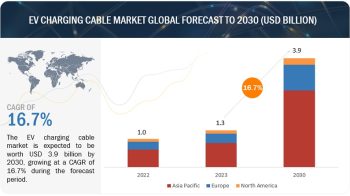

The cell to pack battery market is projected to grow from USD 5.5 billion to USD 29.3 billion in 2030, at a CAGR of 26.9% during the forecast period. The growth of this market can be attributed to the increase in the sale of EVs, the rise in demand for lightweight batteries in order to reduce the overall weight of the EVs, and the rise in demand for cost-efficient long-range electric vehicles with fast charging solutions.

The demand for electric vehicles and advancements in battery technologies have gone hand-in-hand in recent years. The recent innovation of CTP technology, which eliminates the need for modules to house cells in the battery pack, is gaining traction as it reduces the dead weight in the pack and improves the energy density of the batteries. Contemporary Amperex Technology Co Limited. (CATL), BYD Company Ltd, C4V (US), and Sunwoda Electronic Co, Ltd. are some early birds for developing cell-to-pack battery packs. BYD Company Ltd. (China) has innovated its cell-to-pack battery technology with blade battery technology. Similarly, LiSER battery technology has been patented by C4V (US). Apart from this, CATL launched the third generation of cell-to-pack battery by the name “Qilin” battery which offers a longer range than the conventional battery type. On the other hand, LG Energy Solution intends the mass production of these module-less battery packs by 2025. Thus, the current demand for long-range electric vehicles with fast charging capabilities would drive the demand for advanced battery packs. It is likely to create growth opportunities for other battery manufacturers and motivate them to augment their R&D initiatives for developing improved battery packs for passenger and commercial vehicles.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=249749128

Battery composition plays a crucial role in determining the efficiency of the battery. Apart from this, the cost of the cattery composition directly influences the overall battery pack. Battery compositions like lithium iron phosphate (LFP), nickel manganese cobalt (NMC), nickel cobalt aluminum oxide (NCA), lithium manganese oxide (LMO), lithium iron manganese phosphate (LFMP), and bio-mineralized lithium mixed metal phosphate (BM-LMP) are considered for the CTP battery manufacturing by the manufacturers. Almost 90-95% of batteries developed with the CTP technology use LFP chemistry due to advantages such as its lightweight, improved discharge and charge efficiency, longer life span, minimal maintenance, and optimized safety, among others. The use of LFP battery composition in CTP battery packs has seen a high adoption rate as it has reduced the cost of the battery by 20−30%. Attributed to such reasons, OEMs like Tesla (US), BYD Company Ltd, (China), Xpeng (China), and Hozon New Energy Automobile Co, Ltd (China) are offering LFP batteries in their EV models. China is the major contributor in developing and using LFP battery composition in cell-to-pack batteries.

Electric buses and trucks require high-energy-density batteries with long-range capacity. This created an opportunity for the cell to pack batteries in commercial electric vehicles. The cell-to-pack batteries offer higher volumetric density with reduced weight and lower costs. Seeking the opportunity in the commercial segment, BYD Company Ltd. has developed blade battery technology, which offers 40−50% more energy density capacity. In September 2022, BYD Company Ltd. (China) introduced the cell-to-pack equipped eBus platform at the IAA Transportation event in Berlin (Germany). Similarly, in May 2022, Solaris Bus & Coach sp. z o.o. (Poland), a European electric bus manufacturer, entered into a partnership with CATL (China) to receive cell-to-pack batteries from the battery manufacturer. Also, the government initiatives for promoting the use of electric buses in public transport would support the growth of the cell-to-pack battery industry

Asia Pacific will continue to lead the cell to pack battery market due to high EV sales in the region. According to MarketsandMarkets analysis, Asia Pacific contributed about ~99.6% to the cell to pack battery market in 2022 by volume. China is the largest market for cell to pack batteries in Asia Pacific, with the presence of major battery manufacturers like Contemporary Amperex Technology Co., Limited., BYD Company Ltd., Sunwoda Electronic Co Ltd. and many more local battery manufacturing players. The strong presence of Tesla, BYD Company Ltd, XPENG INC, NIO and others in China which has already initiated the adoption of cell to pack battery in their electric models are supporting the growth of cell to pack battery market in China.

Key Market Players:

Cell to Pack Battery Companies are Contemporary Amperex Technology Co., Limited. (China), BYD Company Ltd. (China), LG Energy Solution. (South Korea), Tesla (US), XPENG INC. (China), C4V (US), and Sunwoda Electronic Co., Ltd. (China). These companies adopted new product launches and expansion to gain traction in the cell to pack battery market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=249749128