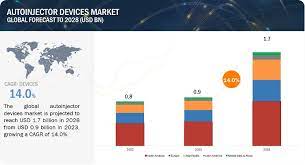

Autoinjectors Market in terms of revenue was estimated to be worth $0.9 billion in 2023 and is poised to reach $1.7 billion by 2028, growing at a CAGR of 14.0% from 2023 to 2028 according to a new report by MarketsandMarkets™. Whereas, the autoinjector finished formulations market is projected to reach USD 136.5 billion in 2028 from USD 59.6 billion in 2023, growing a CAGR of 18.0%. Some of the prominent factors driving the growth of this market are favorable government support and reimbursements and growing number of regulatory approvals for autoinjectors.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=173991724

The autoinjectors industry is set to experience significant growth in the near future as a result of several factors. With the rise in chronic diseases and the increasing need for self-administration of medication, autoinjectors have emerged as a convenient and efficient solution. These innovative devices enable patients to easily and safely administer their medications in the comfort of their own homes, reducing the dependence on healthcare professionals and improving treatment adherence. In the near future, we can anticipate further advancements in autoinjector technology, such as the integration of connectivity features that allow for remote monitoring and data collection. This connectivity will enable healthcare providers to track patient usage and adherence, ensuring effective disease management.

Rheumatoid Arthritis subsegment accounted for the largest share of the autoinjectors market by therapy area

Among the therapy area, the autoinjectors market is segmented into rheumatoid arthritis, multiple sclerosis, anaphylaxis, diabetes, and other therapy areas. In 2023, the rheumatoid arthritis segment accounted for the largest share of the autoinjectors market by therapy area. Growth in this market segment can be attributed to growing prevalence of rheumatoid arthritis and the wide adoption of autoinjectors for the treatment of this condition.

Disposable usage is the fastest-growing segment of the autoinjectors market by usage

In 2023, the disposable segment accounted for the fastest-growing share of the usage segment of autoinjectors market. Market growth can largely be attributed to the high convinience and ease of use for patients as the need for manual loading of drug in the injector is eliminated due to presence of prefilled syringe, and low chances of infections through used needle.

Europe: The second-largest region in the autoinjectors market.

The European autoinjectors market is the second-largest autoinjectors market globally, mainly due to factors such as presence of a large geriatric population in the region and the improving reimbursement and regulatory scenario. The presence of large geriatric population in the region is expected to increase the prevalence of chronic diseases leading consequently leading to growing adoption of autoinjectors for treatment of these disease. The favorable reimbursement and regulatory scenario is expected to further support market growth.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=173991724

Key Market Players:

The market for autoinjectors is consolidated, with key players strategizing to capture the market. Prominent players in the autoinjector devices market are Becton, Dickinson and Company (BD) (US), Ypsomed Holding AG (Switzerland), SHL Medical (Switzerland), West Pharmaceutical Services, Inc. (US), Recipharm AB (Sweden), Haselmeier GmbH (Germany), Owen Mumford Ltd. (UK), Philip-Medisize, LLC (US), Oval Medical Technologies Ltd. (UK), Kaleo, Inc. (US), Solteam Incorporation Co., Ltd. (China), Antares Pharma, Inc. (US), and the some of the major market players for finished formulations include AbbVie Inc. (US), Amgen Inc. (US), Eli Lilly and Company (US), Novartis AG (Switzerland), Merck KGaA (Germany), Viatris Inc. (US), and Biogen (US).

Autoinjectors market – Report Highlights:

- Market sizes are updated for the base year 2022 and forecasted from 2023 to 2028.

- The market overview chapter in the current edition of this report provides the ecosystem analysis, patent analysis, key conferences and events during 2023-24, technology analysis, regulatory analysis, Porter’s Five Forces analysis, and the key stakeholders and buying criteria in the autoinjectors market.

- The current edition of the report provides updated financial information for each listed company in a graphical representation. This will help in the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, and business segment focus in terms of the highest revenue-generating segment.

- Recent developments are helpful in understanding market trends and growth strategies adopted by players in the market in the last three years (January 2020 to April 2023).

- Tracking the product portfolios of prominent market players helps analyze the major products in the autoinjectors market. The new edition of the report provides an updated product portfolio of the companies profiled in the report.

- The market evaluation framework, market share analysis, and competitive leadership mapping have been updated in the competitive landscape chapter of the report. The current version of the report includes the revenue share analysis of key market players from 2020 to 2022.

- The company evaluation matrix is an output of a comprehensive study of the key vendors of autoinjector devices and finished formulations. The top 25 vendors were shortlisted from a list of 50+ vendors, post which they were evaluated based on their market share/ranking and product footprint, rated and positioned on a 2×2 matrix, categorizing them as ‘Stars,’ ‘Emerging Leaders,’ ‘Pervasive Players,’ and ‘Emerging Companies.’

- A comprehensive study of the key startup vendors offering autoinjectors was also performed. The top 15 vendors were shortlisted from a list of 50+ vendors. These players were evaluated, rated, and positioned on a 2×2 matrix, categorizing them as ‘Progressive Companies,’ ‘Starting Blocks,’ ‘Responsive Companies,’ and ‘Dynamic Companies.’

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=173991724