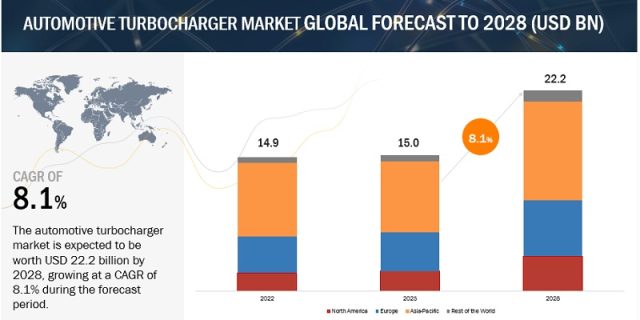

The Automotive Turbocharger Market is estimated to grow from USD 15.0 billion in 2023 to USD 22.2 billion by 2028 at a CAGR of 8.1% over the forecast period.

The growth in the automotive turbocharger market is attributed to the growing fuel-efficiency targets & decreasing emission limits, and the trend toward high-performance vehicles. Due to the growing vehicle parc of turbocharged vehicles, the demand for turbochargers in the aftermarket is also growing. An increase in the stringency of emission limits in gasoline-powered vehicles; the demand for gasoline turbochargers would fuel the market in coming years.

Gasoline-powered vehicles are the largest application for automotive turbochargers.

Gasoline-powered vehicles in the passenger car segment have the largest market share, which has grown due to reduced emission limits in new emission regulations. Currently, Euro 6d went into effect in January 2020 and applies to all new vehicles sold in Europe, setting NOx: 80 mg/km for petrol vehicles and 114.4 mg/km for diesel vehicles, and Particulate Matter: 0.0045 g/km for petrol vehicles and 0.005 g/km for diesel vehicles. Soon these will be replaced by the Euro 7 standards in July 2025. To achieve the emission limits, most of the vehicles are equipped with GDI and are also turbocharged.

The automakers in the Asia Pacific region are also adopting the new technologies of turbochargers such as Toyota (Japan), Honda (Japan), Hyundai (South Korea), Mitsubishi (Japan), and Nissan (Japan) have been using turbocharging technology in some of the gasoline engines to improve the performance and fuel efficiency of the vehicles.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=919

Cast iron will dominate the Automotive Turbocharger Material market.

Cast iron can withstand high temperatures up to 900°C, a popular material used for the turbine housing and intake and exhaust manifold in many turbochargers because of its ability to withstand high temperatures and its durability. This cast iron finds its application mostly in the turbine housing. Mitsubishi Heavy Industries (MHI) provides turbine housings made of cast iron, which can withstand an allowable temperature of 700°C, and austenitic stainless cast steel that resists temperatures exceeding 1,000°C. The models offered by Ford, for instance, the F-Series Super Duty (line of heavy-duty pick-up trucks), use turbocharged diesel engines with cast iron turbine housings. Considering all the factors and importance, cast iron is assumed to dominate the material type segment in the automotive turbocharger market.

Asia Pacific is estimated to be the dominant automotive turbocharger market.

Asia Pacific is the largest market for small passenger cars, and more than 80% of the passenger cars in this region run on gasoline. The market growth in countries such as China, India, South Korea, and Japan can be attributed to the increasing demand for gasoline engines that use TGDI (turbocharged gasoline direct injection) technology, where China is the key market for automotive turbochargers in the Asia Pacific. According to MarketsandMarket analysis, the Asia Pacific region has gasoline-powered vehicles with a>35% installation rate of turbochargers, while diesel vehicles have an almost 100% installation rate. The Asia Pacific region has recently witnessed the rise of hybrid vehicles, which is also an opportunity for electric turbochargers.

Key Market Players

The automotive turbocharger market is consolidated. Garrett Motion Inc. (Honeywell), BorgWarner, IHI Corporation, MHI, and Cummins Inc. are the key companies operating in the market. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=919