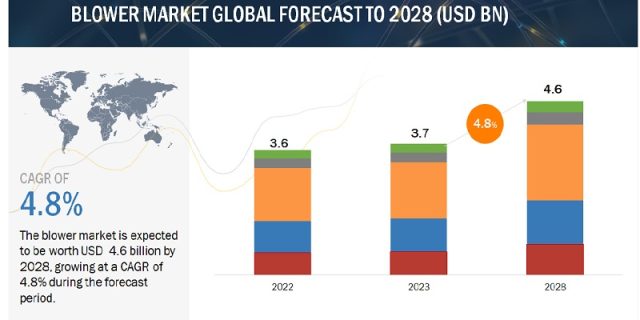

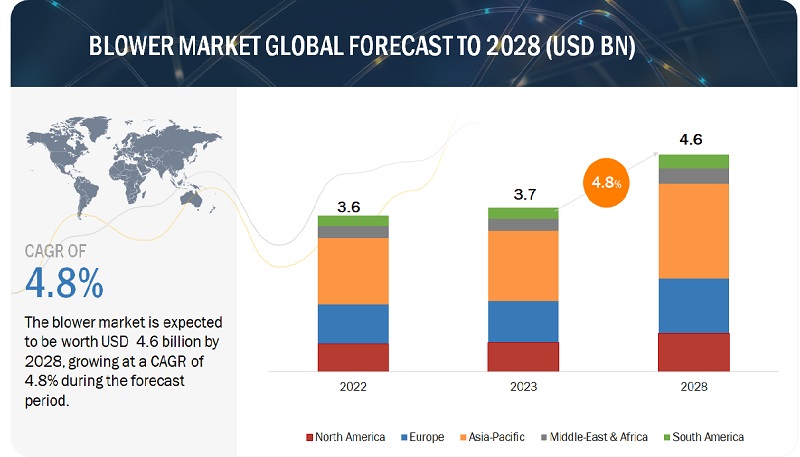

According to a research report “Blower Market by Product Type (Positive Displacement Blowers, Centrifugal Blowers, High-speed Turbo Blowers, Regenerative Blowers), Pressure, Distribution Channel, End-user Industry and Region – Global Forecast to 2028″ published by MarketsandMarkets, the Blower is projected to reach USD 4.6 billion by 2028 from an estimated USD 3.7 billion in 2023, at a CAGR of 4.8% during the forecast period.

The increasing demand for blowers across various industries is spurred by their versatile applications. From ventilation and cooling in manufacturing plants to combustion support in furnaces, blowers play a pivotal role in diverse industrial processes. The emphasis on energy efficiency, stringent environmental regulations, and the need for precise air and gas handling contribute to the growing adoption of blowers. Industries ranging from manufacturing and construction to wastewater treatment find these devices essential, driving the overall demand for blowers across diverse sectors.

Browse 219 market data Tables and 48 Figures spread through 266 Pages and in-depth TOC on “Blower Market – Global Forecast to 2028”

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=23329060

Positive displacement blowers, by product type, are expected to grow by the largest segment during the forecast period.

Based on product type, the blower market has been segmented into positive displacement blowers, centrifugal blowers, high-speed turbo blowers, and regenerative blowers. Positive displacement blowers are in high demand across a wide range of sectors because of their unparalleled versatility and dependability. Given their superior ability to deliver steady airflow and pressure, these blowers are crucial for use in water treatment facilities, wastewater treatment facilities, and pneumatic conveying. Businesses value their versatility in managing a variety of gases and their capacity to function under difficult circumstances. Positive displacement blowers are in more demand as industries place a higher value on accuracy and longevity while still satisfying the wide range of requirements for industrial operations.

The pressure segment above 20 psi segment is expected to grow at the second fastest CAGR during the forecast period.

This report segments the blower market based on pressure into up to 15 psi, 15 – 20 psi, and above 20 psi. The above 20 psi segment is expected to be the second fastest-growing segment during the forecast period. The above 20 psi blowers can also be known as the high-speed blowers. The industry uses these blowers because of how well they work to provide tailored airflow and quick air circulation. For procedures that need rapid cooling, ventilation, or material handling, these blowers are essential. Their capacity to provide strong airflow at high velocities speeds up production by accelerating temperature regulation and guaranteeing ideal conditions in industrial environments. High-speed blowers are a favored option for many industrial applications as they also aid in energy conservation and process optimization.

Europe is expected to be the third largest region in the blower market.

Europe is expected to be the second-largest blower market during the forecast period. The European region has been subdivided into five key countries: the UK, Germany, France, Italy, Spain, and the Rest of Europe. High and medium-voltage products are crucial to industries as they enable efficient power transmission over long distances from generation centers to transformer substations. The revitalization of the European industrial sector and the establishment of new industrial set-ups and facilities are also expected to fuel the demand for high & medium-voltage products in the region.

Request Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=23329060

Key Players

Some of the major players in the blower market are Atlas Copco (Sweden), Ingersoll Rand (US), Kaeser Kompressoren (Germany), Aerzen (Germany), and Xylem (US). The major strategies adopted by these players include sales contracts, product launches, investments, collaborations, partnerships, and expansions.