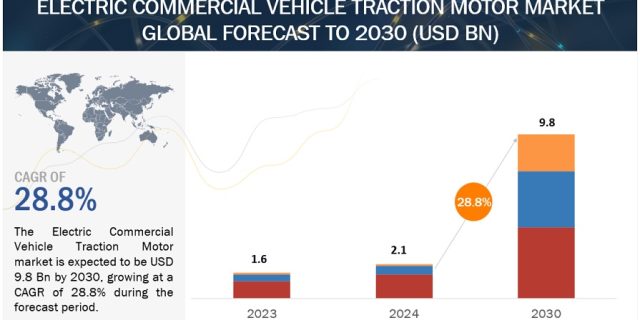

The global electric commercial vehicle traction motor market is projected to grow from USD 2.1 billion in 2024 to USD 9.8 billion by 2030, registering a CAGR of 28.8%. The traction motor market for Electric Commercial Vehicles (ECVs) has witnessed substantial growth in recent years, driven by several key factors. With the increasing focus on environmental sustainability and stringent emissions regulations, there has been a significant shift towards electrification in the transportation sector, particularly in commercial vehicles. This transition has fueled the demand for traction motors, which are integral components in electric vehicles, powering their propulsion systems. Moreover, advancements in battery technology and the expanding infrastructure for electric vehicle charging have bolstered the adoption of ECVs, further propelling the traction motor market’s expansion. Additionally, governments worldwide are incentivizing the adoption of electric vehicles through subsidies, tax credits, and regulatory measures, which has accelerated the market growth. In February 2023, the European Union proposed ambitious CO2 standards for most new trucks and coaches (90% emissions reduction by 2040) and urban buses (100% zero-emission city bus sales by 2030).

Market Dynamics:

Driver: Technical innovations in Motor Control and Power Electronics

The development of advanced motor control algorithms, generally based on artificial intelligence (AI), allows for more accurate control of the motor’s magnetic field and torque delivery. This results in smoother operation, quicker acceleration, and more sustained power output, all of which increase the performance and drivability of electric commercial vehicles. Furthermore, advancements in power electronics components such as inverters and converters, particularly the adoption of silicon carbide (SiC) MOSFETs, contribute to higher power densities, faster switching speeds, and increased efficiency in electric drivetrains. This results in reduced energy losses during power conversion, ultimately extending the range and improving the overall efficiency of electric commercial vehicles. These technological innovations have significantly enhanced the efficiency, performance, and reliability of electric traction motors. Companies such as Evolito Ltd., EVR Motors, Passionchip, and Petalite are taking initiatives in the development of power electronics for EV traction motors. Modern motor control algorithms enable finer control over motor speed, torque, and efficiency, facilitating smoother acceleration, regenerative braking, and optimized energy management in electric commercial vehicles. The utilization of AI in motor control further enhances precision and adaptability, ensuring optimal performance across varying driving conditions.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=74436467

Opportunity: Developments in Fuel Cell technology

Fuel cell vehicles, powered by hydrogen fuel cells, offer an alternative zero-emission solution to battery electric vehicles, particularly for heavy-duty applications such as trucks and buses where long-range and rapid refueling are critical. Traction motors play a crucial role in fuel cell vehicles, powering electric drivetrains that propel the vehicles forward. As the demand for fuel cell commercial vehicles increases, traction motor manufacturers have the opportunity to supply high-performance motors tailored to the specific requirements of fuel cell drivetrains. By leveraging their expertise in electric motor technology and adapting their products to suit the unique characteristics of fuel cell vehicles, traction motor manufacturers can capture a growing share of the market for electric drivetrain components. Additionally, collaboration with fuel cell vehicle manufacturers and infrastructure providers can accelerate the adoption of fuel cell commercial vehicles, creating additional opportunities for traction motor suppliers to expand their presence in the evolving market for zero-emission transportation solutions. Various automakers are also showcasing their fuel cell tech-laden commercial vehicles. For instance, GM (US) announced in December 2023 that it had partnered with Autocar, LLC (US) to develop zero-emission commercial vehicles powered by GM’s fuel cell solution, HYDROTEC power cubes.

The less than 100 kW segment to show a significant growth rate during the forecast period.

The less than 100 kW market is projected to register a CAGR of 32.5% during the forecast period. The less than 100 kW power output is primarily found in smaller electric vehicles, such as small electric vans, designed for efficiency in short-distance applications, offering an eco-friendly alternative for urban logistics and last-mile deliveries. These vans are becoming increasingly popular among logistics companies for their ability to easily navigate congested city streets, reducing emissions and noise pollution. Their design and electric propulsion make them suitable for quick and efficient deliveries, contributing to the overall evolution of urban logistics toward more sustainable and environmentally conscious practices.

Various leading OEMs offer electric commercial vehicles with power outputs below 100 kW as the demand for sustainable last-mile delivery has significantly increased. For instance, Tata Motors (India) targeted the intra-city cargo transport operators for e-commerce, FMCG, and courier businesses and began the deliveries of the electric Ace in 2023, with a power output of 27 kW, offering a lower total cost of ownership. MAHLE Group (Germany), Schaeffler Group (Germany), BorgWarner (US), and Robert Bosch GmbH (Germany), among others, offer various motors in this segment.

The comprehensive offerings by motor manufacturers of 100–200 kW power output segment to drive growth of the electric commercial vehicles traction motor market over the forecast period.

The 100–200 kW power output is primarily found in delivery vans, medium-duty trucks, and pick-up trucks, offering versatile regional transport and urban logistics solutions. Some 100–200 kW motors can be designed to accept higher DC fast charging rates. This can significantly reduce charging times, making electric vehicles more convenient for long trips or everyday use. A 100–200 kW motor delivers better passing power and overall responsiveness when passing slower vehicles or maintaining speed on high-speed roads. This is crucial for safety and confidence while driving on highways.

Traction motor manufacturers such as ABB Ltd. (Switzerland) offer 163 kW EV traction motors for heavy electric vehicles with a peak power output of 163 kW and motor speed of 5000 rpm. Similarly, Dana Incorporated (US) offers 170 kW IP6K9K-rated EV traction motors/inverters for light, medium, and heavy electric vehicles with a peak power of 170 kW and speed of 3,250 rpm. Such comprehensive offerings by motor manufacturers support the market growth of the 100–200 kW segment in the electric commercial vehicle traction motor market.

Asia Pacific is the largest market for electric commercial vehicle traction motors during the forecast period.

The Asia Pacific region is projected to be the largest ECV traction motor market by 2030. The Asia Pacific market is dominated by China, which has large sales volumes for Electric Commercial Vehicle Traction Motors, especially electric buses. With favourable government regulations and the increasing adoption of electric buses in public transport fleets, India is expected to be a high potential market for Electric Commercial Vehicle Traction Motors in the future. Automotive manufacturers, technology companies, and startups in India are actively collaborating to develop and deploy electric commercial vehicles. This collaboration fosters innovation and accelerates the adoption of traction motors in the Indian market. In January 2023, American Axle and Manufacturing, Inc. and EKA mobility (India) have collaborated to supply eka e-beam axle for the 2.5 T battery electric commercial vehicle by EKA. Asia Pacific is home to many traction motor manufacturers and suppliers, such as BYD (China), Shenzhen Inovance Technology (China), Zhejiang Founder Motor Co., Ltd. (China), Kirloskar Electric Company Limited (India), Mitsubishi Electric Corporation (Japan) and among others. The presence of all such manufacturers in the region will drive the market for Electric Commercial Vehicle Traction Motors during the forecast period.

Key Market Players:

The electric commercial vehicle traction motor market is dominated by established players such as ZF Friedrichshafen AG (Germany), Dana Limited (US), Robert Bosch GmbH (Germany), Magna International Inc. (Germany), and Allison Transmission, Inc. (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=74436467