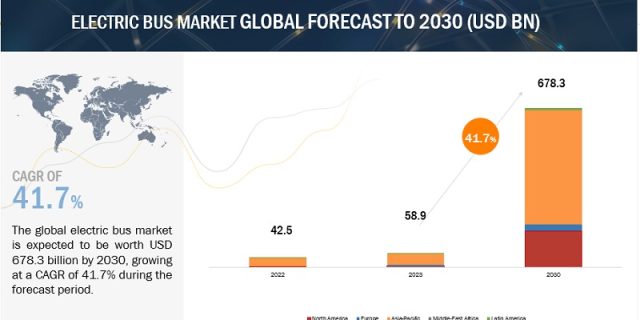

The global electric bus market is expected to grow from USD 58.9 million in 2023 to USD 678.3 billion by 2030. The increasing demand for electric buses is driven by various factors, including government initiatives and subsidies for electric vehicle adoption, advancements in battery technology, and charging infrastructure.

Governments of the UK, Hungary, Japan, China, India, the US, and other countries, have announced their target for complete electrification of their public transportation fleet. This is greatly supported by various developments and advancements in battery technology, developments in the charging infrastructure, and increasing government subsidies, tax exceptions, and incentives. For instance, in 2021, Shenzhen city in China was the first city to completely electrify its public transport fleet, including over 16,000 electric buses. The government subsidized around 50% cost of these electric buses and more than 40,000 charging points were built within the city. Furthermore, several countries have signed agreements with electric bus manufacturers to deploy electric buses in public transportation. For instance, in 2021, Nova Bus, a subsidiary of AB Volvo, announced a supply order from the Chicago Transit Authority for 600 new 40-foot electric buses.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38730372

The fuel cell stacks are expected to grow rapidly in the electric bus components segment during the forecast period. Fuel cell vehicles offer a relatively better fuel economy and can travel 300–400 miles on a full tank. This is one of the key driving factors for the developments in hydrogen fuel cells. The Asia Pacific region is expected to dominate the fuel stacks market during the forecast period, owing to the large presence of fuel cell stack manufacturers. For instance, Doosan Fuel Cell (South Korea), GS Yuasa (Japan), and others manufacture fuel cell stacks for various applications, including buses. Government initiatives to promote hydrogen fuel cell electric buses in this region also boost the market. For instance, Golden Dragon (China) secured a supply order for 100 fuel cell electric buses from Jiashan County, Zhejiang, with a total value of USD 22 million in 2020.

Electric buses with > 70 seats are expected to grow rapidly during the forecast period. The key reason for the segment to grow rapidly is the increasing number of daily commuters, who opt for public transport, increasing the demand for electric buses with high passenger-carrying capacity. Incorporating electric buses with relatively lower seating capacity will, in turn, increase the overall cost of operation with more buses or trips. The most common examples include articulated buses or bi-articulated buses with a seating capacity of > 70 passengers. More electric buses with > 70 seats incorporate the LFP/NMC batteries. However, solid-state batteries with similar battery capacity are more efficient than a similar lithium-ion battery. For instance, the Mercedes Benz e-Citaro 12m electric bus with 8 NMC batteries that produce a battery capacity of 264 kWh offers a seating capacity of 74 passengers. Still, the same seating capacity can be offered by incorporating only seven solid-state batteries and an additional battery capacity of 378 kWh. This additional battery capacity can in turn, increase the range of the vehicle. For these reasons, the OEMs should start focusing on manufacturing solid-state batteries for electric buses. Many such developments are actively driving the growth of solid-state batteries for electric buses. For instance, in 2021, Toyota (Japan) and Panasonic(Japan) announced a joint venture called Prime Planet Energy & Solutions, which aimed to develop and manufacture high-capacity, solid-state batteries for electric vehicles, including buses.

Key Market Players:

The key players in the Electric bus market BYD (China), Yutong (China), Proterra (US), CAF (Solaris) (Spain), VDL Groep (Netherlands), and AB Volvo (Sweden). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=38730372