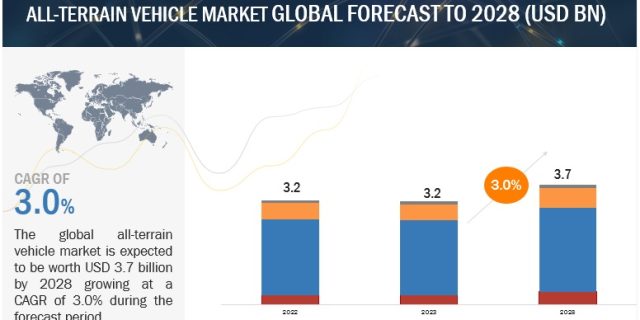

The all-terrain vehicle market size was valued at USD 3.2 billion in 2023 and is expected to reach USD 3.7 billion by 2028, at a CAGR of 3.0%, during the forecast period 2023–2028. ATVs are used in multiple applications such as sports, agriculture, military & defense, construction, etc. Key driving factors for the market include increasing recreational activities, growing usage of ATVs in agriculture and defense, and increased purchasing power and spending capacity of individuals. Product launches and increasing players’ market share, such as Polaris Inc. (US), Textron Inc. (US) Honda (Japan) etc., are expected to drive the ATV market. Thus, looking at the abovementioned factors, the ATV market is expected to boost globally during the forecast period.

Increased demand for recreational activities, agriculture, and military operations.

ATVs were earlier endorsed and traded as leisure vehicles designed to deliver thrilling experiences to the rider. However, it was soon realized that ATVs are useful machines to travel through zones inaccessible by trucks, four-wheel drives, or other vehicles. Gradually, ATVs became popular with their many applications in agriculture, such as inspecting crops and livestock, applying fertilizers and chemicals, repairing irrigation systems and pipelines, supervising field crews, and transporting materials. Today, ATVs are found in all types of farms, orchards, nurseries, and forests.

John Deere, a major agricultural and farm equipment manufacturer, recently launched UTV models for farming applications. The company plans to update its various utility vehicles for farming purposes owing to the higher demand for such vehicles by customers working in the agriculture sector for multiple applications. In July 2022, John Deere introduced its AutoTrac-assisted steering system for its Gator Utility Vehicles. The AutoTrac-assisted steering system was created to help operators be more productive and less tired. This system ensures that the vehicle maintains consistency and precise accuracy while moving through the field, allowing for efficient and reliable performance. This AutoTrack Steering system comes in models such as XUV835M HVAC, XUV835R, XUV835R Signature Edition, XUV865M HVAC, XUV865R, and the XUV865R Signature Edition. Other players like BRP’s Outlander, Outlander Pro, Commander, Suzuki KingQuad, Polaris Sportsman Series, Honda TRX420 Fourtrax, etc., also have an extensive portfolio of ATVs for farming use worldwide.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=255821381

Positive outlook toward electric ATVs will create new opportunities.

The ‘UN-Habitat’ global report claims that cities account for 70% of greenhouse emissions and energy consumption worldwide. With such alarming environmental threats, most automotive manufacturers have been looking to introduce fuel-efficient and emission-free models in the coming years. The adoption of technologies related to electric ATVs has been increasing among manufacturers. Leading markets for electric ATVs, such as China, the US, and Germany, are investing heavily in R&D infrastructure for off-road vehicles. Since there is a lot of pressure on OEMs, mainly due to new regulations implemented by countries worldwide to reduce their greenhouse gas emissions, most of the investments are likely to go towards developing electric-powered vehicles. The same applies to the ATV market as well.

In 2021, Polaris launched its EV ATV, a Ranger XP Kinetic model developed in collaboration with Zero Motorcycles. It has a 14.9kWH battery and can travel 45 miles on a single full charge. Polaris also partnered with Qmerit, a provider of residential EV charging infrastructure. Further, companies such as Ecocharger, Powerland, evoletIndia, and DRR USA focus on developing ATVs and Side-by-side vehicles for applications such as agriculture, sports, and recreational activities.

North America to be the largest market for all-terrain vehicles during the forecast period

North America will lead the all-terrain vehicle market during the forecast period. The North American all-terrain vehicle industry is one of the most advanced industries globally, contributing more than 50% of global demand. The US is the leading market in the region due to the increasing usage of ATVs in sports and outdoor events as well as growing use in agriculture and military & defense applications. According to Yamaha Factbook 2022, the US market accounts for over 50% of the global ATV demand. Further, the US and Canada together accounted for around 75% of the total all-terrain vehicle production in the region in 2022. The demand for ATVs has witnessed a significant rise in this region. The market growth is attributed to consumers’ higher inclination towards outdoor recreational activities in the US and Canada. North American countries have long unpaved terrains of mountain trails, flat surfaces, and sandy locations. These vehicles are used for recreational and sports activities and utility purposes in agriculture, farmlands, and hunting & forestry. Polaris dominates the North American ATV market along with other established players such as Textron, BRP, Honda, Yamaha, and John Deere.

Key Market Players

The all-terrain vehicle market is dominated by players such as Polaris Inc. (US), BRP (Canada), Honda Motor Co., Ltd (Japan), Textron Inc. (US), Yamaha Motor Corporation (Japan), Kawasaki Heavy Industries Ltd (Japan), Suzuki Motor Corporation (Japan), CFMoto (China), and Kymco (Taiwan).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=255821381