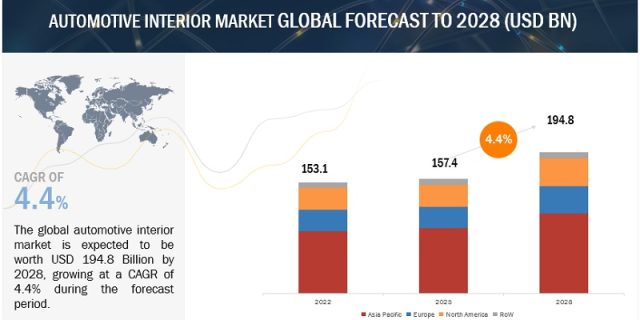

The global automotive interior market, by value, is estimated to be USD 157.4 billion in 2023 and is projected to reach USD 194.8 billion by 2028, at a CAGR of 4.4% from 2023 to 2028.

The growth of the automotive interior market is influenced by various factors such as Increasing customer preference for convenience, premium features, and advanced safety features, Integration of smartphone connectivity, Use of variety of lightweight & advanced materials and innovative finish.

The growth of automotive interior market in the future is expected to be driven by several key factors. The increased popularity of lightweight vehicles is a result of their higher fuel efficiency. This is increasing the demand for lightweight automobile interiors composed of composites and polymers. autonomous vehicles are expected to become increasingly popular in the coming years. These vehicles will require different interior designs than traditional vehicles, as they will not have a driver or passengers. This is driving demand for new and innovative automotive interior solutions. Additionally, more comfort and luxury are becoming priorities for consumers when purchasing cars. This is increasing demand for car interiors with amenities like massage chairs, heated and ventilated seats, and high-end music systems.

India, Canada, South Korea, Japan and Brazil have increased their investments in the development of automotive industry due to the growing urban population and economy in these countries. Due to such investment demand for automotive interior components will be more during the forecast period.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=10199544

Battery electric vehicle segment is estimated to account for the largest market size during the forecast period

The battery electric vehicle (BEV) segment holds the largest market share. BEVs tend to have a higher number of electronics and advanced systems than traditional combustion engine vehicles, including touchscreen displays, infotainment systems, and driver assistance features. The Audi e-tron GT 2023 model will feature a HUD that projects key driving information, such as speed, navigation, and safety alerts, onto the windshield. The HUD is designed to be glare-free and easy to read, even in direct sunlight. The governments of India, China, the US, and several European countries are subsidizing electric infrastructure, which has resulted in the growth of the BEV segment. OEMs are focusing on launching new electric variants of existing ICE models. Electric and hybrid vehicles are premium vehicles equipped with multiple advanced systems, such as digital instrument clusters, center stacks, HUDs, and rear seat entertainment systems. The Lucid Air 2023 model will feature a HUD that projects key driving information onto the windshield, as well as a rearview camera image. The HUD is designed to be particularly useful for night driving, as it allows drivers to see the road ahead without having to look down at the instrument cluster. Also, the majority of BEVs now have features such as powered & heated seats and heated steering systems. The BMW iX 2023 model will also feature 14-way power-adjustable front seats with heating and ventilation. The seats are also ventilated. Hence, the demand for automotive interior technologies and solutions in the EV segment is expected to remain strong during the forecast period.

“Asia Pacific is expected to be the largest market during the forecast period.”

Asia Pacific is expected to hold the largest share in the automotive interior market in 2023. The region is the largest market for small passenger automobiles. The expansion of the passenger car segment will have a favourable impact on the region’s automotive interior market. The large automobile production capacity of countries such as China, Japan, India, and South Korea is significantly driving the region’s automotive interior market. Furthermore, increased R&D of various automotive interior components such as seating, infotainment systems, HUDs, ambient lighting, vehicle-connected features, and central consoles, as well as high vehicle production in emerging economies such as Asia Pacific, are driving the automotive interior market. Ford has invested USD 1 billion in R&D for its automotive interiors in 2023. This investment will be used to develop new materials, technologies, and features for its interiors. In addition to this, the increasing preference for the SUV/MPV vehicle segment, the increase in bus production, and regulations for truck cabin comfort are a few additional factors influencing the demand for automotive interior components and solutions in emerging economies, including China, India, and Thailand.

Inquire Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=10199544

Key Players

The automotive interior market is dominated by global players such as FORVIA Faurecia (France), Adient plc. (Ireland), Robert Bosch GmbH (Germany), Lear Corporation (US), and Antolin (Spain). These companies adopted new product launches, deals, and other strategies to gain traction in the automotive interior market.