion by 2025, at a CAGR of 3.31% during the forecast period. The demand for air brake systems is driven by the increasing sales and production of commercial & OHV trucks, increasing railways & high-speed trains and the fail-safe nature of air brakes compared with that of hydraulic brakes.

In the recent past, countries such as India increased their per axle load capacity by 20–25%. The increase in the load per axle has increased the demand for high power brakes in the commercial vehicle segment in India. Due to an increase in the weight per axle, many medium commercial vehicles have witnessed an increase in the regulated load carrying capacity per vehicle. Additionally, the regulations pertaining to stopping distance in the western countries will result in the development of powerful air brake systems with reduced stopping distance. This will drive the air brake system market as improved components will result in a slight increase in the overall pricing of the air brake system, resulting in profits for the brake system manufacturers.

The key players in the air brake system market are Knorr-Bremse (Germany), Wabco (Belgium), Meritor (US), Haldex (Sweden), ZF (Germany), Wabtec (US), Nabtesco (Japan), TSE Brakes (US), Federal-Mogul (US) and SORL Auto Parts (China).

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=163805421

The disc brake segment is estimated to grow at the fastest rate, by brake type, during the forecast period. The major factor driving the demand for air disc brakes is the rising focus on safety and stopping distance reduction mandate. Air disc brakes have started to gain a market share in countries such as the US, China, Japan, and India because of its efficiency and durability. This gain in the market share can be attributed to the increasing focus of governments and OEMs on safety and reduction of road accidents. The major challenge preventing the air disc brake market is the high cost. Hence, the air disc brake manufacturers need to work on their pricing and develop cost-effective air disc brakes as there is a willingness in the industry to shift toward them from air drum brakes.

The storage tank segment is the fastest-growing component market, for the on-highway air brake system market. The compressed air generated by the compressor is stored in the storage tanks. The storage tank is also known as an air reservoir. The number of storage tanks depends on the design and architecture of the air brake system. The size and number of storage tanks may vary from vehicle to vehicle. As the engine power of trucks is increasing resulting in a higher average axle count and weight-bearing capacity, OEMs and brake system manufacturers need to incorporate more storage tanks to their designs in order to ensure fail-safe operations of the brake system. This is a great opportunity for storage tank manufacturers and companies providing materials for the same. As stronger tanks will be required in the future, there will be an opportunity for material suppliers to develop material formulations which can support high air pressure without increasing the overall weight of the air tank. This can give the lightweight air storage tank manufacturers an advantage over companies providing regular air storage tanks.

Request FREE Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=163805421

The Asia Oceania region is projected to lead the air brake system market owing to the largest share in global commercial vehicle production compared to other regions such as North America and Europe. As per MarketsandMarkets analysis, the share of heavy trucks and buses in Asia Oceania is very high. Further, according to OICA statistics, heavy trucks have shown a significant rise of 19.5% between 2016 and 2017. As the air brake systems are fitted in almost all medium and heavy trucks (above 7.0 ton), the growing number of heavy trucks in Asia Oceania would subsequently boost the air brake system market in the coming years.

Recent Developments:

• In August 2018, Knorr-Bremse introduced 2 new disc brakes, ‘SYNACT and NEXTT”, for future generations of heavy-duty commercial vehicles. Compared to its predecessor, SYNACT attains new dimensions of performance and weight. With a stronger but lighter caliper and smooth-running internal mechanics, the full braking torque of 30 km remains available even during prolonged braking maneuvers.

• In September 2018, Wabco established a new joint venture for vehicle control systems with FAW Jiefang Automotive Company to advance the safety and efficiency of commercial vehicles in the Chinese market. Under this joint venture, the companies will start the production of Wabco’s advanced MAXXTM single-piston Air Disc Brake (ADB) from 2019.

• In March 2018, Meritor received a supply contract from Daimler Trucks North America (DTNA) for providing EX+ L air disc brakes. These EX+ L air disc brakes will be standard on all wheel positions for DTNA’s Freightliner new Cascadia model to further enhance safety and performance. The deployment of EX+ L air disc brakes began in the second quarter of 2018. With a standard position on Freightliner Cascadia models, Meritor offers industry-leading warranty coverage of five-year/500,000 miles/parts when specified with Meritor MA761 exclusive friction material.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=163805421