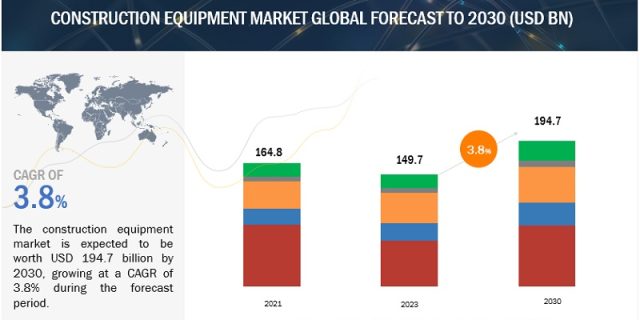

The Construction Equipment Market is projected to grow from USD 149.7 billion in 2023 to USD 194.7 billion by 2030, at a CAGR of 3.8%.

The sales of Construction Equipment are observed to have dropped due to the recession impact between 2023 and 2025 and hence show a declining trend in China, the US, Russia, and South Africa. This downside is due to inflation, a severe issue throughout 2022, and while improving, it remained high in early 2023. In addition to this, the war in Ukraine continues to enhance inflationary pressures worldwide. But, after 2025, the growth in construction equipment sales will revive, attributed to the regional recovery in the construction output and the increasing construction activities. In European countries, the decline in construction equipment sales is negligible due to the strong infrastructure developments that stimulate the sales of large construction equipment market growth. Additionally, new product launches in the trend of electric and compact construction equipment would create promising growth opportunities in the Construction Equipment market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=179948937

“Crawler excavator is estimated to account for the largest market in 2023.”

Crawler excavators accounted for the maximum share in all construction equipment types as it is an all-around excavator used for demolishing surfaces and structures, digging sites, trenching, and lifting heavy objects. With rising urban infrastructure development (roads, metros, airports, etc.), real estate business, and other commercial buildings (malls, shopping centers), the crawler excavators would be the most preferred equipment due to their versatile work nature in confined spaces. Further, crawler excavators find applications for quarrying and aggregates in the agriculture, landscaping, and forestry industries. Additionally, key OEMs offer advanced-designed crawler excavators like CASE excavators, which deliver up to 17% more horsepower, faster cycle times, and lower fuel costs. Also, in 2023, Develon, formerly Doosan Construction Equipment, launched its new DX140LC-7K (14.6 tonne) crawler excavator. These excavators are designed for high performance and durability. These products are versatile; they can be equipped with various attachments such as buckets, hydraulic hammers, grapples, and drills. This makes them suitable for multiple applications – from digging and grading to demolition and material handling. Thus, owing to its ability to navigate challenging rough or muddy terrains with a high range of versatility and adaptability, crawler excavators are expected to dominate the construction equipment market over the forecast period.

>10L engine capacity construction equipment to register the fastest growth during the forecast period.

Diesel engines with >10L are projected to notice the highest growth rate as these are preferred in heavy construction equipment owing to large torque and power requirements. Construction equipment such as excavators, loaders, and articulated dump trucks are usually equipped with these large engines. The demand for this equipment is highest in Asian countries owing to extensive infrastructure and development projects. Developing countries such as China and India have showcased increased demand for heavy-duty equipment with engine capacity >10L due to increased road tunnel construction activities and smart city projects in the region and China, its Belt and Road Initiative (BRI) crossed the USD 1.016 trillion mark with about USD 596 Bn in construction contracts. The Indian government is working towards expanding the national highway network to 2 lakh km by 2025 with an investment of USD 350 Bn. Such projects upsurge the demand for large and heavy construction equipment with larger engine capacity for handling huge quantities of materials and complex construction tasks, which also provide better productivity, and the revenue generation through this equipment is better than the small construction equipment. Construction equipment manufacturers are focusing on the development of alternate fuel-powered equipment. For instance, in May 2022, Tata Hitachi India introduced the CNG-compliant ZW225 wheeled loader.

Asia Pacific is estimated to be the dominant regional market.

Asia Pacific is projected to lead the global Construction Equipment market by 2028. The dominance is mainly due to China which is predicted to be the largest market in Asia. Growing infrastructure development activities like constructing railway lines, road constructions, new commercial complexes, and others would drive the future demand for construction equipment like Crawler Excavators and road rollers.

According to Off-Highway research, in 2023, it is expected that there will be broadly based growth in equipment sales, and the Indian market is predicted to increase by 10%. Several proposals for infrastructure investment drive this growth. One of the key factors influencing the demand for construction equipment is the increasing demand for compact construction equipment. The JCB and Tata Hitachi, the executives in India’s compact construction equipment market, cater to this demand. In 2022, these manufacturers were top suppliers of compact construction equipment in India and catered to the 50% demand.

Key Market Players & Start-ups

The construction equipment market is dominated by players such as Caterpillar (US), Komatsu Ltd. (Japan), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group (China), and SANY Group (China). These companies have strong distribution networks at the global level.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=179948937