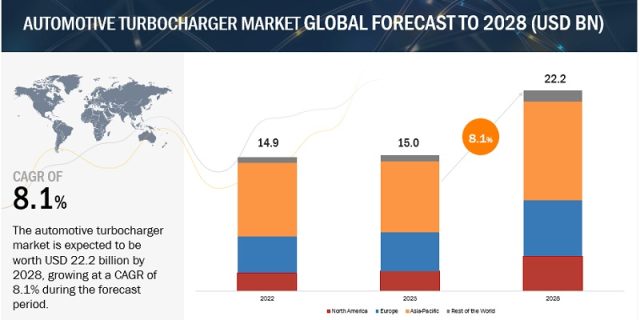

The automotive turbocharger market is projected to grow from USD 15.0 billion in 2023 to USD 22.2 billion by 2028, at a CAGR of 8.1%. The automotive turbocharger market is driven by decreasing emission limits and increased demand for high-performance vehicles. With the shift from diesel to gasoline in light-duty vehicles and growing vehicle hybridization, gasoline and electric turbochargers would be the future potential markets for turbocharger manufacturers.

VGT Turbochargers are predicted to be the largest segment.

The VGT Turbochargers are estimated to dominate the market over the forecast period. Compared to wastegate turbochargers, the variable geometry design necessitates more intricate engineering and precise parts, which raises the cost. The VGT turbocharger offers enhanced performance with reduced turbo lag, outperforming traditional wastegate turbochargers. Its variable geometry design optimizes airflow, delivering improved response across a wider range of engine speeds. It loads well at higher levels for boosting pressure throughout the engine’s RPM range due to adjustable vanes. Considering all these factors, though VGTs are priced higher than wastegate turbochargers, they are gaining popularity across all vehicle segments. Asia Pacific, the largest vehicle production hub, is also estimated to be the largest market for VGTs with >50% of the vehicles in the region equipped with VGTs in 2023.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=919

The passenger car segment is projected as the largest Turbocharger Market.

According to the Association of European Automobile Manufacturers (ACEA), global passenger car production increased by ~8% from 2021 to 68 million units in 2022. The top five countries contributing to top passenger car production in 2022 were China (26.2 million units), the US (10.3 million units), Japan (9.7 million units), Germany (5.3 million units), and India (4.3 million units).

Many OEMs have shifted from diesel to gasoline vehicles for many reasons, such as stringent emission limits on diesel emissions, higher taxes on diesel fuel and vehicles to reduce the demand and narrowing the fuel efficiency and performance gap between gasoline and diesel vehicles. Gasoline vehicles are now equipped with a gasoline direct injection (GDI) system, which has improved fuel efficiency up to 20% compared to all the traditional gasoline engines providing more power and torque. It has also helped reduce the emissions of pollutants such as nitrogen oxides (NOx) and particulate matter (PM). Due increase in the use of GDI engines has also propelled the use of turbochargers, and the combination of both GDI and turbochargers makes the automakers create more efficient and powerful engines, which has increased the popularity of gasoline engines by giving a good balance of performance, fuel efficiency, and emissions. Europe has the highest proportion of turbocharged passenger cars, according to the ACEA. >50% of all passenger vehicles sold in Europe in 2022 had turbochargers. This exceeds the ~37% global average by a wide margin. Hence, gasoline-turbocharged vehicles are projected to be the market with future potential.

Asia Pacific is estimated to be the dominant automotive turbocharger market.

Asia Pacific is the largest market for small passenger cars, and more than 80% of the passenger cars in this region run on gasoline. The market growth in countries such as China, India, South Korea, and Japan can be attributed to the increasing demand for gasoline engines that use TGDI (turbocharged gasoline direct injection) technology, where China is the key market for automotive turbochargers in the Asia Pacific. According to MarketsandMarket analysis, the Asia Pacific region has gasoline-powered vehicles with a>35% installation rate of turbochargers, while diesel vehicles have an almost 100% installation rate. The Asia Pacific region has recently witnessed the rise of hybrid vehicles, which is also an opportunity for electric turbochargers.

By 2030, the ACEA predicts that there will be ~52 million EVs on the road by 2030 in the Asia Pacific region, up from 1.2 million in 2022. In terms of the percentage, EV sales would rise from ~3% in 2022 to ~50% by 2030. In this, China is anticipated to continue to be the largest EV market in the Asia Pacific region by 2030, contributing to ~40%, followed by Japan (~18%). Ultimately, the turbocharger’s demand in the future is projected to fall due to the trend of electric vehicles. Some of the leading turbocharger manufacturers in the region are IHI Corporation (Japan), Mitsubishi Heavy Industries (MHI, Japan), and Turbo Energy Ltd (India).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=919