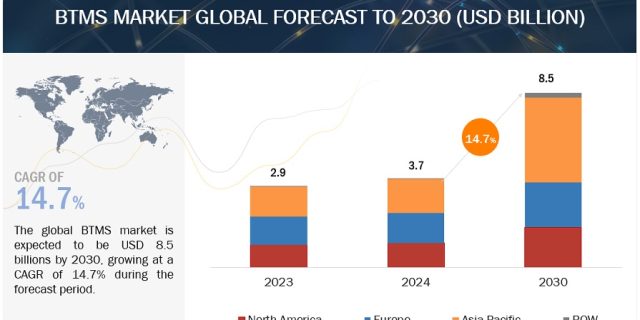

The global battery thermal management systems market size is projected to grow from USD 3.7 billion in 2024 to USD 8.5 billion by 2030, at a CAGR of 14.7%. The BTMS market is witnessing robust growth driven by increasing demand for electric vehicles and innovation around battery technologies may drive the market for BTMS systems.

Driver: Innovation in EV battery system

Battery thermal management systems are integral to maximizing the performance and longevity of EV batteries, particularly in the context of significant advancements in battery technology. As innovations such as solid-state batteries and improvements in cathode chemistry reshape the landscape of EV batteries, thermal management becomes even more critical to ensure the efficient operation of these cutting-edge systems. Innovations in cathode chemistry, such as lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP), have led to higher energy densities and improved range in EV batteries. However, these advancements also bring challenges in terms of thermal management. For instance, the Tesla Model S uses LFP batteries. Tesla has developed a new battery design in which the cooling ribbons are now glued directly to the cooling ribbon, and the cooling ribbon spans a greater percentage of the cells’ height. NMC batteries typically operate within a voltage range of 3.0–4.2 volts per cell. These have a nominal voltage of 3.6–3.7 volts per cell. NMC batteries use graphite anode and lithium compounds like Lithium Manganese Oxide (LiMn2O4) and Lithium Nickel Oxide (LiNiO2). Due to their current battery components, these batteries typically rely on air or liquid cooling.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=184479896

Opportunity: Growing potential of modular design

Modular design is a promising approach for developing next-generation battery thermal management systems (BTMS) that can improve performance, flexibility, and cost-effectiveness. There are some developments in this area, such as using mini-channel cooling plates with modular designs that can be easily integrated into battery packs. These plates allow for targeted cooling of individual battery cells or modules, improving temperature uniformity. The modular nature enables scalability to different pack sizes and configurations. Optimizing the structural layout of modular BTMS components can further improve performance. Studies have used topology optimization to design efficient liquid cooling plates. Incorporating modular vortex generators or perforated plates into air-cooled racks enhances airflow and heat transfer. Continued research in this area will further advance next-generation BTMS.

<100 KWH battery capacity segment is estimated to exhibit the largest growth in global BTMS market

<100 KWH battery capacity segment is expected to have significant growth opportunities in the BTMS market during the forecast period. This battery capacity range offers a balance between range and practicality. It satisfies the needs of consumers who desire an EV capable of longer distances without the added cost or weight of extremely high-capacity batteries. The infrastructure development supports the adoption of EVs with larger battery capacities and proper thermal management as consumers feel more confident about long-distance travel and quick charging options. With the improving range, the sales of vans falling under the segment are estimated to rise, which will boost the EV battery market in the <100 kWh segment. For instance, the 2024 Audi e-tron GT is a sedan with a 93-kWh battery pack that provides a range of around 300 miles (483 kilometers; it uses liquid-cooled systems for its batteries to provide optimum performance. Thus, the launch of EVs with a battery capacity of <100 kWh will drive the segment.

US to lead the BTMS market in North America

The US is predicted to lead the North American BTMS market. The US is a leading market in the automotive industry, renowned for its innovation, technology adoption, and vast network of manufacturers, suppliers, and consumers. With a diverse landscape ranging from the cold winters of Alaska to the scorching summers of Arizona, the demand for effective BTMS is paramount. As EV adoption continues to rise, driven by environmental concerns and government incentives, the importance of efficient thermal management solutions becomes even more pronounced. The climate across the US varies significantly from region to region, presenting unique challenges for automotive thermal management systems. In northern states such as Minnesota and Maine, frigid temperatures during winter months can severely impact battery performance and longevity. Conversely, in southern states such as Texas and Florida, extreme heat poses similar challenges, accelerating battery degradation and reducing overall efficiency. The growing demand for EVs in the US presents a significant opportunity for companies specializing in BTMS.

Key Players

The BTMS market is dominated by global players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Webasto Group (Germany), Denso (Japan), and BorgWarner Inc. (US), among others. These companies adopted new product development strategies, expansion, partnerships & collaborations, and mergers & acquisitions to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=184479896