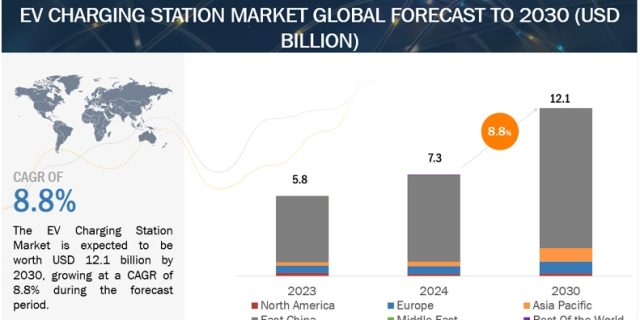

According to a research report “EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation and Region – Global Forecast to 2030″ published by MarketsandMarkets, the global EV Charging Station Market is projected to grow from USD 7.3 billion in 2024 to USD 12.1 billion by 2030, at a CAGR of 8.8%.

Factors such as rising EV sales worldwide will increase demand for EV charging stations, government policies and subsidies to support faster setup of EV charging stations, limited driving range boosting need for extensive charging infrastructure, reducing price of EVs in global market will boost EV sales and EVCS demand. These factors propel the development and expansion of EV charging stations, facilitating the widespread adoption of electric vehicles and the establishment of a sustainable transportation ecosystem.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=89574213

Shift in NACS Standards in the US Expected to Accelerate Demand for Tesla Superchargers.

The adoption of the North American Charging Standard (NACS) in the United States is set to accelerate demand for Tesla Superchargers. These chargers are designed to work with various electrical systems and feature automatic support for both AC and DC charging. They can add up to 200 miles of range in just 15 minutes, making them highly efficient. With over 55,000 Supercharging points globally and rapidly expanding networks, Tesla is enhancing accessibility, including a pilot program in the Netherlands open to non-Tesla vehicles. Tesla adjusts pricing periodically to support network growth, and urban installations are strategically located for convenience. It also offers 400 kWh of free Supercharger credit annually to Model S and Model X owners. While most electric vehicle manufacturers in North America currently use the SAE J1772 connector, Tesla has transitioned to open standards like NACS, with major manufacturers planning to adopt unified connectors in the future. Charging providers are integrating NACS options into their offerings, and leading automakers like Volkswagen, GM, and Ford in the US have partnered with Tesla to enable compatibility with NACS-enabled vehicles in the US.

Increasing Demand for DC Ultra-Fast 2 Chargers Expected with Rising Need for Fast-Charging Solutions.

The increase in demand of EV charging solutions has persisted due to the imperative of reducing charging durations. Ultra-fast charging has been developed to address this demand, requiring EVs equipped with batteries capable of handling ultra-fast 2 charging, operating within optimal temperature ranges. This method can fully charge an EV within approximately 5-10 minutes. Leading companies involved in ultra-fast charging installations include ABB, Delta, Tritium, and EVBox. ABB introduced the world’s first 360 kW charger in 2022. Likewise, in February 2024, Chaevi (South Korea) unveiled its latest 400 kW Tesla NACS-compatible DC fast charger, equipped with dual ports for simultaneous charging, supporting CCSI and/or NACS connector configurations. Leading Charging Point Manufacturers (CPMs) have begun deploying 400 kW chargers since late 2023; Mercedes-Benz, for instance, installed its initial 400 kW chargers in the US in October 2023. Similarly, Vital EV Solutions installed the UK’s premier 400 kW DC ultra-fast 2 chargers. Initially utilized primarily for commercial vehicle rapid charging, ultra-fast 2 charging has found application in passenger cars as well. Various countries are already planning the deployment of these charging stations along highways. In the UK, EON Energy (Germany) and GRIDSERVE (UK) have erected such charging stations along highways. Siemens (Germany) and ARAL (Germany) have deployed charging stations across Germany. Fastned has also installed these chargers across the UK, Germany, and France. IONITY (Germany) has established similar charging points across Europe. Tritium (US), Electrify America (US), and ABB (Switzerland) have also erected Ultra-fast level 2 chargers in the US.

Increasing Demand for Fixed EV Chargers to Drive Market.

Fixed chargers, also known as charging stations, are stationary infrastructure essential for electric vehicles (EVs). Placed in public areas, highways, malls, and offices, they require EV owners to bring their vehicles for charging. Despite higher initial costs compared to portable chargers due to infrastructure needs, fixed chargers offer faster charging rates. Governments collaborate with OEMs to deploy fixed chargers, supported by subsidies and incentives to promote EV adoption and reduce carbon emissions. Fixed chargers provide economic benefits and quicker charging rates, driving market growth amid the transition to electric vehicles. China is expected to be the largest as well as the fastest growing in fixed charger segment, by installation type. South Korea, Germany, Netherlands, France, US etc. are among the other leading countries in the fixed charger segment. In Europe and Asia Pacific, governments of leading EV-using countries granted incentives for the adoption of EV vehicles and the installation of EV chargers, which is expected to increase the demand for fixed chargers.

Key Players

The major players in EV Charging Station market include ABB (Switzerland), BYD (China), ChargePoint (US), Tesla (US), Siemens (Germany), among others. These companies offer EV Charging stations and solutions for OEMs as well as for Charge Point Operators and have strong distribution networks across the globe.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=89574213