Global Asia Pacific Generator Sales Market Overview:

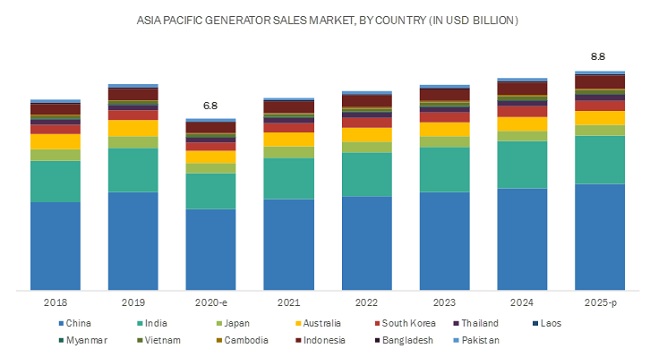

The Asia Pacific generator sales market size is projected to reach USD 8.8 billion by 2025 from an estimated USD 6.8 billion in 2020, at a CAGR of 5.1% during the forecast period. Increasing adoption of hybrid generators, bi-fuel, and inverter generators is creating demand opportunities for the Asia Pacific generator sales industry. Also, expanding manufacturing sector drives the Asia Pacific generator sales.

Download PDF Brochure @https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=150307902

China is estimated to be the largest market for generator sales during the forecast period. The generator sales market in China is expected to be driven primarily by the increased industrialization and urbanization, which requires an uninterrupted and reliable power supply. Also, the development of the healthcare and real estate industry in China requires proper electrification services, thus, driving the demand for emergency backup solutions in industrial and commercial facilities. Moreover, due to the vast population and manufacturing sectors, the country faces power outages owing to poor transmission grid lines. Thus, it creates opportunities for the generator sales market in the Asia Pacific region.

Standby generators are expected to grow at the highest CAGR during the forecast period. Standby power generators are used in applications requiring a regular power supply to carry out operations. Their primary function is to supply emergency power for a limited duration during a power outage. Commercial buildings, such as hospitals, data centers, and telecom centers, among others, consume a large amount of energy and require generator sets that are reliable and ensure continuous power supply in the event of grid failure and power outages. Lack of transmission grid lines in remote locations results in power outages, which hampers the production lines. Therefore, a standby generator plays a vital role in providing this continuous power supply during peak hours and during power outages and is expected to drive the Asia Pacific generator sales market.

Key Market Players:

A few major players that have an extensive geographic presence dominate the generator sales industry in Asia Pacific. The leading players in the Asia Pacific generator sales market include Caterpillar (US), Cummins (US), Generac (US), Wärtsilä (Finland), Mitsubishi Heavy Industries (Japan), Rolls-Royce Holdings (UK), Yanmar (Japan), Siemens (Germany), Weichai Group (China), and Sterling & Wilson (India).

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=150307902

The major strategies adopted by these players include new product launches and contracts & agreements. New product launches was the most commonly adopted strategies from July 2018 to June 2020.

Caterpillar is the world’s leading manufacturer of mining and construction equipment, diesel and natural gas engines, diesel-electric locomotives, and industrial gas turbines. The company operates through three primary segments, i.e., construction industries, resource industries, and energy & transportation. It also provides financing and related services through the financial products segment. Under the energy & transportation segment, the company offers generators for power generation, industrial & commercial, oil & gas, marine, rail, and transport applications. Its product and services portfolio includes gas engines, reciprocating engines, generator sets, marine propulsion systems, gas turbines, integrated systems used in the electric power generation industry, turbines, centrifugal gas compressors, and diesel-electric locomotives and other rail-related products and services. It offers gensets & engines under the brand names CAT and MWM. The company has manufacturing facilities of its energy & transportation segment located in Brazil, China, the US, Australia, Germany, India, Italy, Mexico, Sweden, and the UK. The company has established numerous manufacturing facilities and subsidiaries in the Americas, EMEA, and Asia Pacific, and has 165 dealers globally. Its major global competitors are INNIO, Rolls-Royce Power Systems Wärtsilä, Cummins, and Deutz AG. MAN Energy Solutions (VW), GE Power, Mitsubishi Heavy Industries, Siemens Power, Fiat Industrial SpA (CNHI), Volvo Penta AB, Kawasaki Heavy Industries Energy System & Plant Engineering, Gas, and Weichai Power are also the other competitors of the company.

Request Sample Pages @https://www.marketsandmarkets.com/requestsampleNew.asp?id=150307902

Cummins designs, manufactures, distributes, and services diesel & natural gas generators, electric and hybrid engines. It also offers power system-related components, including filtration, turbochargers, fuel systems, controls systems, air handling systems, automated transmissions, electric power generation systems, batteries, electrified power systems, and hydrogen generation and fuel cell products. The company offers its products and services to original equipment manufacturers (OEMs), distributors, dealers, and other customers worldwide. The company operates through 5 business segments, namely, engine, components, distribution, power systems, and new power. Through the power system segment, the company offers power generator sets, engines, alternators, and other power components. It also offers standby and prime power generators and these applications across the mining, oil & gas, marine, and railways industries. The company competes with a wide range of independent engine/generator set manufacturers as well as OEMs. Its primary competitors include MTU (Rolls Royce Power Systems Group), CAT, and Kohler/SDMO (Kohler Group). It also competes with Generac, INNIO, Mitsubishi (MHI), and numerous regional generator set assemblers. Its alternator business competes globally with companies such as Leroy Somer (NIDEC), Marathon Electric, and Mecc Alte. The company serves its customers through a network of approximately 600 wholly-owned joint ventures and independent distributors in more than 190 countries and territories.

Browse related reports:

Portable Generator Market by Fuel (Gasoline, Diesel, Natural Gas, Others), Application (Emergency, Prime/Continuous), Power Rating (below 5 kW, 5–10 kW, 10–20 kW), End User (Residential, Commercial, Industrial), and Region – Global Forecast to 2026

Transmission Sales Market by Type (Reciprocating, Rotary, Centrifugal, Axial Flow), Application (Artificial lift, Gas Processing Station, LNG & FPS, Storage & Facilities), Compression Media, End Users, and Region – Global Forecasts to 2024

Generator Sales Market by Type (Diesel, Gas), Application (Standby, Peak Shaving, Continuous), Power Rating (<100 KVA, 100-350 KVA, 350-1000-2500 KVA, 2500-5000 KVA, >5000 KVA), Sales Channel (Direct, Indirect), End User, Region – Global Forecast to 2026