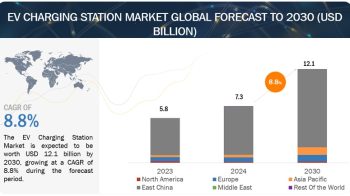

The automotive engineering service market is projected to grow from 153.2 billion in 2022 to 243.9 billion by 2028, registering a CAGR of 8.1%.

The growing demand of zero-emission vehicles, advancements in technologies such as ADAS, battery management, connectivity, among others, and rising commercial transport are expected to increase the demand for automotive engineering services around the world. For instance, the demand for automotive engineering services for electric vehicles such as battery development & management, charger testing, motor control, among others, is increasing due to the increased demand for electric passenger cars and commercial vehicles due to their lower operating noise and lower emissions as compared to their ICE counterparts. At present, major global automotive OEMs outsource processes such as designing, prototyping, system integration, and testing to an external source. The demand for outsourcing automotive engineering services has been increased from last few years. The outsourcing of automotive engineering services can help automotive OEMs by integrating product development with related operations such as engineering and warranty management.

Prototyping segment to be the largest market by value during forecast period

Prototyping is estimated to be the largest service type segment of the automotive engineering services market during the forecast period. Prototyping enables industry professionals to create functional models of a new part design in a short time. In addition, the adoption of 3D printing technology has significantly reduced the time it takes to manufacture the functional model. In the automotive industry, 3D printing has created opportunities for the creation of new designs (making products safer, cleaner, and lighter) and other 3D plastic prototype parts, with shorter delivery times and at lower costs. Rapid prototyping is done to keep the assembly line moving fast while staying flexible to adopt new designs. A visual prototype represents the appearance of a product but not the functionality. Prototyping allows OEMs to test new parts and technologies before sending them to the actual assembly line. Without prototyping, these parts and technologies can be dangerous or inefficient for the assembly line. It can also lead to stalled or canceled production runs. Incorporation of new features requires prototyping before final implementation. Thus, the demand for prototyping in automotive engineering services is expected to grow during the forecast period. Many OEMs and automotive engineering service providers have developed new prototyping techniques to scale up their design and development processes. For instance, Tech Mahindra, an Indian automotive service provider, partnered with ServiceNow to collaborate on creating value and scaling through rapid prototyping and development of the next generation codes, no code apps, IoT (Internet of things), and AI/ML (Artificial Intelligence/Machine Learning). According to the European Automobile Manufacturers’ Association (ACEA), Europe’s R&D investment for the automotive industry was the highest in 2019 compared to Japan and the US. Increasing R&D investment in this region is expected to drive the market for automotive engineering services during the forecast period. Volkswagen unveiled a fully electric SUV, the ID. ROOMZZ, at the Shanghai Auto Show in 2019. This vehicle is available in China after 2021 and compete against Tesla’s Model X. Upcoming electric SUVs would require new materials and components, which must be prototyped before sending to the production line.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=151284922

In-house to be the fastest growing segment during the forecast period

The In-house segment is estimated to be larger than the outsource segment during the forecast period. To control the overall vehicle engineering process, OEMs prefer to keep the research and design in-house. Many OEMs have established their in-house teams for automotive software, such as BMW’s Car-IT and Volkswagen’s Car Software, and few other companies are developing long-term partnerships or joint ventures with application software specialists like Audi-Elektrobit. Performing engineering services in-house has many advantages over outsourcing those services such as streamlined communication, improved quality control, faster time to market, ability to address changes in technology, and improved customer satisfaction. This leads to OEMs preferring in-house R&D for major applications, which are developed by them, or with the participation of others. For instance, Alten Group, a French engineering service provider, supported the in-house development of the powertrain of a British car manufacturer. The car manufacturer availed Alten Group’s services to develop a compact, lightweight, and low-emission ICE powertrain. Alten Group assisted the automaker by sending 150 engineers to the UK for the in-house project. Major Asia Pacific companies focus on designing electric vehicles with their own customizations, which enhance the demand for in-house investments. Tata Motors has an in-house software company that designs and develops innovative software for future automobiles. Automotive designing in Europe and North America is also likely to grow during the forecast period. The European company Volkswagen provides in-house car software. The company stated that from January 1, 2020, the Car software service will operate as part of an independent business unit

“Asia Pacific to be the fastest growing market for automotive engineering services during the forecast period”

Asia Pacific is estimated to be the fastest-growing market. The growth of the Asia Pacific automotive engineering services market can be attributed to favorable government regulations and the high adoption of electric passenger cars and commercial vehicles. The region has the presence of top outsourcers, such as Great Wall Motor, Tata Motors, Daimler, Volvo, and Groupe PSA. Japan is estimated to be the largest market during the forecast period. Japan plays a vital role in the development of advanced electronic technology in Asia Pacific. With advancements in technologies such as smart components, ADAS and safety solutions, autonomous driving and connectivity solutions, EV powertrains and batteries, and fuel cell technology, the automotive engineering services market in Japan is expected to grow. India is expected to be the fastest-growing market during the forecast period due to the presence of automotive service providers such as Tech Mahindra, L&T Technology Services, and HCL Technologies. These companies offer services such as body engineering, hybrid & electric mobility, infotainment & connectivity, and powertrain engineering to OEMs globally. With the increase in electric passenger and commercial vehicle sales in Asia Pacific, the demand for automotive engineering services, such as simulation, battery development & management, charger testing, and motor controls, is expected to grow.

Request Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=151284922

Key Market Players:

The automotive engineering services market is dominated by established players such as Capgemini (France), IAV Automotive Engineering (Germany), Tech Mahindra (India), AKKA Technologies (Belgium), and HCL Technologies (India), among others.

Related Reports:

Automotive Acoustic Engineering Services Market – Global Forecast to 2025

Electric Commercial Vehicle Market – Global Forecast 2030

ADAS Market – Global Forecast to 2030