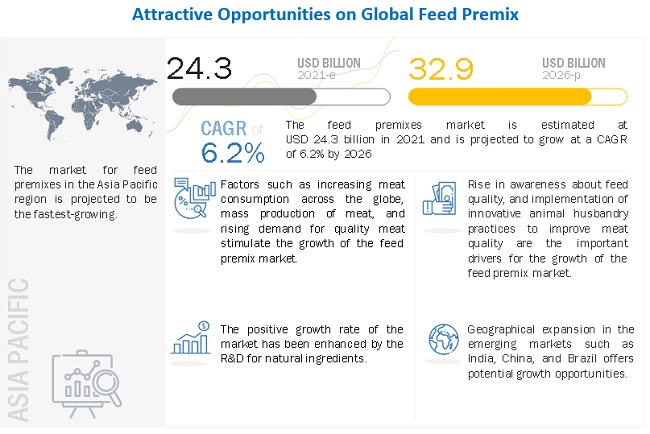

The report “Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants), Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), Form (Dry and Liquid), and Region – Global Forecast to 2026 “,size is estimated to be valued at USD 24.3 billion in 2021 and is projected to reach a value of USD 32.9 billion by 2026, growing at a CAGR of 6.2% during the forecast period. The growth of this market is attributed to increasing awareness about feed quality, and the implementation of innovative animal husbandry practices to improve meat quality are the important drivers for the growth of the feed premix market.

COVID-19 Impact on the Feed premix:

COVID-19 impact on the feed premix is low to moderately affected. However, the rising health concerns and fears associated with the consumption of animal meat due to the COVID-19 outbreak are projected to increase market prospects. The feed premixes aid in boosting the immunity of animals; hence, the addition of such nutritional additives in the feed will lead to an increase in demand for feed premixes. Countries across regions are coping with the impacts of COVID-19, which thus causes the feed premixes market to be projected to grow at a much lower rate in the coming years.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

Restraint: Ban on antibiotics in different countries

Antibiotics have been used in feed for decades; however, in 2006, the European Union (EU) banned the use of antibiotics in feed as growth promoters, as microbes developed resistance to antibiotics, which are used to treat human and animal infections. Following the ban by the EU, the use of antibiotics declined in many countries around the globe, especially in countries such as China, India, and the US, due to their overexploitation or misuse.

Restriction on the use of antibiotics, as a growth promoter in feed, in many countries, forced companies to stop using antibiotics in feed premixes. This acts as a major restraint for manufacturers that offer antibiotic-based feed premixes.

Opportunity: Developing countries emerge as strong consumers of feed premix.

The demand from emerging markets such as Asia Pacific and Latin America accounted for a combined global share of ~47% in 2017. The population of developing countries in the Asia Pacific region—such as India, China, Indonesia, Vietnam, and Thailand—are expected to consume meat at an annual rate of 2.4% till 2030, according to the FAO report on “World Agriculture: Towards 2015/2030.” This has increased the demand for high-quality feed concentrates and premixes to enhance the meat weight and quality of the animals. Key players in the premix market have sensed this opportunity to start premix production plants in these regions, to meet the growing demand for feed premixes. Similarly, in South America, Brazil housed the largest cattle population in 2017, with a headcount of 330 million, and is projected to grow at a rate well above the regional average, according to the FAO. It is expected that the rising consumer awareness for nutritious products and requirement for export quality meat products can establish a strong demand for feed premixes.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=170749996

Asia pacific is estimated to hold the largest market share during the forecast period

Asia Pacific is projected to be the largest and fastest-growing segment. Increased awareness among consumers about quality meat and increased meat consumption across the region is expected to provide more scope for market expansion. Livestock is an important constituent of agriculture in the Asia Pacific region. The region widely rears and consumes pork and poultry. With the rising demand for animal products, increased livestock productivity is necessary. Quality feed is the primary determinant of the performance and productivity of livestock.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Feed premix. It consists of the profiles of leading companies such Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK).