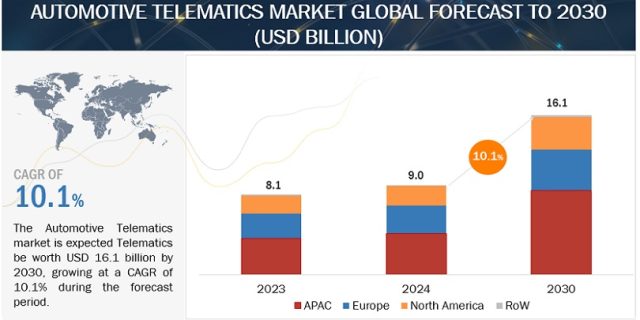

The Automotive Telematics Market is projected to grow from an estimated USD 9.0 billion in 2024 to reach USD 16.1 billion by 2030 at a CAGR of 10.1% during the forecast period.

Automotive manufacturers are highly focused on collaborating with telematic suppliers to integrate their services into their new models to increase drivers’ and on-road safety. Several automakers offer e-SIM card facilities in their top-end variants, like Ford, who collaborated with Vodafone to offer 4G Wi-Fi connectivity. All the premium vehicles are equipped with this e-Sim card facility, which is also anticipated to drive the overall market growth. The Telematics market is further boosted by the growing emphasis on vehicle connectivity and data-driven insights to enhance driver safety, efficiency, and convenience.

“Passenger Cars dominate the automotive telematics market at a global level.”

The passenger car segment is projected to lead the automotive telematics market during the forecast period. The growth is mainly attributed to the highest share of passenger cars, with about 70 million in 2023, among overall vehicle production, which is expected to surpass 79 million by 2030. Factors such as rising demand for connected features, advanced safety technologies, and growing acceptance of ADAS for improved safety and comfort drive the passenger car telematics market. Over 40% of Class C segment passenger cars are installed with an OE-fitted telematic system. Alternatively, Class D & above passenger cars are installed with OE-fitted telematics modules in their luxury vehicles to attract consumer attention. Although Asia-Pacific leads the automotive telematics market owing to a higher volume of passenger cars, the European and North American markets hold a higher penetration of telematics unit fitment. OEMs like Volkswagen, Ford, Mercedes-Benz, Audi, and BMW offer telematics units as a standard or optional feature in these regions.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=245073008

Furthermore, regulatory mandates for vehicle safety (such as the e-Call mandate in Europe) and emissions monitoring in these regions have pushed automakers to adopt telematics solutions to comply with stringent requirements – moreover, robust telecom infrastructure with widespread presence complementing the access to telematic services. As the penetration of embedded telematics is expanding beyond luxury and premium segments, mid-range models from Chery, GAC Motor, Toyota, Honda, and Nissan and strategic collaborations with technology companies like Google and Samsung to extend their telematic offerings will allow them to capture a significant share for automotive telematics market in passenger cars segment.

“Insurance-based assessment to be the fastest growing automotive telematics service by 2030.”

Insurance-based assessment services are projected to become a prominent telematics service market by the end of 2030 as they offer several benefits over standard insurance. This service provides insurers with valuable data to assess risk and tailor insurance premiums based on individual driving behavior. By leveraging telematics devices installed in vehicles, insurers can track metrics such as driving speed, distance traveled, braking patterns, and time of day, allowing for a more personalized and fair pricing model. This approach incentivizes safer driving habits among policyholders, reducing accident rates and insurance claims ultimately lowering costs for insurers. Regulatory bodies are pushing automakers to deploy telematics and connectivity functionalities in vehicles to improve passenger and vehicle safety. This increased demand for cars with more sophisticated and connected features. In a 2022 study on public perception and use of telematics, the Insurance Research Council (IRC) found that in the US, 45% of drivers surveyed indicated they had significantly changed their driving habits for safety after taking part in a telematics program, and an additional 35% stated that they had made minor adjustments to their driving style.

Further, a whitepaper published by LexisNexis Risk Solutions stated that around 80%-90% of those who bought auto insurance in 2017 had telematics-enabled coverage. Additionally, insurance firms may help customers in times of need due to the growing demand for connected car services, which expedites the claims procedure and saves time. Hence, the increasing adoption of automotive telematics would prompt the market growth of insurance-based assessment services in the coming years.

“North America is the second largest market for automotive telematics.”

North America is estimated to remain the second-largest region for the automotive telematics market. The region’s growth is mainly driven by stringent government regulations and the presence of prominent OEMs Ford Motor Company (US), General Motors (US), and Fiat Chrysler Automobiles (US). The automotive market in the US has favored passenger cars with advanced comfort and safety technologies. The US is the largest market in the region and accounts for more than two-thirds of the overall market, followed by Mexico and Canada. With the increasing penetration of luxury cars and the upcoming availability of 5G connection, which will enable more advanced telematics solutions, the need for telematics solutions is anticipated to rise in this region. In addition to this, the regulatory landscape and government programs encourage the use of telematics for environmental and safety reasons. For instance, To measure hours of service, commercial vehicles must carry electronic logging devices (ELDs), according to the governments of the US and Canada. As a result, OEMs and telematics suppliers partnered to develop compliance solutions. OEMs are also looking to develop alliances with telematics providers due to the rising popularity of connected car platforms and subscription-based services to improve their products and maintain their competitiveness in the North American market. In the US, around 80% of cars are connected with the increasing advancement in 5G technology. Telecom companies are working with automakers, including Toyota, General Motors, and Porsche, to build practical 5G solutions. AT&T has partnerships with more than 30 automotive OEMs using its network, such as BMW, Ford, Chevrolet, Jaguar, and Honda. The growth of telematics in premium SUVs and pickup trucks is driven by a strong emphasis on technology and innovation in the automotive industry, particularly in the premium segment, where vehicles are offered with advanced features and connectivity options.

Key Players

The Automotive Telematics Market is dominated by globally established players, such as Robert Bosch GmbH (Germany), Continental AG (Germany), AT&T Inc (US), LG Electronics. (South Korea), and Verizon (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=245073008