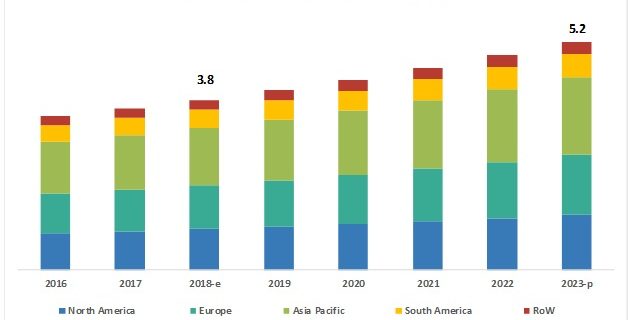

The beverage flavoring systems market was valued at USD 3.8 billion in 2018 and is projected to reach USD 5.2 billion by 2023, at a CAGR of 6.1% from 2018 to 2023. The global demand for beverage flavoring systems is increasing significantly due to the launch of advanced technologies in flavor processing, the increasing consumer inclination toward clean-label and organic products, and favorable regulatory environment for fortified products. Fruit & vegetable flavors find applications in the manufacturing of juices, functional drinks, carbonated soft drinks, alcoholic beverages, and dairy-based beverages. The Asia Pacific region is projected to hold the largest market due to growing consumption of carbonated soft drinks. There is also a growing demand for natural, tropical, and exotic aromas in flavors from this region. The market for beverage flavoring systems is set to grow, owing to the favorable regulatory policies for the consumption of products with low sodium, low sugar, and natural products. All these factors are expected to fuel the market growth of beverage flavoring systems.

Report Objectives

- Determining and projecting the size of the beverage flavoring systems market with respect to ingredients, beverage type, type, origin, form, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different sub-segments and regions

- Identifying and profiling key players in the beverage flavoring systems market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying major growth strategies adopted by players across the key regions

- Analyzing the supply chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights on key investments in product innovations and technology and patent registrations

Beverage flavoring systems market, by form, is segmented into dry and liquid. The liquid segment is projected to be the faster-growing segment since liquid flavors can be easily mixed together to provide a homogeneous distribution of each flavor component—a reason why most beverage manufacturers prefer the usage of liquid flavors.

Read more @ https://www.marketsandmarkets.com/PressReleases/beverage-flavoring-system.asp

The launch of advanced and cost-effective flavor systems, development of multi-functional flavor systems, and changing lifestyles coupled with the rising demand for carbonated soft drinks in the Asia Pacific and South American economies prove to be opportunities for this market. The growing demand for a variety of innovative flavors in soft drinks, the launch of advanced technologies for flavor processing, and favorable regulatory environment for fortified products coupled with growing consumer inclination toward clean-label and organic products are some of the factors which drive growth in the beverage flavoring systems market.

The major players in the industry are focusing on new service & technology launches as well as attaining the leading market position through the provision of a broad portfolio, catering to the varied requirements of the market, along with a focus on the diverse end-user segments.

Recent Developments

- In June 2018, Firmenich launched its Natural and Clean-Label platform through which it would provide natural, authentic, and traceable products to gain customers and their trust.

- In August 2018, ADM opened its new technical innovation center in Shanghai, China, to support the development and creation of innovative and nutritious products. This center would help the company to cater to the increasing demand for nutritional food & beverage products in the Asia Pacific region.

- In July 2018, Sensient Technologies acquired Mazza Innovation Limited (Canada) to expand its portfolio of natural and organic ingredients for its food & beverage, nutraceutical, and personal care products by using Mazza’s technologies.