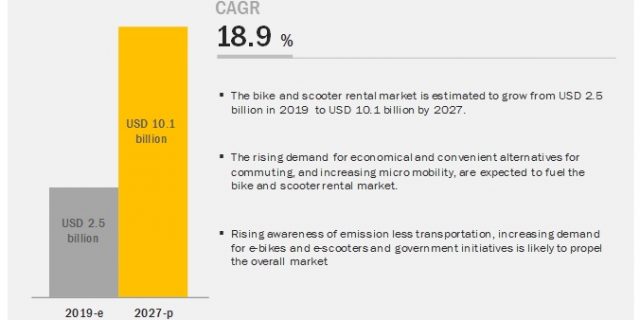

The demand for options in personal transport and rides has triggered an increase in bike and scooter rental services. Consumers prefer economical and flexible mode of transport for micro mobility. Supporting infrastructure and growing demand for small-sized commute vehicles would drive the bike and scooter rental market. This offers an opportunity to bike and scooter rental providers to maximize profits. The Bike and Scooter Rental Market is projected to grow from USD 2.5 billion in 2019 to reach USD 10.1 billion by 2027, at a CAGR of 18.9%.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/bike-scooter-rental-market-122654882.html

Asia Pacific is estimated to be the fastest growing market during the forecast period due to high adoption of electric bikes and scooters in countries such as China and India. Moreover, low charges of bike and scooter rentals create an opportunity in the region. Additionally, the increased use of smartphones and emerging government regulations for pollution limitations are likely to deliver a positive impact. The governments in the region offer several incentives to encourage the adoption of emission-free vehicles and ride-sharing. For instance, the Indian government has announced to ban all petrol-based two-wheelers under 150cc by April 2025, which has given an opportunity to rentals, especially electric-based. The fact that India will outpace China in terms of demand for two-wheeler electric vehicles in 2–4 years has made companies alert toward a revenue shift.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=122654882

Europe is the second fastest growing market as it focuses heavily on advanced technologies to reduce emissions. Almost all countries in the region have plans to incorporate necessary changes to bring down emission levels drastically and propmote emission-free vehicles. European countries have a high demand for bikes. For instance, 90% of the population in Denmark owns a bike, while 56% owns a car. La Rochelle, a French city, launched a bike sharing platform in 1974 and it is still in operation. The Velib in Paris was one of the biggest public bike-share programs outside of China until replaced in 2018 by the Velib Metropole. JCDecaux has also funded self-service bike rental schemes that offer thousands of bikes in many European cities, including Paris, Brussels, Dublin, Luxembourg, Vienna, and Valencia.

Critical Questions:

- Where will rental and sharing services take the industry in the long term? What will be the growth of the bike and scooter rental market?

- How e-scooters and e-bikes will transform the outlook of the overall automotive industry?

- What are the upcoming trends in the bike and scooter rental market? What impact would they make post 2022?

- What are the key strategies adopted by the top players to increase their revenues?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst