Market Forecast:

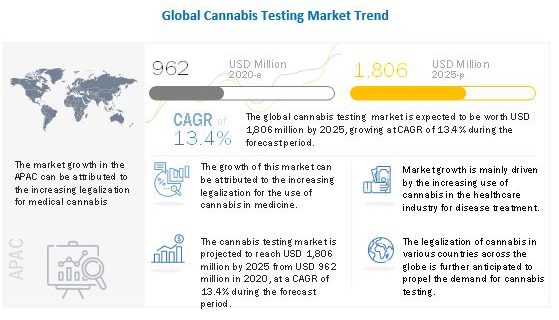

The global cannabis testing market is expected to reach USD 1,806 million by 2025 from USD 962 million in 2020, at a CAGR of 13.4% during the forecast period.

Key Growth Drivers:

The growth in this market is mainly driven by factors such as the legalization of medical cannabis and the growing number of cannabis testing laboratories (specifically in the US), the growing adoption of LIMS in cannabis testing laboratories, and increasing awareness. A lack of uniformity in rules and regulations, high costs, and inadequate personnel are major factors expected to hamper the market growth.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46932450

Legalization of medical cannabis coupled with the growing number of cannabis testing laboratories

Medical cannabis has proven effective in various medical applications, such as reducing nausea caused due to chemotherapy, stimulating appetite in AIDS patients, controlling muscular spasms in multiple sclerosis patients, and reducing intraocular pressure in patients with glaucoma. Owing to their health benefits, governments in various countries are legalizing the use of medical cannabis—Australia (2016), Canada (2015), North Korea, Spain, Portugal (2001), the UK (2006), Germany (2017), Italy, the Netherlands, Israel, and Brazil have all legalized the use of medical cannabis in recent years. Moreover, in the US, 25 states have legalized medical cannabis, while four—Colorado, Washington, Oregon, and Alaska—have legalized cannabis for medical and recreational use. As medical cannabis is being legalized in several countries/states globally, the demand for the analytical testing of cannabis for ensuring its safety before human consumption has increased in recent years. According to industry experts, the number of cannabis testing labs is expected to grow at a significant CAGR in the coming years, primarily due to the growing legalization and increased adoption of cannabis testing. Such trends indicate the expected growth in demand for analytical instrumentation, software, and services for cannabis testing in the coming years.

Recent Developments:

- In 2020, DigiPath acquired VSSL Enterprises Ltd., a provider of agritech consulting solutions for cannabis genetics, tissue culture, cultivation, analytical testing, and predictive tools. The acquisition will expand DigiPath’s global ability to provide customers with technical services in germplasm development, tissue culture, and cultivation.

- In 2020, Agilent Technologies Inc., launched Cannabis and Hemp Potency Kit.

North America accounted for the largest share of the cannabis testing market

The global cannabis testing market is segmented into five regions, namely, North America, Europe, Asia Pacific (APAC), Latin America (LATAM), and the Middle East and Africa (MEA). North America dominated the market followed by Europe in global cannabis testing market in 2019. North America is expected to command the largest market share of 71.2% in 2020. This market is also projected to register the highest CAGR of 13.8% during the forecast period. Factors such as the legalization of cannabis (especially in the US) and the growing availability of products, software, and services for the cannabis testing industry are driving the growth of the North American cannabis testing market.

Key Market Leader – Cannabis Testing Market

Agilent Technologies (US) held the leading position in the cannabis testing products market in 2019. The leading position of the company is primarily attributed to its strong geographic presence. The company provides analytical instrumentation, consumables for pesticide testing solutions, terpene testing solutions, potency testing solutions, residual solvent solutions, and heavy metal testing. To gain a competitive edge in the market, the company focuses on adopting organic and inorganic growth strategies such as product launches and acquisitions.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=46932450

Shimadzu Corporation (Japan) was the second-leading player in this market in 2019. Shimadzu’s growth and large share are attributed to its robust product portfolio, including analytical instruments and consumables for cannabis testing. To maintain its position in the market, the company focuses on adopting organic growth strategies such as product launches and expansions.

Thermo Fisher Scientific(US) held a substantial market share in 2019. The company provides services across the globe through its industry-leading brands. It has a wide range of solutions for the cannabis testing industry and a strong global brand presence.

DigiPath (US) is one of the leading players in the cannabis testing services market. The company offers a robust portfolio of testing services. To sustain its leading position in the cannabis testing industry, the company has adopted organic and inorganic growth strategies such as partnerships, collaborations, and agreements with cultivators and growers. This has helped it to gain a competitive edge.