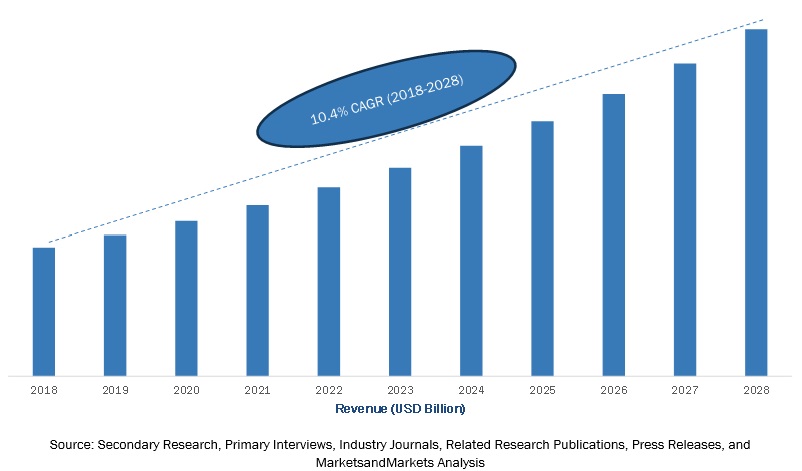

According to a research report “China Cold Chain Market by Type (Refrigerated Warehouse and Transportation), Temperature Type (Chilled and Frozen), Application (Dairy & Frozen Desserts, Fish, Meat & Seafood, Fruits & Vegetables, Bakery & Confectionery) and Region – Global Forecast to 2028″, published by MarketsandMarkets, China Cold Chain Market to Grow at a CAGR 10.8% from 2023 to 2028.

The government’s commitment to reducing food waste is another driving factor for the Chinese cold chain market. Cold chain solutions, such as temperature-controlled warehouses, refrigerated transportation, and real-time monitoring systems, play a vital role in preserving the freshness and shelf life of perishable goods. The government has implemented initiatives and incentives to encourage cold chain technology adoption, leading to increased investment and growth in the market. The “14th Five-Year Plan for Cold Chain Logistics Development” issued in December 2021 demonstrates China’s commitment to cold chain logistics and aims to establish a comprehensive cold chain logistics network connecting production and sales regions, urban and rural locations, and domestic and international markets.

The Chinese cold chain industry is highly fragmented, with numerous SMEs and a few large players like SF Express, JD Logistics, and Yunda Express. For instance, SF Express launched a new “smart cold chain* logistics platform that will use the Internet of things (loT) technology to monitor and adjust the temperature of goods in real-time. In addition, JD Logistics started a new “green logistics” initiative in 2020, with the goal of reducing the carbon footprint of its cold chain activities through the use of electric vehicles and other sustainable technologies.

Increasing government initiatives to improve food safety and reduce food waste to stimulate market

The Chinese government has prioritized food safety and quality due to the growing middle class and urbanization. This has led to the adoption of advanced cold chain technologies and practices, resulting in the growth of the cold chain market in China. The rise of e-commerce and online grocery shopping has fueled the demand for efficient cold chain logistics, ensuring timely and safe delivery of fresh, high-quality food products. The growing middle class favors premium imported food products, necessitating a robust cold chain network to maintain their quality during import and distribution. China’s vast geographical expanse and regional disparities in climate and infrastructure further emphasize the need for a well-integrated and efficient cold chain network across different regions.

Speak to the Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=811