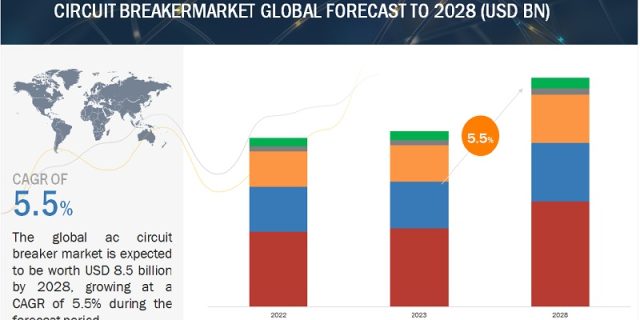

The global Circuit Breaker Market size is expected to grow from an estimated USD 6.5 billion in 2023 to USD 8.6 billion by 2028, at a CAGR of 5.5% during the forecast period. Key drivers for this growth include increasing investments in smart grid technologies aimed at protecting and controlling power equipment, as well as the replacement of aging infrastructure. Additionally, the demand for reliable transmission and distribution (T&D) networks presents high-growth opportunities for the circuit breaker market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1237

The International Energy Agency (IEA) reports that the global investment in renewable generation is expected to reach USD 281 billion in 2020. Renewable energy sources, such as photovoltaic and wind generators, necessitate a dedicated protection system, and circuit breakers play a crucial role in connecting power generating stations to switchyards and the electrical grid. They are vital components in electrical systems, ensuring power system protection and regulating power supply. The growing concerns over the reliability of renewable power have spurred the market for renewable generation and distribution, consequently driving the global circuit breaker market.

T&D utility segment is the largest contributor in the circuit breaker market.

The Circuit Breaker Market is primarily led by the T&D utility segment. Within this segment, Asia Pacific emerged as the largest market in 2022. This significant market size in the Asia Pacific region can be attributed to the growing demand for electricity and the need to replace aging infrastructures. Countries like Japan, China, and South Korea are particularly driving this demand in the Asia Pacific region, further bolstering the market for circuit breakers.

The high voltage is expected to be the largest segment of the circuit breaker market.

In 2022, the high voltage segment emerged as the dominant segment in the circuit breaker system market. These high voltage circuit breakers find extensive usage across various end-user industries, including T&D utilities, large power generation plants, and railways & metros. The market for high voltage circuit breakers is primarily driven by increasing investments in transmission and distribution networks. This is a response to the growing demand for power and the necessity to enhance the reliability of high-voltage electrical assets. As a result, the high voltage segment is expected to experience substantial growth in the market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1237

Asia Pacific is expected to be the largest and fastest-growing region in the circuit breaker market.

Asia Pacific is anticipated to be the largest and fastest-growing market in the circuit breaker industry. This region is segmented into key countries, including China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. Countries in Asia Pacific are witnessing a surge in power demand driven by rapid urbanization and industrialization. To address the need for energy efficiency and uninterrupted power supply, the State Grid Corporation of China (SGCC) has planned significant investments. Approximately USD 62 billion, accounting for 11.1% of the total investment, is allocated to grid technologies, including circuit breakers, to accommodate a substantial amount of renewable energy in the grid. China has emerged as a major consumer of smart grid technology due to the ongoing transformation in its energy landscape. The country’s focus on energy efficiency, clean energy adoption, and power industry transformation further supports the demand for smart grid infrastructure. By 2020, China is expected to have over 100 GW of installed wind capacity and a significant increase in solar PV installations, resulting in a higher demand for circuit breakers in the market.

Key Market Players:

The key players in the Circuit Breaker Market are as ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric (Japan), and Eaton (Ireland).